Question

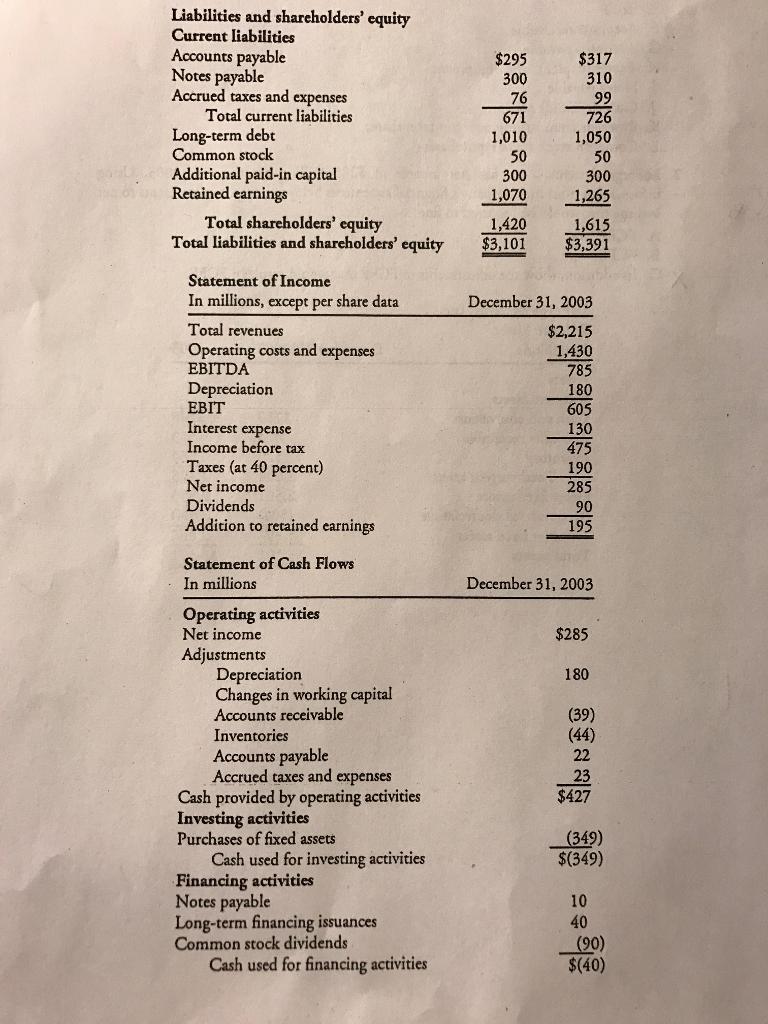

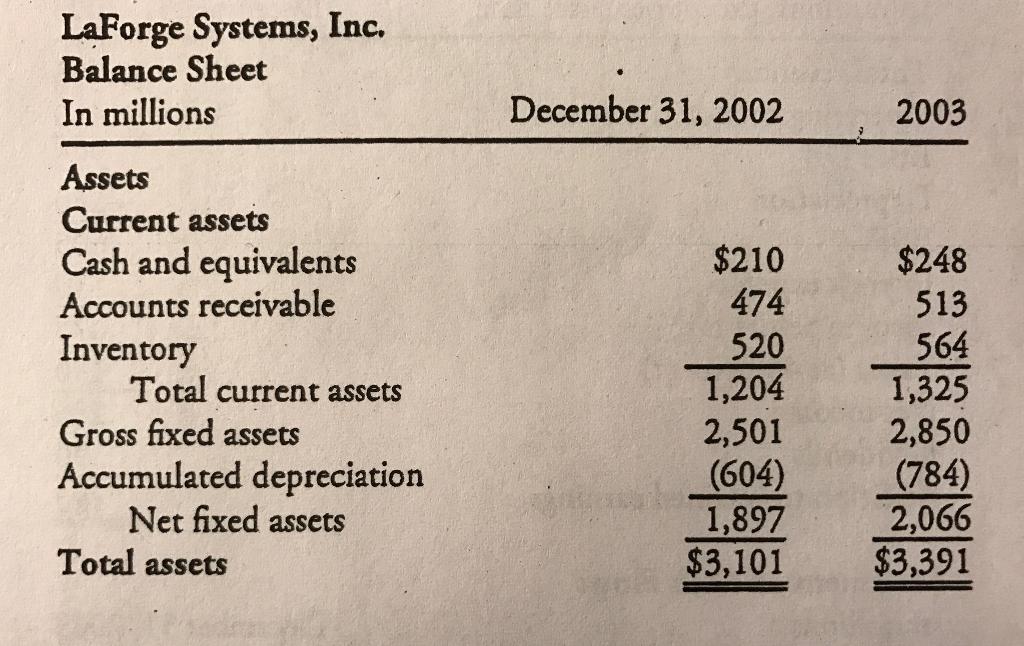

LaForge Systems, Inc, has a net income of 285$ million for the year 2003. Using information from the company's financial statement below, show the adjustments

LaForge Systems, Inc, has a net income of 285$ million for the year 2003. Using information from the company's financial statement below, show the adjustments to net income that would be required to find:

A. FCFF, and

B. FCFE

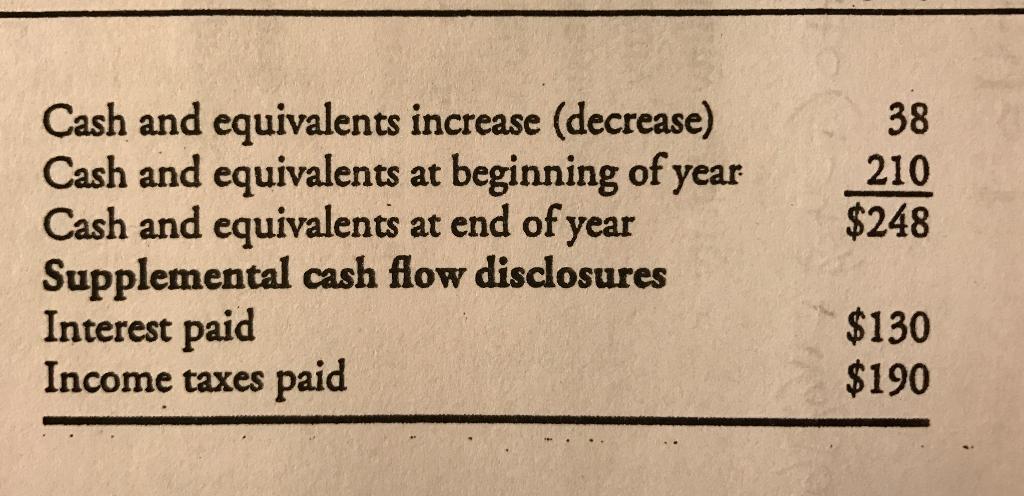

Cash and equivalents increase (decrease) Cash and equivalents at beginning of year Cash and equivalents at end of year Supplemental cash flow disclosures Interest paid Income taxes paid 38 210 $248 $130 $190

Step by Step Solution

3.39 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

Calculation of FCFF net income 285 Interest expense 1t 78 add depreciat...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

College Accounting

Authors: Tracie Nobles, Cathy Scott, Douglas McQuaig, Patricia Bille

11th edition

978-1111528300, 1111528128, 1111528306, 978-1111528126

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App