Question

LAB #4 CHAPTER 4 Activity Based Costing OBJECTIVE: Assign indirect costs to products using activity based costing and compare results to indirect costs assigned to

LAB #4

CHAPTER 4

Activity Based Costing

OBJECTIVE: Assign indirect costs to products using activity based costing and compare results to indirect costs assigned to products using traditional volume-based costing

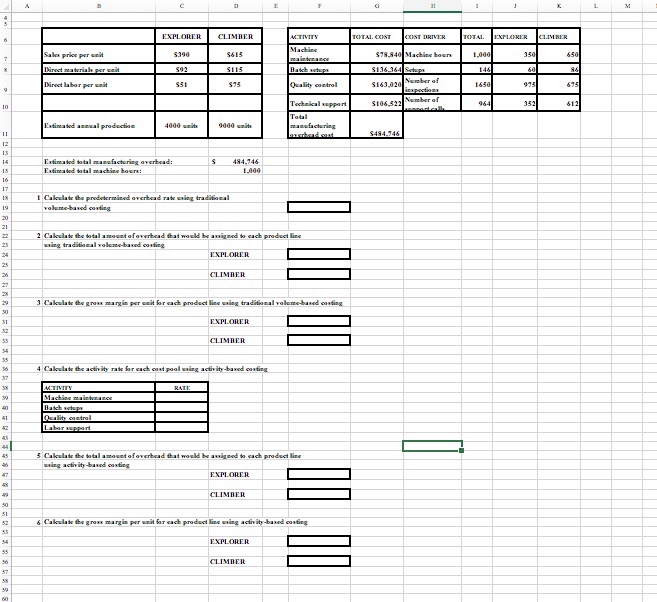

Valley View Trailmasters makes two types of tents for mountain camping, the Explorer and the Climber. Data concerning the two product lines is presented in the table below:

| EXPLORER | CLIMBER |

Sales price per unit | $390 | $615 |

Direct materials per unit | $92 | $115 |

Direct labor per unit | $51 | $75 |

|

|

|

Estimated annual production | 4,000 units | 9,000 units |

The company has always employed a tradition costing system in which manufacturing overhead is applied to units based on direct labor hours. Estimated data concerning manufacturing overhead and direct labor hours for the upcoming year appear below:

Estimated total manufacturing overhead $484,746

Estimated total machine hours 1,000

The company is considering replacing its traditional costing system with an activity based costing system that would assign its indirect product costs to four activity cost pools. Information about the amount assigned to these cost pools, the identified cost driver for each and usage of the cost drivers by the two product lines is presented in the following table:

ACTIVITY | TOTAL COST | COST DRIVER | TOTAL | EXPLORER | CLIMBER |

Machine maintenance | $78,840 | Machine hours | 1,000 | 350 | 650 |

Batch setups | $136,364 | Setups | 146 | 60 | 86 |

Quality control | $163,020 | Inspections | 1,650 | 975 | 675 |

Technical support | $106,522 | Technical support calls | 964 | 352 | 612 |

Total manufacturing overhead cost | $484,746 |

|

|

|

|

INSTRUCTIONS: Use Excel formulas to calculate the following amounts in the spaces provided on your template.

1. Calculate the predetermined overhead rate using the traditional volume-based costing system.

2. Calculate the total amount of overhead cost that would be assigned to each product line under the companys traditional costing system.

3. Calculate the gross margin per unit for each product line using traditional volume-based costing.

4. Calculate the activity rate for each cost pool using activity-based costing.

5. Calculate the total amount of overhead cost that would be assigned to each product line using activity-based costing.

6. Calculate the gross margin per unit for each product line under the proposed activity based costing system.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started