Answered step by step

Verified Expert Solution

Question

1 Approved Answer

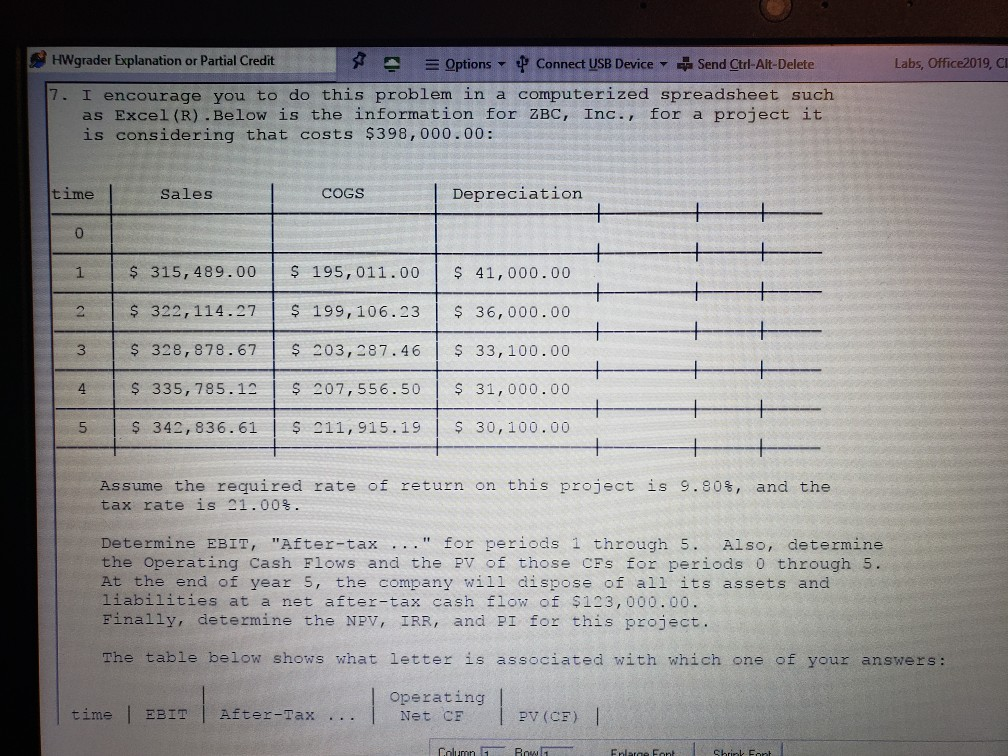

Labs, Office2019, HWgrader Explanation or Partial Credit Options Connect USB Device Send Ctrl-Alt-Delete 7. I encourage you to do this problem in a computerized spreadsheet

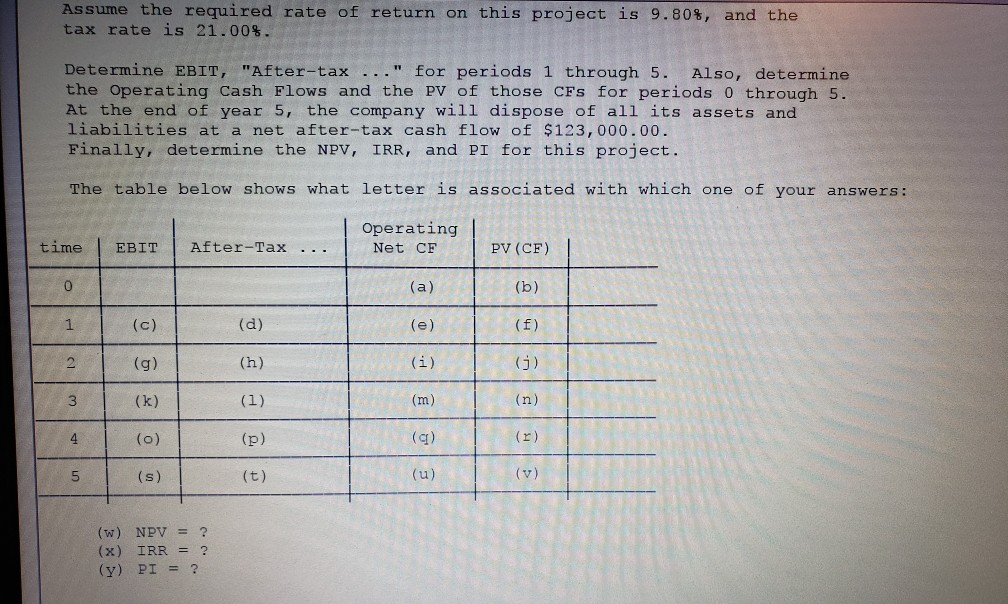

Labs, Office2019, HWgrader Explanation or Partial Credit Options Connect USB Device Send Ctrl-Alt-Delete 7. I encourage you to do this problem in a computerized spreadsheet such as Excel(R).Below is the information for ZBC, Inc., for a project it is considering that costs $398,000.00: time Sales COGS Depreciation + + $ 315,489.00 | $ 195,011.00 $ 41,000.00 ttttt + $ 322,114.27 $ 199,106.23 | $ 36,000.00 + 3 | $ 328,879.67 $ 203,287.46 | $ 33,100.00 + $ 335,785.12 $ 207,556.50 $ 31,000.00 5 1 $ 342,836.61 1 $ 211,915.19 | $ 30,100.00 Assume the required rate of return on this project is 9.80%, and the tax rate is 21.00%. Determine EBIT, "After-tax ..." for periods 1 through 5. Also, determine the Operating Cash Flows and the PV of those CFs for periods o through 5. At the end of year 5, the company will dispose of all its assets and liabilities at a net after-tax cash flow of $123,000.00. Finally, determine the NPV, IRR, and PI for this project. The table below shows what letter is associated with which one of your answers: Operating time | EBIT | After-tax ... | Net CF 1 PV (CF) Column Row E nlarge Font Shrink Font Assume the required rate of return on this project is 9.80%, and the tax rate is 21.00%. Determine EBIT, "After-tax ..." for periods 1 through 5. Also, determine the Operating Cash Flows and the PV of those CF's for periods 0 through 5. At the end of year 5, the company will dispose of all its assets and liabilities at a net after-tax cash flow of $123,000.00. Finally, determine the NPV, IRR, and PI for this project. The table below shows what letter is associated with which one of your answers: Operating Net CF time EBIT After-Tax ... - +- (a) i +- (c) (d) (e) 1 - + - + - + AL LLLL - +- ALLT +- (g) (h) (i) + (k) (1) i T uw (o) (p) - (s) (t) + . (w) NPV = ? (x) IRR = ? (y) PI =

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started