Answered step by step

Verified Expert Solution

Question

1 Approved Answer

L010-1,10-3 AP10-1 Recording Issuance of Note and Computation of Interest (P10-1) Shaw Communications Shaw Communications Inc. is a diversified Canadian communications company that provides cable

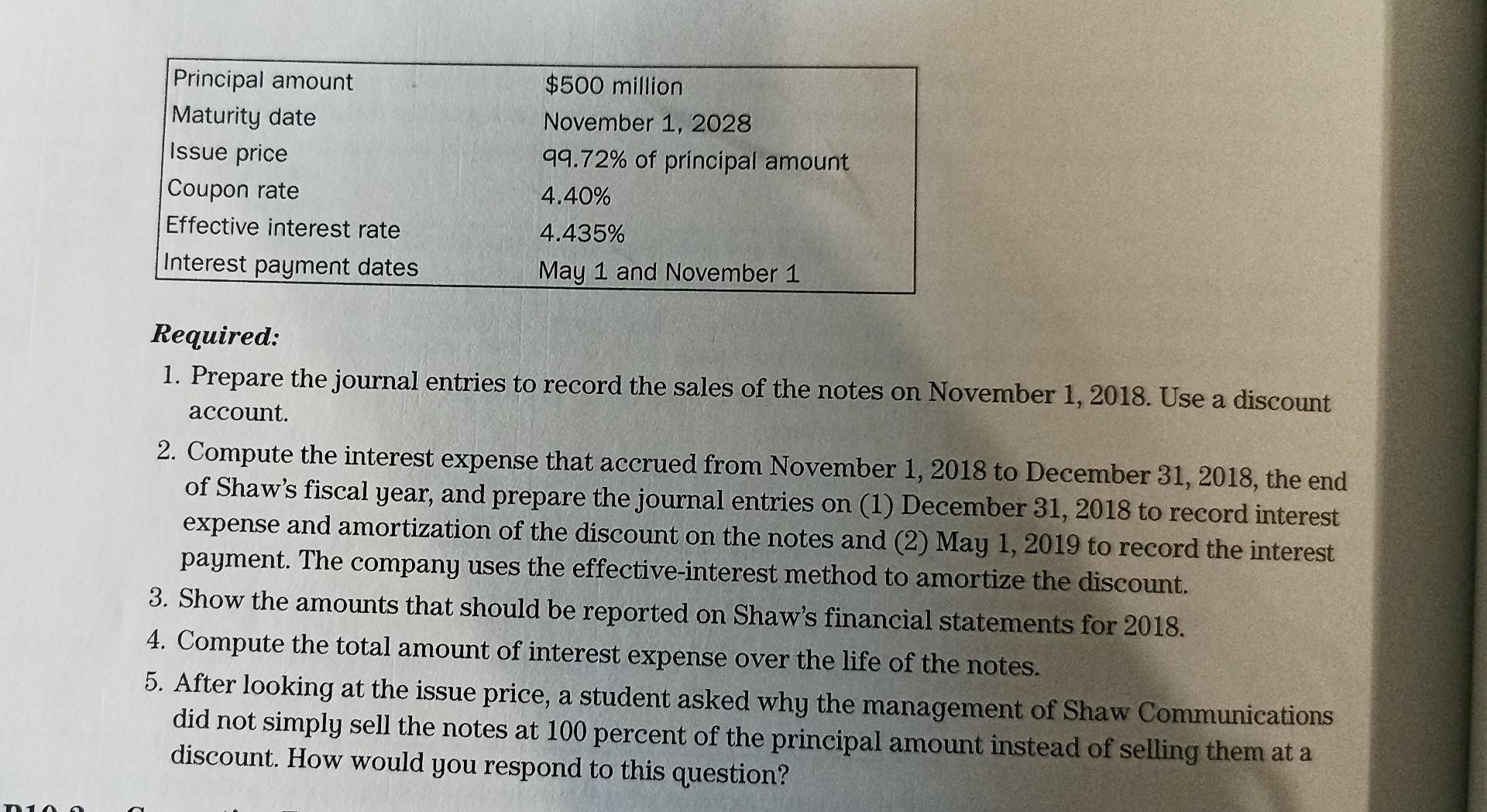

L010-1,10-3 AP10-1 Recording Issuance of Note and Computation of Interest (P10-1) Shaw Communications Shaw Communications Inc. is a diversified Canadian communications company that provides cable Inc. television, Internet, digital phone, telecommunications, and satellite direct-to-home services to more than 3 million customers. On November 1, 2018, the company sold long-term notes with the following specifications: Required: 1. Prepare the journal entries to record the sales of the notes on November 1,2018 . Use a discount account. 2. Compute the interest expense that accrued from November 1, 2018 to December 31,2018 , the end of Shaw's fiscal year, and prepare the journal entries on (1) December 31, 2018 to record interest expense and amortization of the discount on the notes and (2) May 1, 2019 to record the interest payment. The company uses the effective-interest method to amortize the discount. 3. Show the amounts that should be reported on Shaw's financial statements for 2018. 4. Compute the total amount of interest expense over the life of the notes. 5. After looking at the issue price, a student asked why the management of Shaw Communications did not simply sell the notes at 100 percent of the principal amount instead of selling them at a discount. How would you respond to this

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started