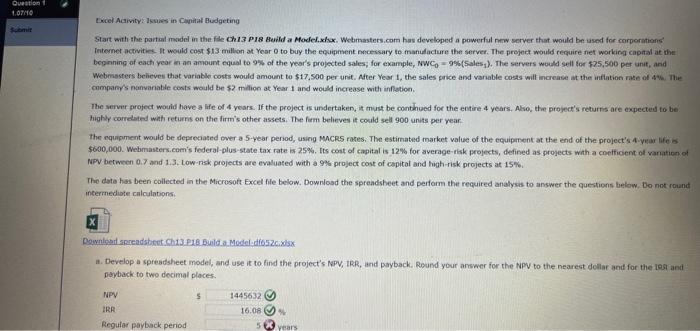

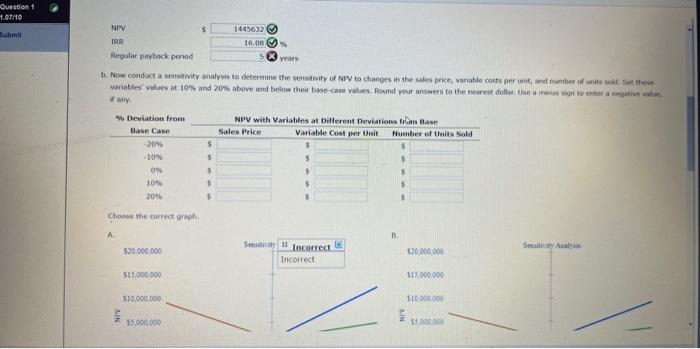

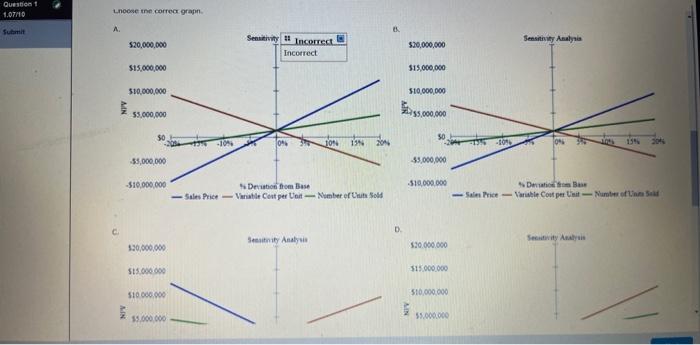

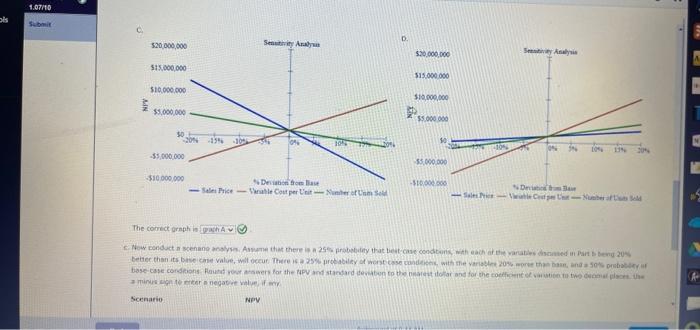

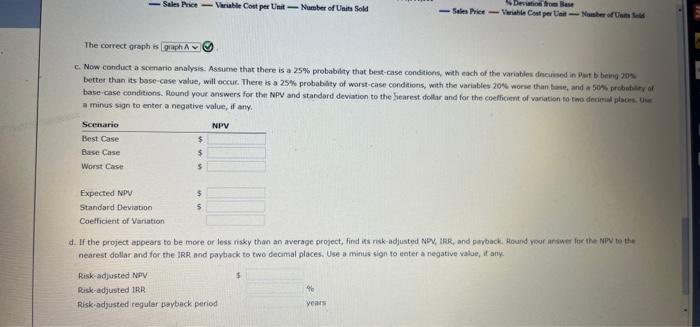

Lacel Acainty: Istikes in Canial Hudgeting icompany's nanyariable cents would te $2 milion at Year t and would increase with infetion. bighly correlated wah returns on the firmis other assets. The farm believes it coeild seld 900 units per year. Rev betwoen 0.7 and 1.3. Low nek projects are evaluated with a.9\%s project cost of capital and hagh-risk projects at 15%. interrnediate calculations. a. Develop a spreadsheet model, and use it to find the project's NPV, IRR, land payback. Reund your answer for the NPV to the nearect dellar and for the lest and pepback to two decimal places. NPV IRR Regular payback period b. Now conduct a tensitivity analysis to setermine the sensitivity of N.V to changes in the sales price, varable costs per unut, and nuenter of unas sid. Get thesis at any. Choose the carrect greph. Lnecse the correcr graju!. Scenatio Aary c. Now conduct a scenario analysis. Assume that there is a 25% probabilty that best-case conditions, with each of the variabies dincinsed in Part b being ?0. better than its bose-case value, will occur. There is a 25% probabilty of worst-case conditions, with the variables 20% wone than base, and an 50 pe probailtr af base case canditions. Round your answers for thit NPV and standard devation to the hearest dollar and for the coeflicient of varation fo tma denieid piaces. Use a minus sign to enter a negative value, if any. d. If the project appears to be more or less risky than an average project, find ifs risk-adjusted NPV, IER, and pwback. Alound rour aniner fne the NFW to the nearest dollar and for the IRR and paytack, to two decamal places, Use a minis sign to eater a negative value, it any. Lacel Acainty: Istikes in Canial Hudgeting icompany's nanyariable cents would te $2 milion at Year t and would increase with infetion. bighly correlated wah returns on the firmis other assets. The farm believes it coeild seld 900 units per year. Rev betwoen 0.7 and 1.3. Low nek projects are evaluated with a.9\%s project cost of capital and hagh-risk projects at 15%. interrnediate calculations. a. Develop a spreadsheet model, and use it to find the project's NPV, IRR, land payback. Reund your answer for the NPV to the nearect dellar and for the lest and pepback to two decimal places. NPV IRR Regular payback period b. Now conduct a tensitivity analysis to setermine the sensitivity of N.V to changes in the sales price, varable costs per unut, and nuenter of unas sid. Get thesis at any. Choose the carrect greph. Lnecse the correcr graju!. Scenatio Aary c. Now conduct a scenario analysis. Assume that there is a 25% probabilty that best-case conditions, with each of the variabies dincinsed in Part b being ?0. better than its bose-case value, will occur. There is a 25% probabilty of worst-case conditions, with the variables 20% wone than base, and an 50 pe probailtr af base case canditions. Round your answers for thit NPV and standard devation to the hearest dollar and for the coeflicient of varation fo tma denieid piaces. Use a minus sign to enter a negative value, if any. d. If the project appears to be more or less risky than an average project, find ifs risk-adjusted NPV, IER, and pwback. Alound rour aniner fne the NFW to the nearest dollar and for the IRR and paytack, to two decamal places, Use a minis sign to eater a negative value, it any