Answered step by step

Verified Expert Solution

Question

1 Approved Answer

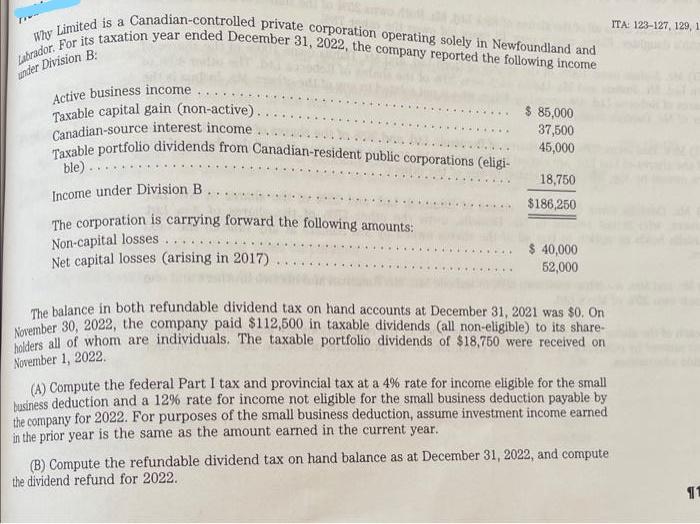

Labrador. For its taxation year ended December 31, 2022, the company reported the following income Why Limited is a Canadian-controlled private corporation operating solely

Labrador. For its taxation year ended December 31, 2022, the company reported the following income Why Limited is a Canadian-controlled private corporation operating solely in Newfoundland and under Division B Active business income Taxable capital gain (non-active). Canadian-source interest income. Taxable portfolio dividends from Canadian-resident public corporations (eligi- ble)... **** Income under Division B The corporation is carrying forward the following amounts: Non-capital losses. Net capital losses (arising in 2017) $ 85,000 37,500 45,000 18,750 $186,250 $ 40,000 52,000 The balance in both refundable dividend tax on hand accounts at December 31, 2021 was $0. On November 30, 2022, the company paid $112,500 in taxable dividends (all non-eligible) to its share- holders all of whom are individuals. The taxable portfolio dividends of $18,750 were received on November 1, 2022. (A) Compute the federal Part I tax and provincial tax at a 4% rate for income eligible for the small business deduction and a 12% rate for income not eligible for the small business deduction payable by the company for 2022. For purposes of the small business deduction, assume investment income earned in the prior year is the same as the amount earned in the current year. (B) Compute the refundable dividend tax on hand balance as at December 31, 2022, and compute the dividend refund for 2022. ITA: 123-127, 129, 1. 11

Step by Step Solution

★★★★★

3.37 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

To compute the federal Part I tax and provincial tax for Limited for the year 2022 well first calculate the taxable income eligible for the small busi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started