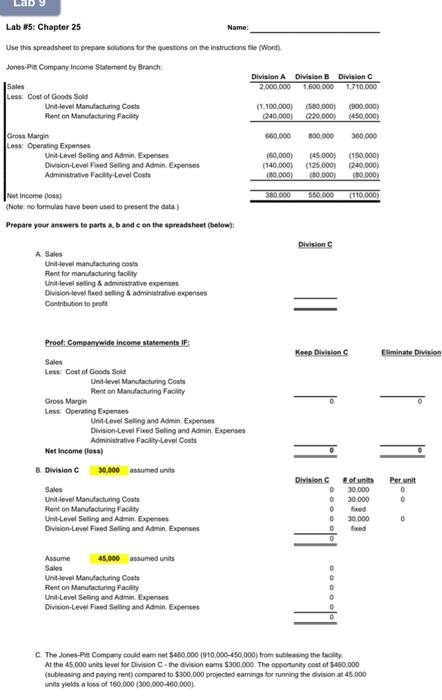

Lab 8: Chapter 25 Name: Use this spreadsheet to prepare solutions for the questions on the instructions file (Word) Jones-Pin Company Income Statement by Branch Division A Division B Division C Sales 2.000.000 1.600.000 1.710.000 Less Cost of Goods Sold Unit-level Manufacturing Costs (1.100,000) (580.000) 100.000) Rent on Manufacturing Facility (240,000) (220.000) (450.000) Gross Margin 660.000 300,000 300,000 Less Operating Expenses Unit Level Seling and Admin Expenses 160,000) 145.0001 (150.000) Division-Level Fond Selling and Admin Expenses (140,000) (125.000) 240.000) Administrative Foolly Level Costs (80.000) (80.000) 0.000) Net Income (oss) 380.000 550.000 (110.000 (Note: no formulas have been used to present the data) Prepare your answers to parts a band on the spreadsheet (below: Division A Sales Unit-level manufacturing costs Rent for manufacturing facility Unit-level selling & administrative expenses Division level fedeling & administrative expenses Contribution to profit Proof: Companwide Income statements Keep Division Eliminate Division Less Cost of Goods Sold Unt-level Manufacturing Costs Renton Manufacturing Facility Gross Margin Less: Operating Expenses Unt-Level Selling and Admin Expenses Division Level Fored Seling and Admin Expenses Administrative Facility Level Costs Net Income foss) B. Division C 30,000 assumed units Sales Unit-tovel Manufacturing Costs Renton Manufacturing Facility Unit-Lovel Selling and Admin Expenses Division-Level Food Selling and Admin Expenses Per unit Division of units 30.000 0 30.000 0 0 0 30.000 fied 1. Assume 45,000 assumed units Sales Unit-level Manufacturing Costs Renton Manufacturing Facility Unit-Level Selling and Admin. Expenses Division-Level Food Selling and Admin. Expenses 11 C. The Jones-Per Company could eam net $460.000 (910,000-450,000) from subling the facility At the 45.000 units level for Division C the division cars 5300,000. The opportunity cost of $460.000 (subleasing and paying rent compared to $300,000 projected eamings for running the division at 45.000 units yields a loss of 160,000 (300,000-460,000) Lab 8: Chapter 25 Name: Use this spreadsheet to prepare solutions for the questions on the instructions file (Word) Jones-Pin Company Income Statement by Branch Division A Division B Division C Sales 2.000.000 1.600.000 1.710.000 Less Cost of Goods Sold Unit-level Manufacturing Costs (1.100,000) (580.000) 100.000) Rent on Manufacturing Facility (240,000) (220.000) (450.000) Gross Margin 660.000 300,000 300,000 Less Operating Expenses Unit Level Seling and Admin Expenses 160,000) 145.0001 (150.000) Division-Level Fond Selling and Admin Expenses (140,000) (125.000) 240.000) Administrative Foolly Level Costs (80.000) (80.000) 0.000) Net Income (oss) 380.000 550.000 (110.000 (Note: no formulas have been used to present the data) Prepare your answers to parts a band on the spreadsheet (below: Division A Sales Unit-level manufacturing costs Rent for manufacturing facility Unit-level selling & administrative expenses Division level fedeling & administrative expenses Contribution to profit Proof: Companwide Income statements Keep Division Eliminate Division Less Cost of Goods Sold Unt-level Manufacturing Costs Renton Manufacturing Facility Gross Margin Less: Operating Expenses Unt-Level Selling and Admin Expenses Division Level Fored Seling and Admin Expenses Administrative Facility Level Costs Net Income foss) B. Division C 30,000 assumed units Sales Unit-tovel Manufacturing Costs Renton Manufacturing Facility Unit-Lovel Selling and Admin Expenses Division-Level Food Selling and Admin Expenses Per unit Division of units 30.000 0 30.000 0 0 0 30.000 fied 1. Assume 45,000 assumed units Sales Unit-level Manufacturing Costs Renton Manufacturing Facility Unit-Level Selling and Admin. Expenses Division-Level Food Selling and Admin. Expenses 11 C. The Jones-Per Company could eam net $460.000 (910,000-450,000) from subling the facility At the 45.000 units level for Division C the division cars 5300,000. The opportunity cost of $460.000 (subleasing and paying rent compared to $300,000 projected eamings for running the division at 45.000 units yields a loss of 160,000 (300,000-460,000)