Answered step by step

Verified Expert Solution

Question

1 Approved Answer

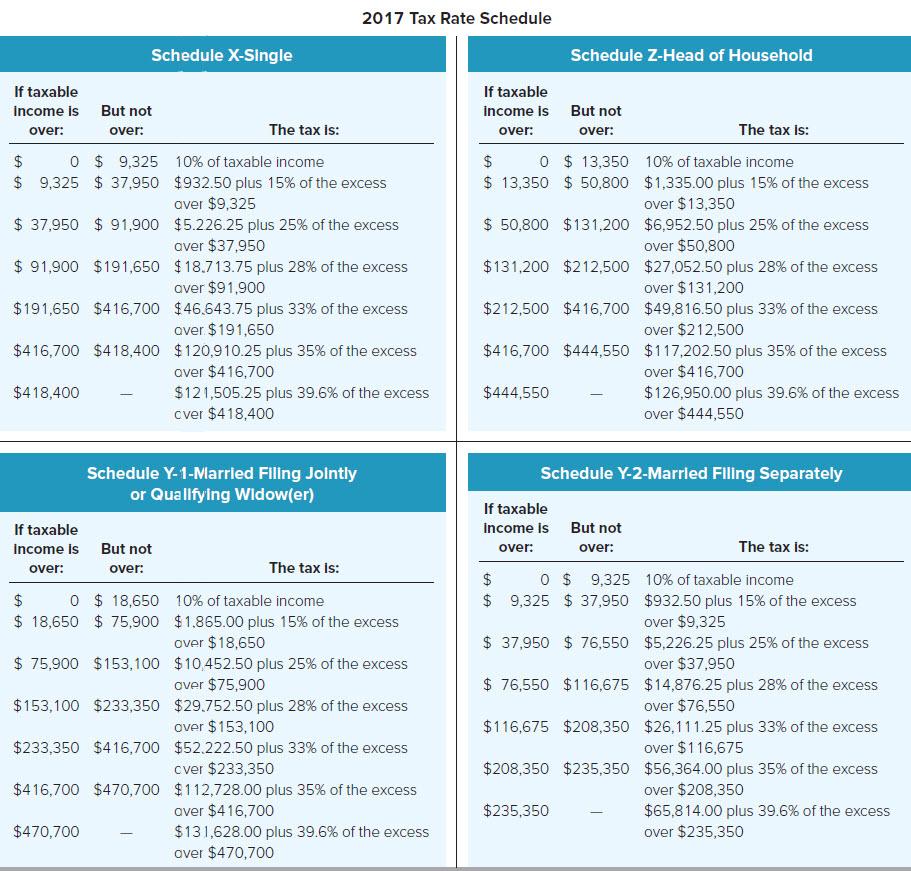

Lacy is a single taxpayer. In 2017, her taxable income is $40,000. What is her tax liability in each of the following alternative situations? Use

Lacy is a single taxpayer. In 2017, her taxable income is $40,000. What is her tax liability in each of the following alternative situations? Use Tax Rate Schedule for reference. (Do not round intermediate calculations. Round your answer to 2 decimal places.)

a. All of her income is salary from her employer.

Tax liability:$____________

b. Her $40,000 of taxable income includes $1,000 of qualified dividends.

Tax liability:$____________

c. Her $40,000 of taxable income includes $5,000 of qualified dividends.

Tax liability:$_____________________

2017 Tax Rate Schedule Schedule X-Single Schedule Z-Head of Household If taxable If taxable income is But not income Is But not over: over: The tax is: over: over: The tax is: O $ 9,325 10% of taxable income $ 9,325 $ 37,950 $932.50 plus 15% of the excess aver $9,325 $ 37,950 $ 91,900 $5.226.25 plus 25% of the excess O $ 13,350 10% of taxable income $ 13,350 $ 50,800 $1,335.00 plus 15% of the excess over $13,350 $ 50,800 $131,200 $6,952.50 plus 25% of the excess 2$ 2$ aver $37,950 $ 91,900 $191,650 $18.713.75 plus 28% of the excess aver $91,900 $191,650 $416,700 $46.643.75 plus 33% of the excess over $50,800 $131,200 $212,500 $27,052.50 plus 28% of the excess over $131,200 $212,500 $416,700 $49,816.50 plus 33% of the excess aver $191,650 over $212,500 $416,700 $418,400 $120,910.25 plus 35% of the excess $416,700 $444,550 $117,202.50 plus 35% of the excess over $416,700 $121,505.25 plus 39.6% of the excess cver $418,400 over $416,700 $126,950.00 plus 39.6% of the excess over $444,550 $418,400 $444,550 Schedule Y-1-Married Filing Jolntly or Quallfying Widow(er) Schedule Y-2-Marrled FIling Separately If taxable Income is But not If taxable Income is But not over: over: The tax Is: The tax is: over: over: O $ 9,325 10% of taxable income $ 9,325 $ 37,950 $932.50 plus 15% of the excess over $9,325 $ 37,950 $ 76,550 $5,226.25 plus 25% of the excess 2$ 24 O $ 18,650 10% of taxable income $ 18,650 $ 75,900 $1.865.00 plus 15% of the excess over $18,650 $ 75,900 $153,100 $10,452.50 plus 25% of the excess over $75,900 $153,100 $233,350 $29.752.50 plus 28% of the excess over $153,100 $233,350 $416,700 $52.222.50 plus 33% of the excess cver $233,350 $416,700 $470,700 $112,728.00 plus 35% of the excess over $416,700 over $37,950 $ 76,550 $116,675 $14,876.25 plus 28% of the excess over $76,550 $116,675 $208,350 $26,111.25 plus 33% of the excess over $116,675 $208,350 $235,350 $56,364.00 plus 35% of the excess over $208,350 $65,814.00 plus 39.6% of the excess over $235,350 $235,350 $470,700 $131,628.00 plus 39.6% of the excess over $470,700

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started