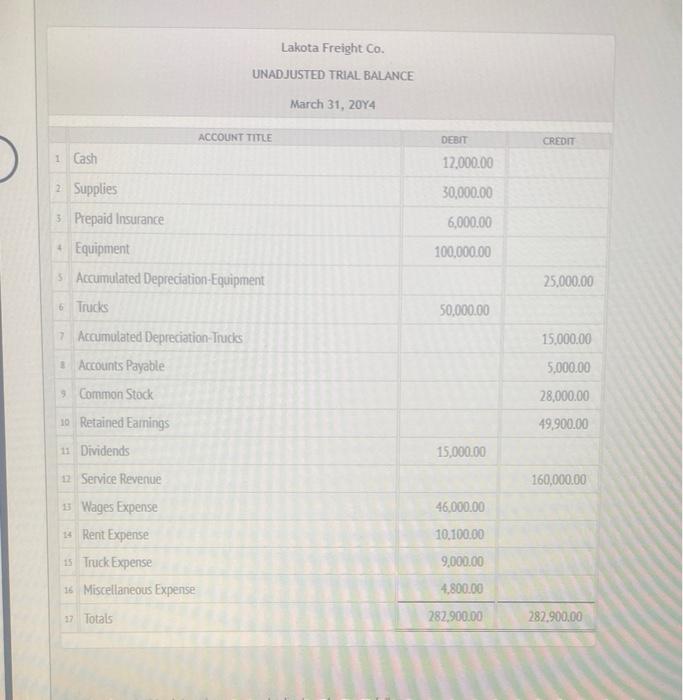

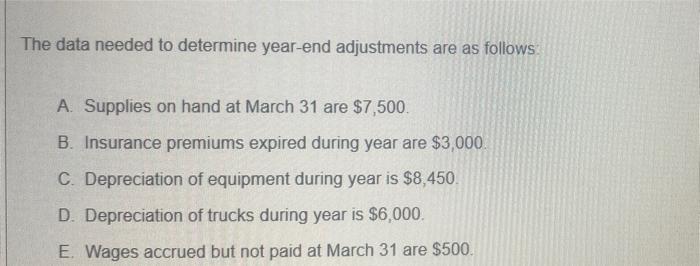

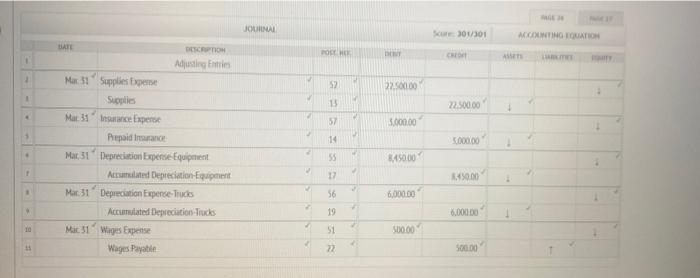

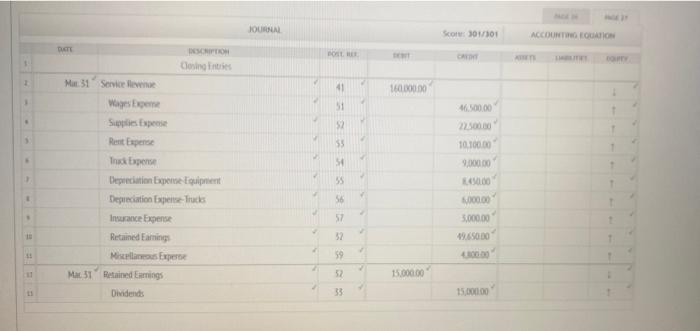

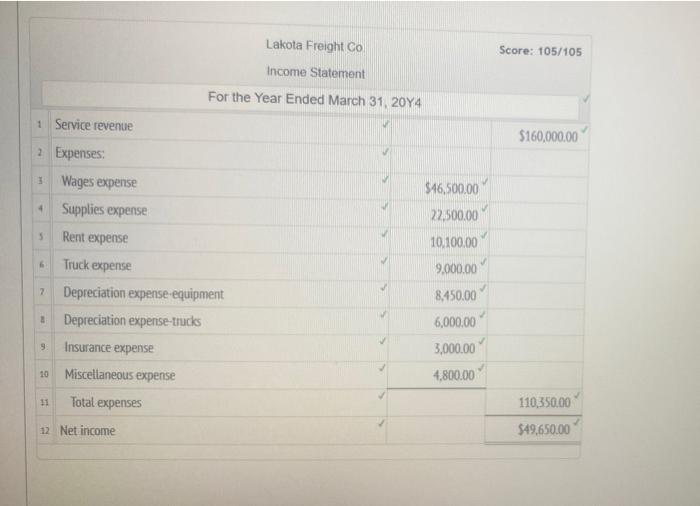

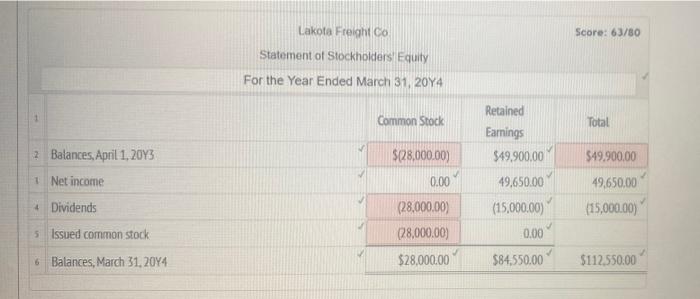

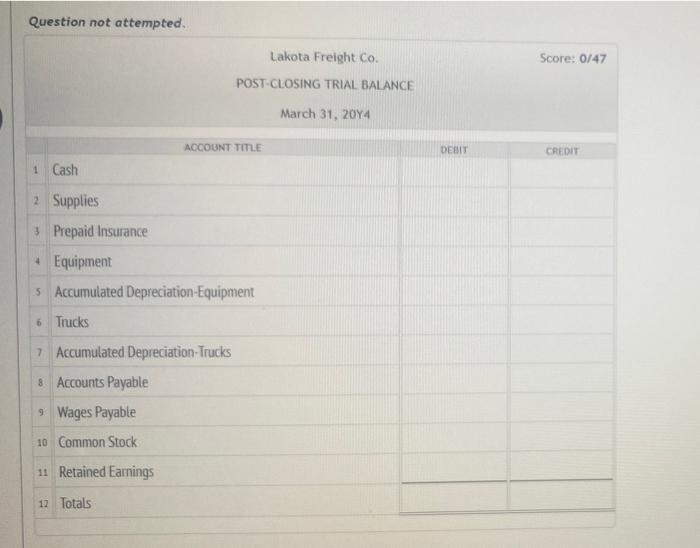

Lakota Freight Co. UNADJUSTED TRIAL BALANCE March 31, 2014 ACCOUNT TITLE DERIT CREDIT 1 Cash 12,000.00 30,000.00 6,000.00 2 Supplies 3 Prepaid Insurance + Equipment 5. Accumulated Depreciation-Equipment 100,000.00 25,000.00 6 Trucks 50,000.00 15.000.00 5,000.00 7 Accumulated Depreciation-Trucks * Accounts Payable 9 Common Stock 10 Retained Earnings 11 Dividends 28,000.00 49,900.00 15,000.00 12 Service Revenue 160,000.00 46.000.00 10,100.00 3 Wages Expense 13 Rent Expense 15 Truck Expense 15 Miscellaneous Expense 9,000.00 4,800.00 17 Totals 282,900.00 282.900.00 The data needed to determine year-end adjustments are as follows: A. Supplies on hand at March 31 are $7,500. B. Insurance premiums expired during year are $3,000. C. Depreciation of equipment during year is $8,450. D. Depreciation of trucks during year is $6,000. E. Wages accrued but not paid at March 31 are $500. JUMA SE301/301 ACCOUNTING ORATION OCH D CH AT 2 22.500.00 1 13 22.500.00 . 57 3.000.00 3 14 5000.00 DATE Dos Adjusting Entries Mar 31 Supplies Expense Supplies Mar 31 Insurance Experte Prepaidance Mar 31 Depreciation Expense Equipment Accumulated Depreciation Equipment Mat 31 Depreciation Expense Trucks Accumulated Depreciation Trudes Mar 31 Wages Expense Wages Payable 55 R450,00 F 17 3.450.00 + 56 6,000.00 19 6.000.00 10 500.00 57 22 500.00 JOURNAL So 01/10 ACCOUNTING OUTON DUTE DOL INSCRIPTION Dosing Enutes CARTE 1 41 1600 DO 51 no 52 22500 10.100,00 55 9,000.00 000 3 Mat 31 Servicelevene Wapesten Spes Expose Rent Expert True Expense Depreciation Expense quiet Depreciation Expense Trucks Insurance Expense Retained Eaming Miscellaneous Expert Mar 31 Retained Earnings Dividends 56 57 000.00 3.000.00 19.650.00 18 32 15 59 52 15.000.00 33 15.000.00 Lakota Freight Co Score: 105/105 Income Statement For the Year Ended March 31, 2044 1 Service revenue $160,000.00 2 Expenses: 1 Wages expense Supplies expense $46,500.00 22,500.00 10,100.00 9,000.00 5 Rent expense Truck expense 8.450.00 3 7 Depreciation expense-equipment Depreciation expense-trucks Insurance expense 10 Miscellaneous expense Total expenses 9. 6,000.00 3,000.00 4,800.00 11 110,350.00 $49,650.00 12 Net income Score: 63/80 Lakota Freight Co Statement of Stockholders Equity For the Year Ended March 31, 2044 Common Stock Total ? Balances, April 1, 2043 Retained Earnings $49,900.00 49.650.00 (15,000.00) 0.00 1 Net income $(28.000.00) 0.00 (28,000.00) (28.000.00) $28,000.00 $49,900.00 49,650,00 (15,000.00) + Dividends 5 Issued common stock 6 Balances, March 31, 2014 $84,550.00 $112.550.00 Lakota Freight Co Balance Sheet Score: 0/169 Label Assets 2 Label bel) 1 Liabilities * Stockholders' Equity Question not attempted. Score: 0/47 Lakota Freight Co. POST-CLOSING TRIAL BALANCE March 31, 2014 ACCOUNT TITLE DEBIT CREDIT 1 Cash 2 Supplies Prepaid Insurance + Equipment 5 Accumulated Depreciation-Equipment 6 Trucks 7 Accumulated Depreciation Trucks 8 Accounts Payable 9 Wages Payable 10 Common Stock 11 Retained Earnings 12 Totals