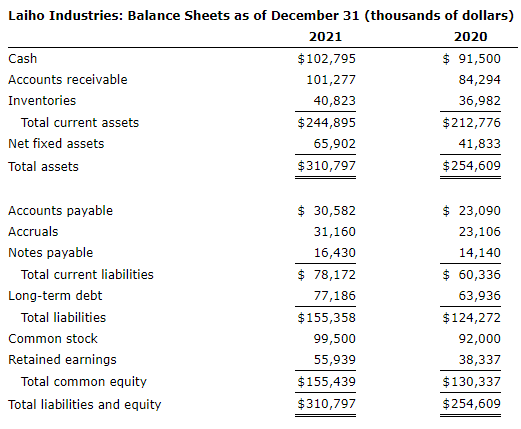

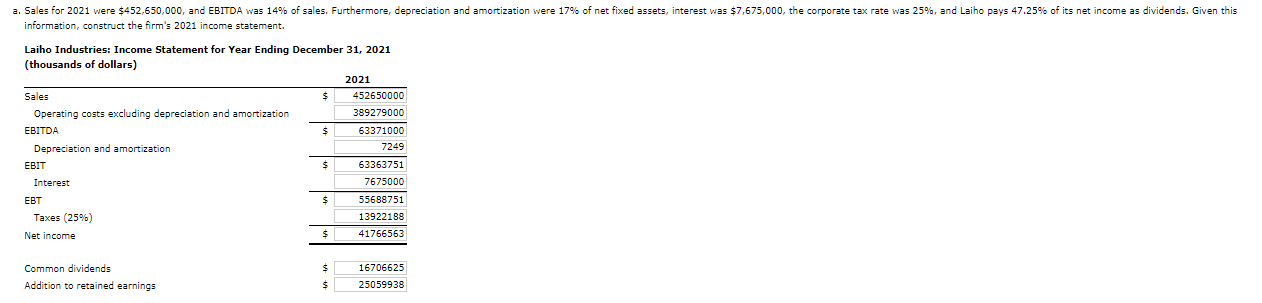

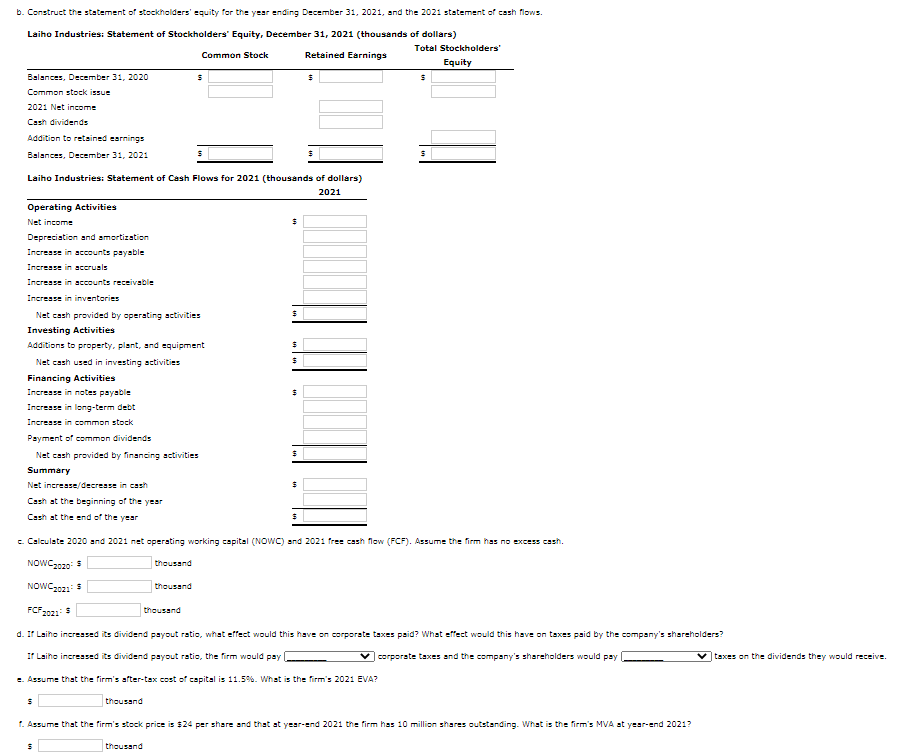

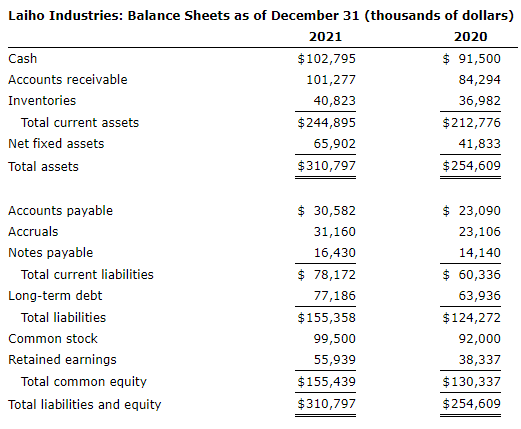

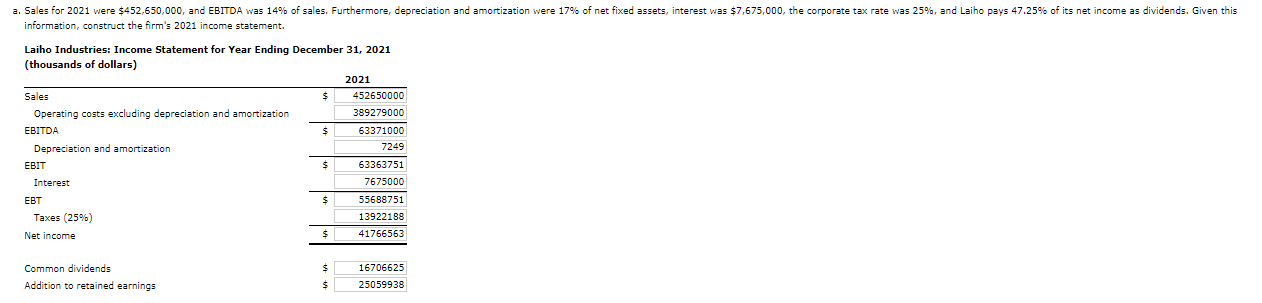

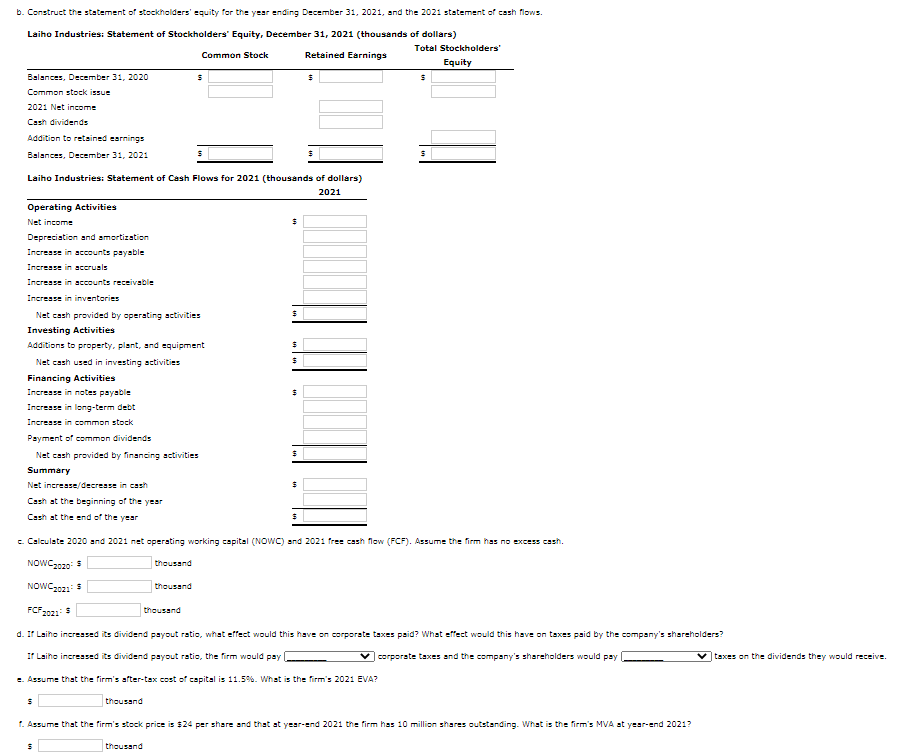

Laiho Industries: Balance Sheets as of December 31 (thousands of dollars) 2021 2020 Cash $ 102,795 $ 91,500 Accounts receivable 101,277 84,294 Inventories 40,823 36,982 Total current assets $ 244,895 $ 212,776 Net fixed assets 65,902 41,833 Total assets $310,797 $ 254,609 Accounts payable Accruals Notes payable Total current liabilities Long-term debt Total liabilities Common stock Retained earnings Total common equity Total liabilities and equity $ 30,582 31,160 16,430 $ 78,172 77,186 $ 155,358 99,500 55,939 $ 155,439 $310,797 $ 23,090 23,106 14,140 $ 60,336 63,936 $ 124,272 92,000 38,337 $ 130,337 $ 254,609 a. Sales for 2021 were $452,650,000, and EBITDA was 14% of sales. Furthermore, depreciation and amortization were 17% of net fixed assets, interest was $7,675,000, the corporate tax rate was 25%, and Laiho pays 47.25% of its net income as dividends. Given this information, construct the firm's 2021 income statement Laiho Industries: Income Statement for Year Ending December 31, 2021 (thousands of dollars) 2021 Sales 452650000 Operating costs excluding depreciation and amortization 389279000 EBITDA $ 63371000 Depreciation and amortization 7249 EBIT $ 63363751 Interest 7675000 EBT 55688751 Taxes (25%) 13922188 Net income $ 41766563 $ Common dividends Addition to retained earnings 16706625 25059938 $ b. Construct the statement of stockholders' equity for the year ending December 31, 2021, and the 2021 statement of cash flows. Laiho Industries: Statement of Stockholders' Equity, December 31, 2021 (thousands of dollars) Total Stockholders' Common Stock Retained Earnings Equity Balances, December 31, 2020 5 $ S Common stock issue 2021 Net income Cash dividends Addition to retained earnings Balances, December 3, 2021 $ s Laiho Industries: Statement of Cash Flows for 2021 (thousands of dollars) 2021 Operating Activities Net income 5 Depreciation and amortization Increase in accounts payable Increase in accruals Increase in accounts receivable Increase in inventories Net cash provided by operating activities $ Investing Activities Additions to property, plant, and equipment $ Net cash used in investing activities $ Financing Activities Increase in notes payable $ Increase in long-term debt Increase in common stock Payment of common dividends Net cash provided by financing activities $ Summary Net increase/decrease in cash 3 Cash at the beginning of the year Cash at the end of the year $ c. Calculate 2020 and 2021 net operating working capital (NOWC) and 2021 free cash flow (FCF). Assume the firm has no excess cash. NOWC2020: 5 thousand NOWC20215 thousand FCF 2021: $ thousand d. It Laiho increased its dividend payout ratio, what effect would this have on corporate taxes paid? What effect would this have on taxes paid by the company's shareholders? If Laiho increased its dividend payout ratio, the firm would pay corporate taxes and the company's shareholders would pay taxes on the dividends they would receive. - Assume that the firm's after-tax cost of capital is 11.59. What is the firm's 2021 EVA? 5 thousand 1. Assume that the firm's stock price is $24 per share and that at year-end 2021 the firm has 10 million shares outstanding. What is the firm's MVA at year-end 2021? 5 thousand