Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Lafayette Co.'s long-term avallable-for-sale portfolio at the start of this year consists of the following. Lafayette enters Into the following transactions Involving its avallable-for-sale debt

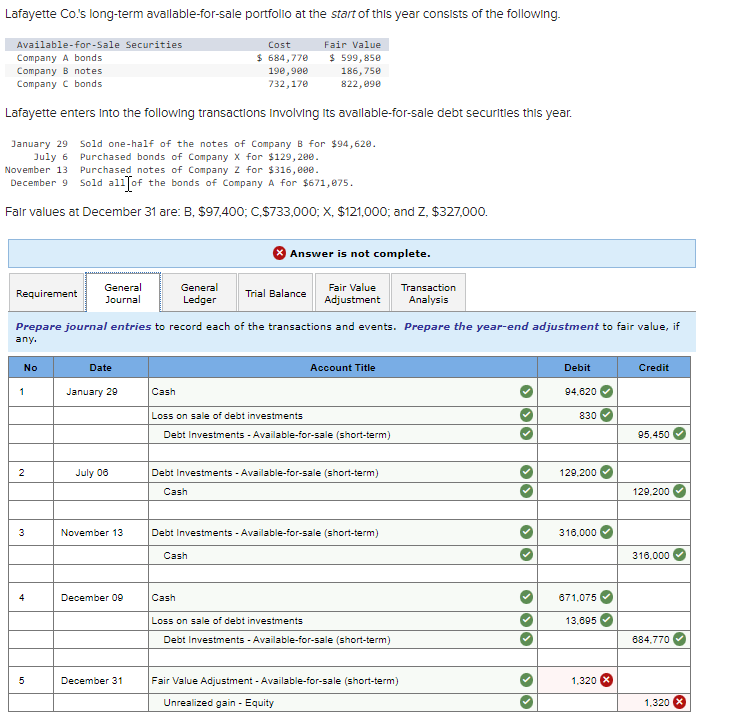

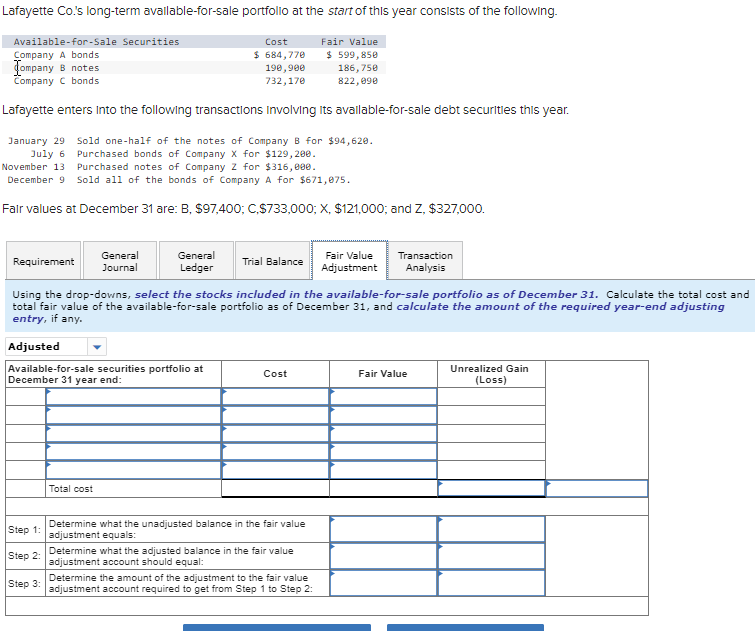

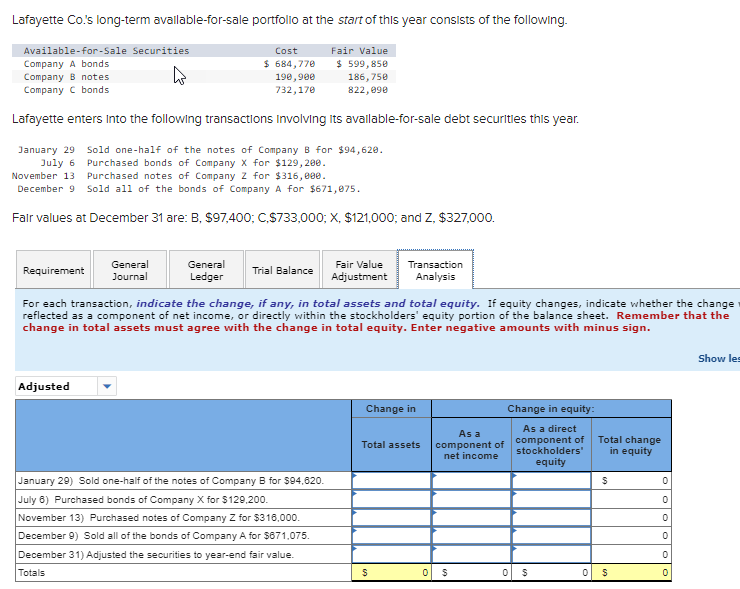

Lafayette Co.'s long-term avallable-for-sale portfolio at the start of this year consists of the following. Lafayette enters Into the following transactions Involving its avallable-for-sale debt securlties this year. January 29 Sold one-half of the notes of Company B for $94,62. July 6 Purchased bonds of Company X for $129,2. November 13 Purchased notes of Company Z for $316, 90. December 9 Sold all] of the bonds of Company A for $671,075. Falr values at December 31 are: B, $97,400;C,$733,000;X,$121,000; and Z,$327,000. Answer is not complete. Prepare journal entries to record each of the transactions and events. Prepare the year-end adjustment to fair value, if any. Lafayette enters into the following transactions involving its avallable-for-sale debt securlties this year. January 29 Sold one-half of the notes of Company B for $94,62. July 6 Purchased bonds of Company x for $129,200. November 13 Purchased notes of Company z for $316, 00. December 9 Sold all of the bonds of Company A for $671,075. Falr values at December 31 are: B, $97,400;C,$733,000;X,$121,000; and Z, $327,000. Using the drop-downs, select the stocks included in the available-for-sale portfolio as of December 31 . Calculate the total cost an total fair value of the available-for-sale portfolio as of December 31 , and calculate the amount of the required year-end adjusting entry, if any. Lafayette Co.'s long-term avallable-for-sale portfollo at the start of this year consists of the following. Lafayette enters Into the following transactions Involving its avallable-for-sale debt securltles this year. January29July6November13December9Soldone-halfofthenotesofCompanyBfor$94,62.PurchasednotesofCompanyZfor$316,9.SoldallofthebondsofCompanyAfor$671,075. January 29 Sold one-half of the notes of Company B for $94,62. July 6 Purchased bonds of Company x for $129,20. November 13 Purchased notes of Company Z for $316, 00. December 9 Sold all of the bonds of Company A for $671,075. Falr values at December 31 are: B, $97,400;C,$733,000;X,$121,000; and Z,$327,000. For each transaction, indicate the change, if any, in total assets and total equity. If equity changes, indicate whether the cha reflected as a component of net income, or directly within the stockholders' equity portion of the balance sheet. Remember that t change in total assets must agree with the change in total equity. Enter negative amounts with minus sign

Lafayette Co.'s long-term avallable-for-sale portfolio at the start of this year consists of the following. Lafayette enters Into the following transactions Involving its avallable-for-sale debt securlties this year. January 29 Sold one-half of the notes of Company B for $94,62. July 6 Purchased bonds of Company X for $129,2. November 13 Purchased notes of Company Z for $316, 90. December 9 Sold all] of the bonds of Company A for $671,075. Falr values at December 31 are: B, $97,400;C,$733,000;X,$121,000; and Z,$327,000. Answer is not complete. Prepare journal entries to record each of the transactions and events. Prepare the year-end adjustment to fair value, if any. Lafayette enters into the following transactions involving its avallable-for-sale debt securlties this year. January 29 Sold one-half of the notes of Company B for $94,62. July 6 Purchased bonds of Company x for $129,200. November 13 Purchased notes of Company z for $316, 00. December 9 Sold all of the bonds of Company A for $671,075. Falr values at December 31 are: B, $97,400;C,$733,000;X,$121,000; and Z, $327,000. Using the drop-downs, select the stocks included in the available-for-sale portfolio as of December 31 . Calculate the total cost an total fair value of the available-for-sale portfolio as of December 31 , and calculate the amount of the required year-end adjusting entry, if any. Lafayette Co.'s long-term avallable-for-sale portfollo at the start of this year consists of the following. Lafayette enters Into the following transactions Involving its avallable-for-sale debt securltles this year. January29July6November13December9Soldone-halfofthenotesofCompanyBfor$94,62.PurchasednotesofCompanyZfor$316,9.SoldallofthebondsofCompanyAfor$671,075. January 29 Sold one-half of the notes of Company B for $94,62. July 6 Purchased bonds of Company x for $129,20. November 13 Purchased notes of Company Z for $316, 00. December 9 Sold all of the bonds of Company A for $671,075. Falr values at December 31 are: B, $97,400;C,$733,000;X,$121,000; and Z,$327,000. For each transaction, indicate the change, if any, in total assets and total equity. If equity changes, indicate whether the cha reflected as a component of net income, or directly within the stockholders' equity portion of the balance sheet. Remember that t change in total assets must agree with the change in total equity. Enter negative amounts with minus sign Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started