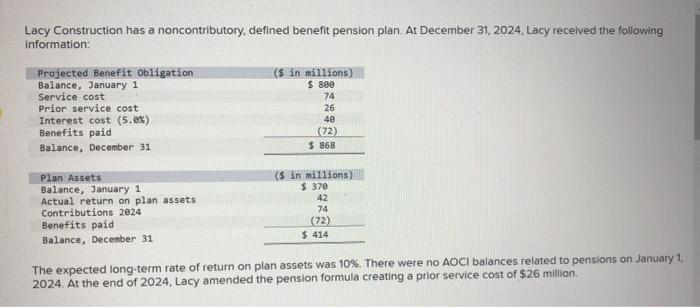

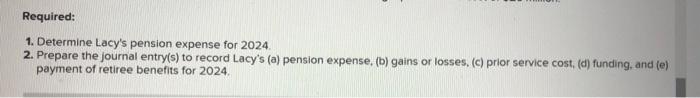

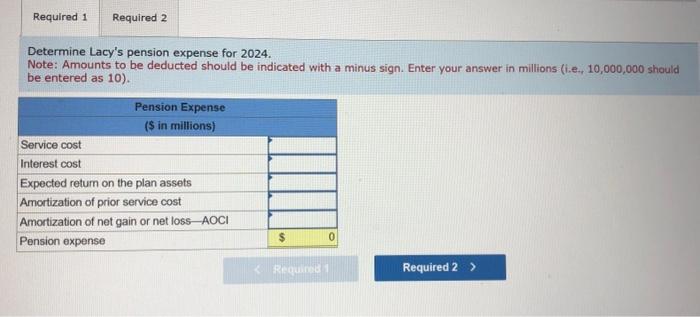

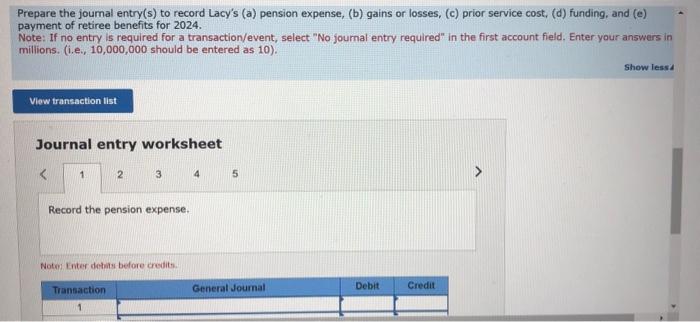

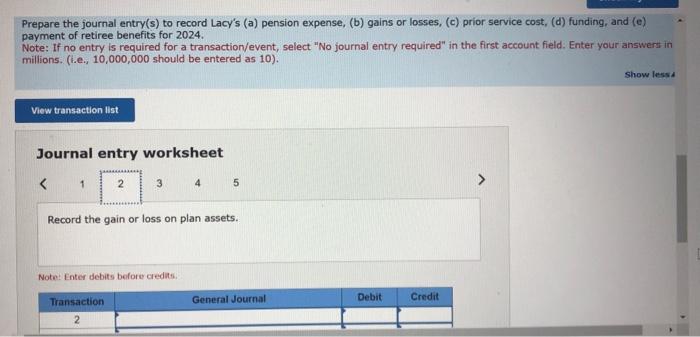

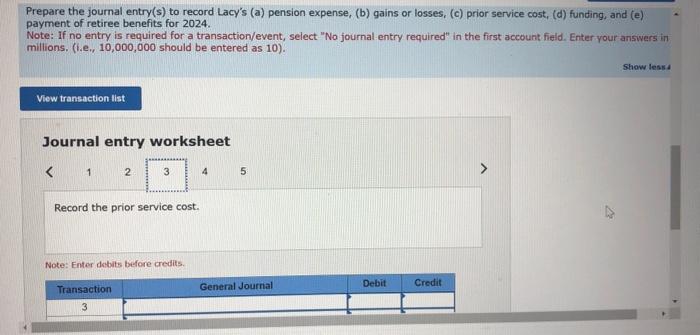

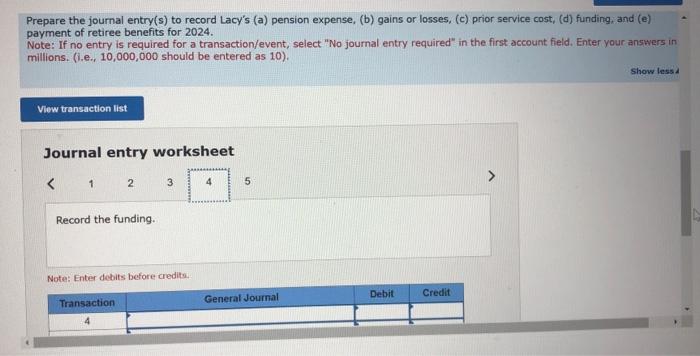

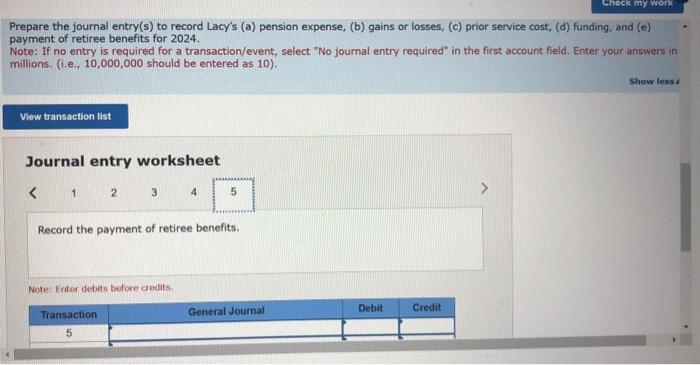

Lacy Construction has a noncontributory, defined benefit pension plan. At December 31, 2024, Lacy recelved the following information: The expected long-term rate of return on plan assets was 10%. There were no AOCI balances related to pensions on January 1 , 2024. At the end of 2024 , Lacy amended the pension formula creating a prior service cost of $26 million Required: 1. Determine Lacy's pension expense for 2024 2. Prepare the journal entry(s) to record Lacy's (a) pension expense, (b) gains or losses, (c) prior service cost, (d) funding, and (e) payment of retiree benefits for 2024 . Determine Lacy's pension expense for 2024. Note: Amounts to be deducted should be indicated with a minus sign. Enter your answer in millions (i.e., 10,000,000 should be entered as 10). Prepare the joumal entry(s) to record Lacy's (a) pension expense, (b) gains or losses, (c) prior service cost, (d) funding, and (e) payment of retiree benefits for 2024. Note: If no entry is required for a transaction/event, select "No joumal entry required" in the first account field. Enter your answers in millions. (i.e., 10,000,000 should be entered as 10). Show less 4 Prepare the journal entry(s) to record Lacy's (a) pension expense, (b) gains or losses, (c) prior service cost, (d) funding, and (c) payment of retiree benefits for 2024 . Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in millions. (i.e., 10,000,000 should be entered as 10). Inurnal entrv worksheet Prepare the journal entry(s) to record Lacy's (a) pension expense, (b) gains or losses, (c) prior service cost, (d) funding, and (e) payment of retiree benefits for 2024 . payment of retiree benefits for 2024. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your ansivers in millions. (i.e., 10,000,000 should be entered as 10). Journal entry worksheet Prepare the journal entry(s) to record Lacy's (a) pension expense, (b) gains or losses, (c) prior service cost, (d) funding, and (e) payment of retiree benefits for 2024 . Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field, Enter your answers in millions. (i.e., 10,000,000 should be entered as 10). Journal entry worksheet Note: Enter debits before credits: Prepare the journal entry(s) to record Lacy's (a) pension expense, (b) gains or losses, (c) prior service cost, (d) funding, and (e) payment of retiree benefits for 2024 . Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field, Enter your answers in millions. (i.e., 10,000,000 should be entered as 10). Journal entry worksheet