Answered step by step

Verified Expert Solution

Question

1 Approved Answer

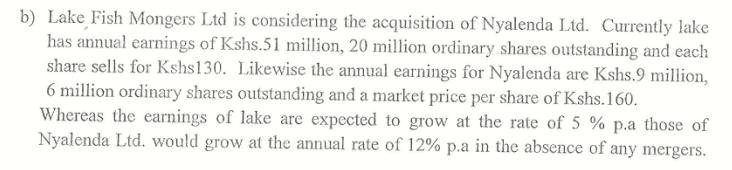

Lake Fish Mongers Ltd is considering the acquisition of Nyalenda Ltd. Currently lake has annual earnings of Kshs.51 million, 20 million ordinary shares outstanding

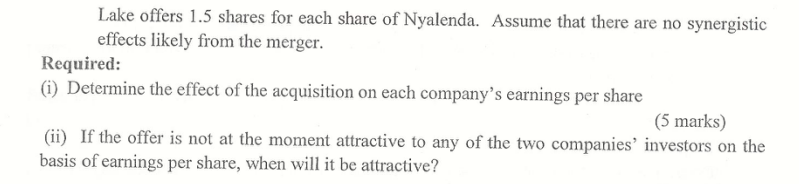

Lake Fish Mongers Ltd is considering the acquisition of Nyalenda Ltd. Currently lake has annual earnings of Kshs.51 million, 20 million ordinary shares outstanding and each share sells for Kshs130. Likewise the annual earnings for Nyalenda are Kshs.9 million, 6 million ordinary shares outstanding and a market price per share of Kshs.160. Whereas the earnings of lake are expected to grow at the rate of 5% p.a those of Nyalenda Ltd. would grow at the annual rate of 12% p.a in the absence of any mergers. Lake offers 1.5 shares for each share of Nyalenda. Assume that there are no synergistic effects likely from the merger. Required: (i) Determine the effect of the acquisition on each company's earnings per share (5 marks) (ii) If the offer is not at the moment attractive to any of the two companies' investors on the basis of earnings per share, when will it be attractive?

Step by Step Solution

★★★★★

3.38 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below i Lake Fish Mongers Ltd Earnings Per Sh...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started