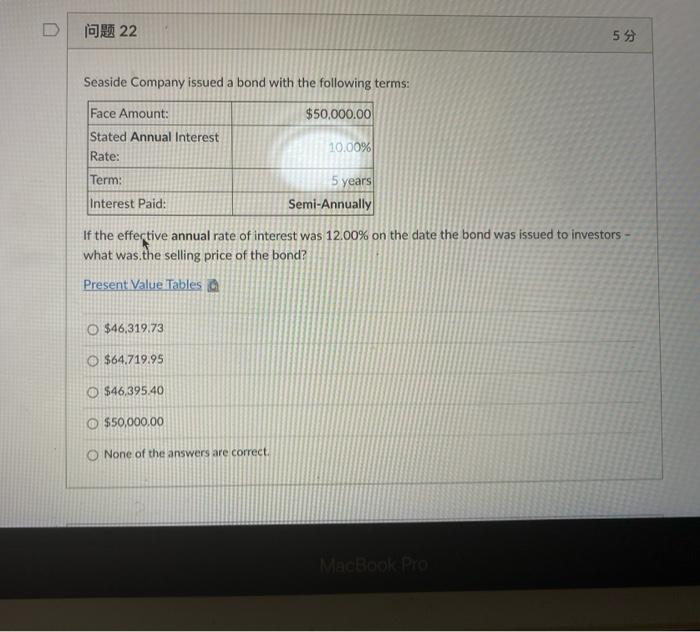

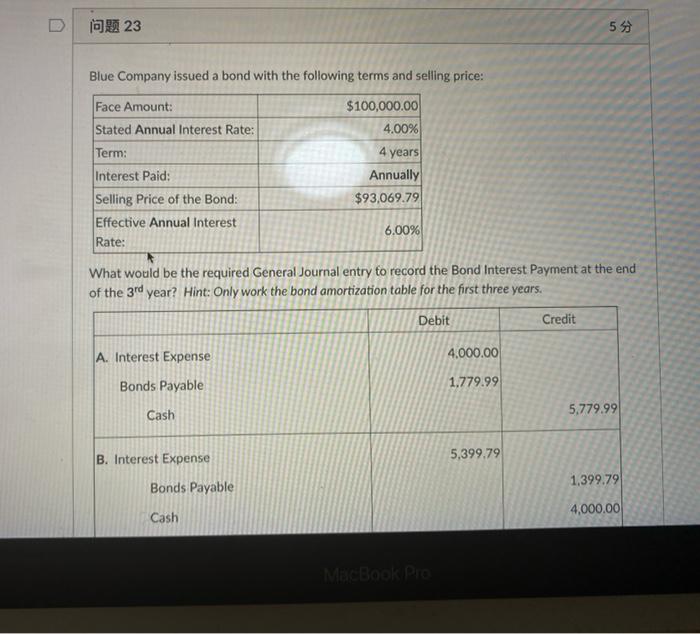

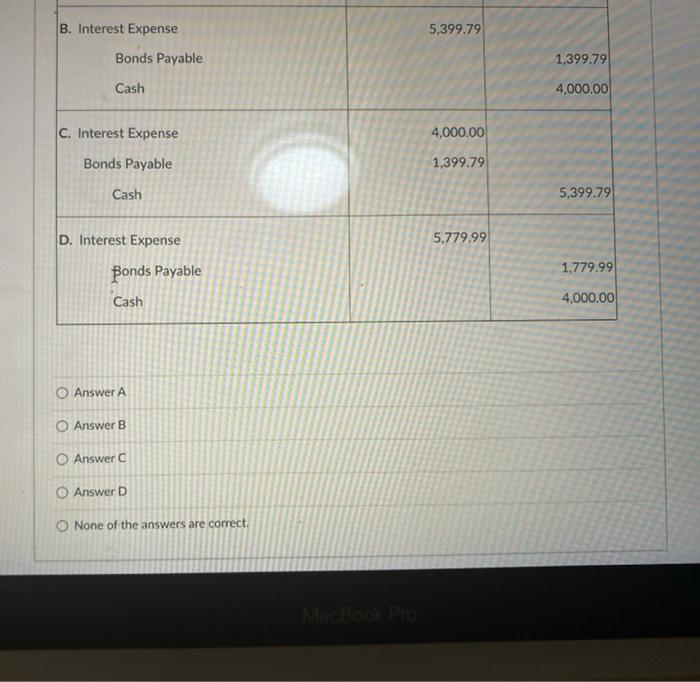

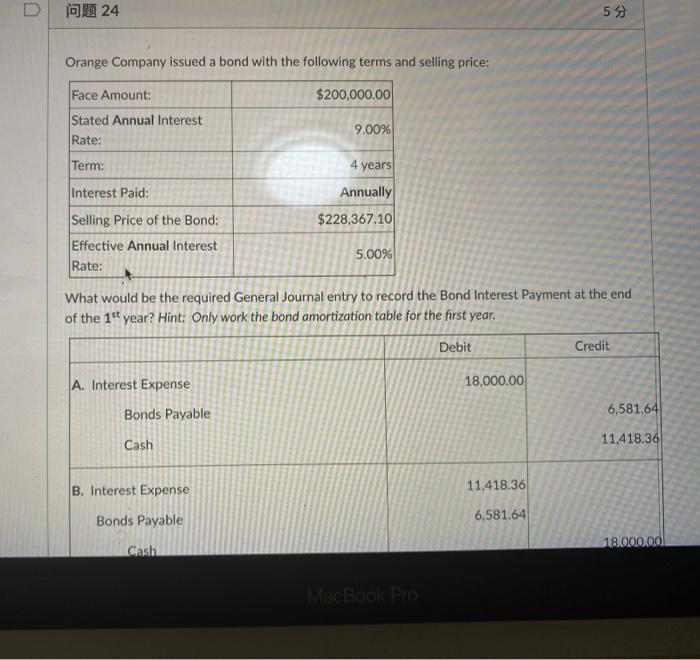

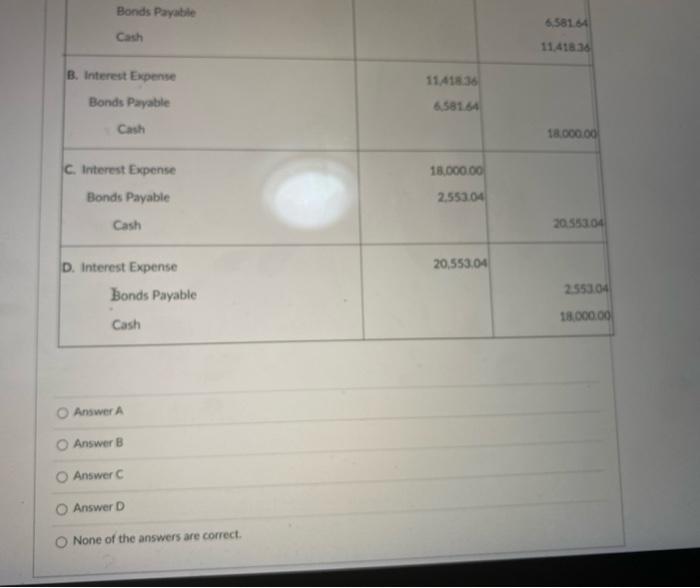

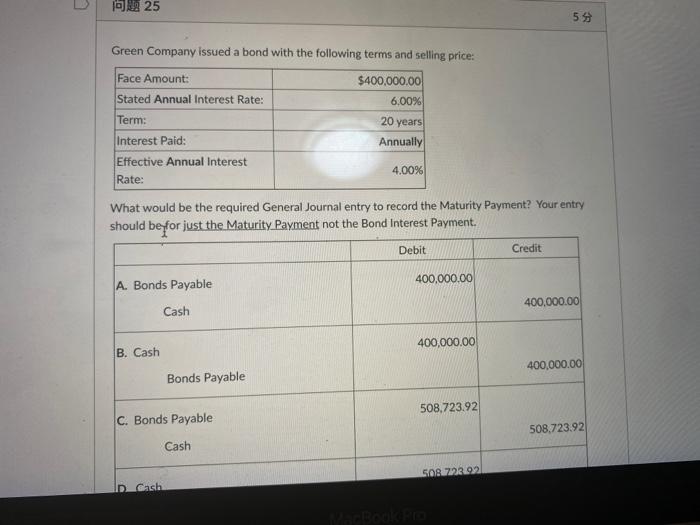

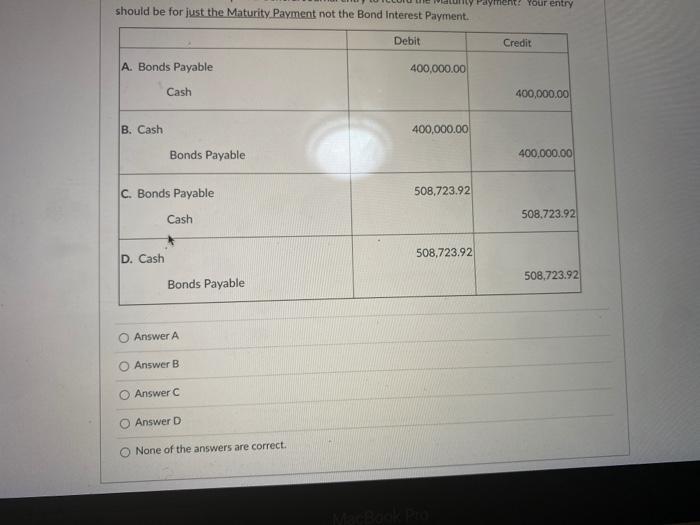

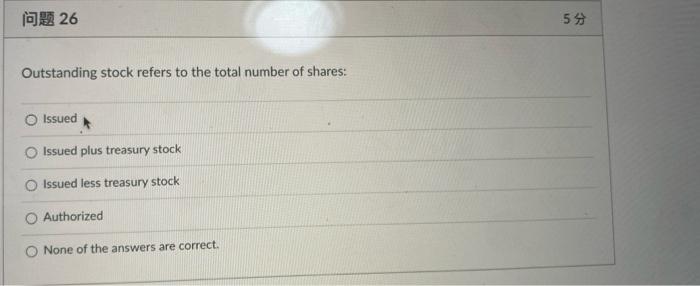

la 22 59 Seaside Company issued a bond with the following terms: Face Amount: $50,000.00 Stated Annual Interest 10.00% Rate: Term: 5 years Interest Paid: Semi-Annually If the effective annual rate of interest was 12.00% on the date the bond was issued to investors - what was the selling price of the bond? Present Value Tables a O $46,319.73 O $64.719.95 $46.395.40 $50,000.00 None of the answers are correct. MacBook Pro lan 23 5 Blue Company issued a bond with the following terms and selling price: Face Amount: Stated Annual Interest Rate: Term: $100,000.00 4.00% 4 years Annually $93,069.79 Interest Paid: Selling Price of the Bond: Effective Annual Interest Rate: 6.00% What would be the required General Journal entry to record the Bond Interest Payment at the end of the 3rd year? Hint: Only work the bond amortization table for the first three years. Debit Credit A. Interest Expense 4,000.00 Bonds Payable 1.779.99 5.779.99 Cash B. Interest Expense 5,399.79 1,399.79 Bonds Payable 4,000.00 Cash MECBOOK Pie B. Interest Expense 5,399.79 Bonds Payable 1,399.79 Cash 4,000.00 C. Interest Expense 4,000.00 Bonds Payable 1,399.79 Cash 5,399.79 D. Interest Expense 5.779.99 1,779.99 ponds Payable Cash 4,000.00 O Answer A Answer B O Answer Answer D O None of the answers are correct 0 24 55 Orange Company issued a bond with the following terms and selling price: Face Amount: $200,000.00 Stated Annual Interest Rate: 9.00% Term: 4 years Interest Paid: Annually $228,367.10 Selling Price of the Bond: Effective Annual Interest Rate: 5.00% What would be the required General Journal entry to record the Bond Interest Payment at the end of the 1st year? Hint: Only work the bond amortization table for the first year. Debit Credit A. Interest Expense 18,000.00 Bonds Payable 6,581.64 Cash 11,418.36 B. Interest Expense 11,418.36 Bonds Payable 6,581.64 18.000.00 Cash MacBook Pro Bonds Payable 6.58154 Cash 11.41834 B. Interest Expense Bonds Payable Cash 11418.30 6.581.64 18.000.00 C. Interest Expense 18.000.00 Bonds Payable 2,55304 Cash 20.55304 20,553.04 D. Interest Expense Bonds Payable 255304 18.000.00 Cash Answer A Answer B Answer Answer D None of the answers are correct. 1925 55 Green Company issued a bond with the following terms and selling price: Face Amount: $400,000.00 Stated Annual Interest Rate: 6.00% Term: 20 years Annually Interest Paid: Effective Annual Interest Rate: 4.00% What would be the required General Journal entry to record the Maturity Payment? Your entry should be for just the Maturity Payment not the Bond Interest Payment. Debit Credit A. Bonds Payable 400,000.00 400,000.00 Cash 400,000.00 B. Cash 400,000.00 Bonds Payable 508,723.92 C. Bonds Payable 508.723.92 Cash SO 72202 D Cash ent: Your entry should be for just the Maturity Payment not the Bond Interest Payment. Debit Credit A. Bonds Payable 400,000.00 Cash 400,000.00 B. Cash 400,000.00 Bonds Payable 400,000.00 C. Bonds Payable 508,723.92 Cash 508,723.92 D. Cash 508,723.92 508,723.92 Bonds Payable Answer A Answer B Answer C Answer D None of the answers are correct. Od 26 55 Outstanding stock refers to the total number of shares: Issued Issued plus treasury stock Issued less treasury stock Authorized None of the answers are correct