Answered step by step

Verified Expert Solution

Question

1 Approved Answer

LaMarande Company is preparing a budgeted income statement and cash budget for the year ended December 31, 20X3. Selected information is already shown on

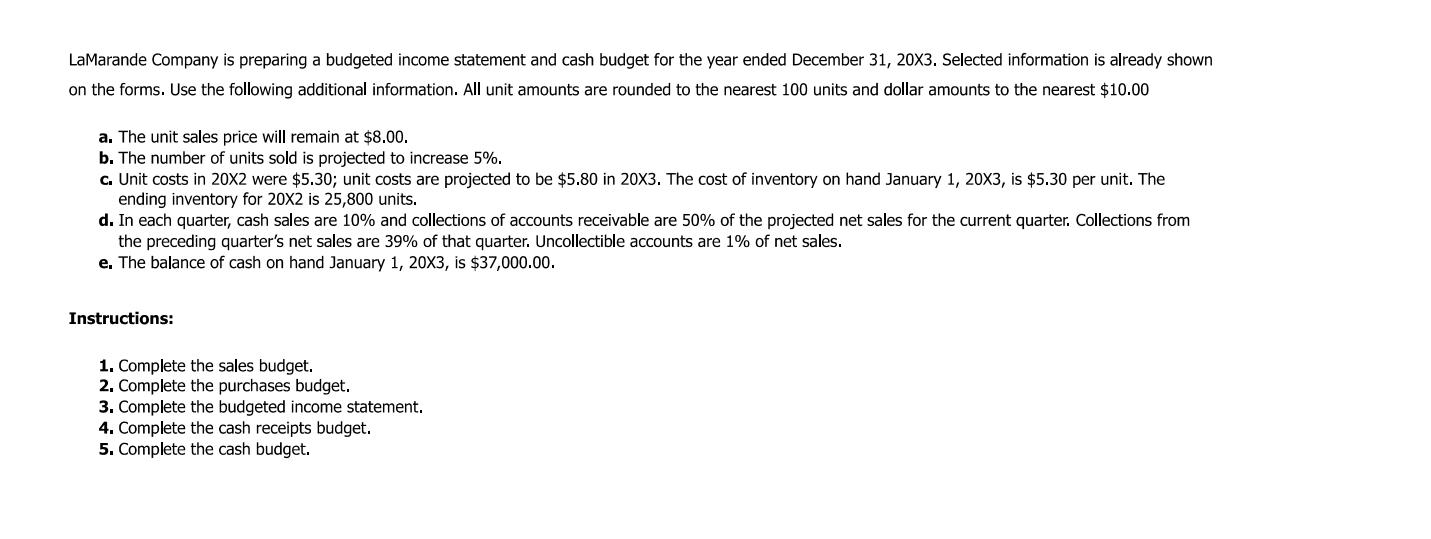

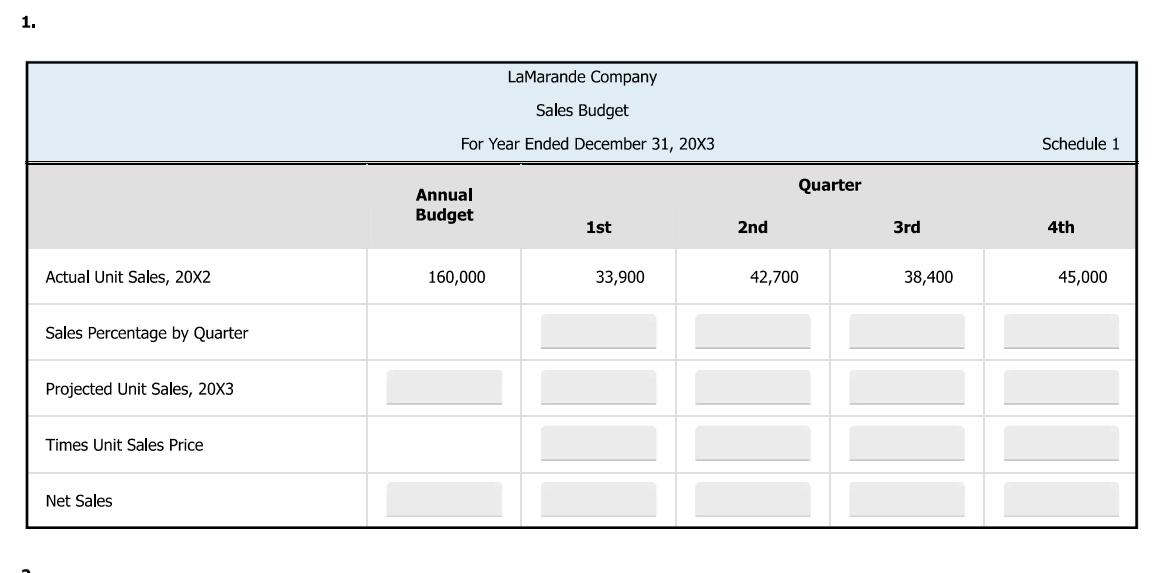

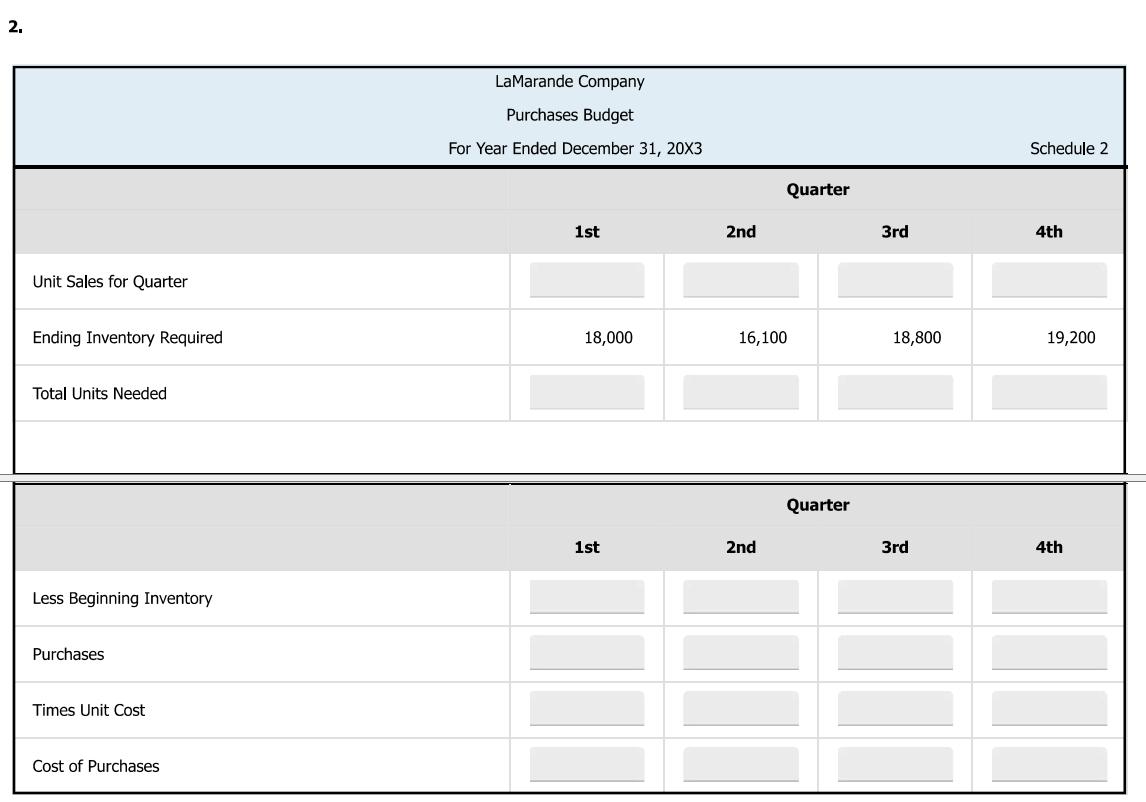

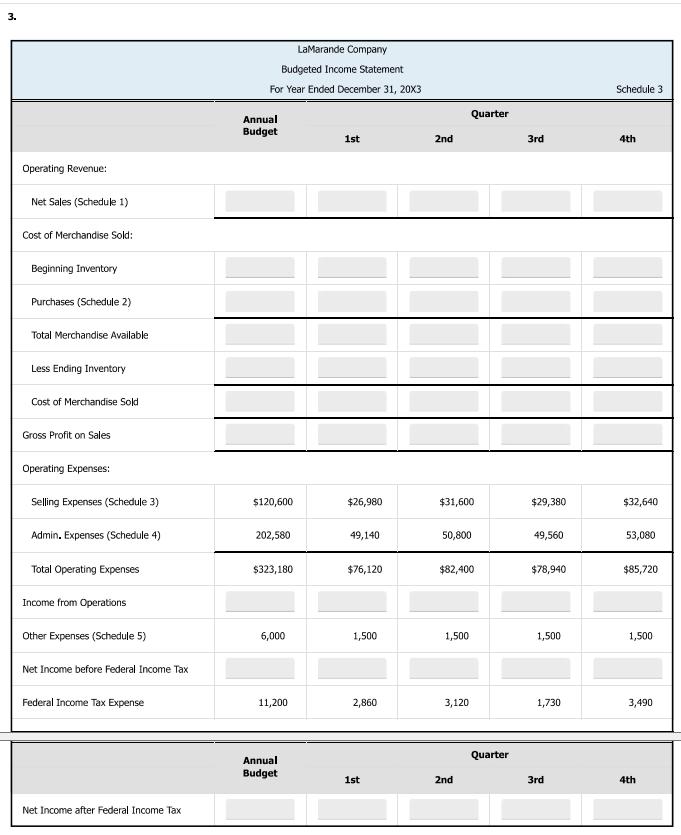

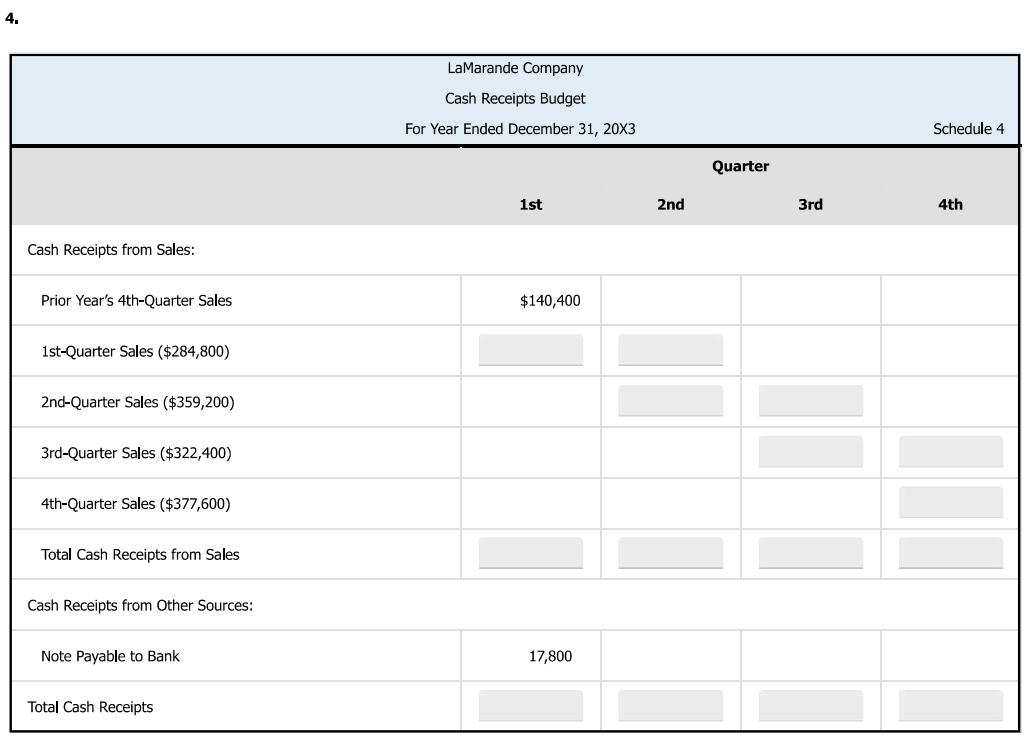

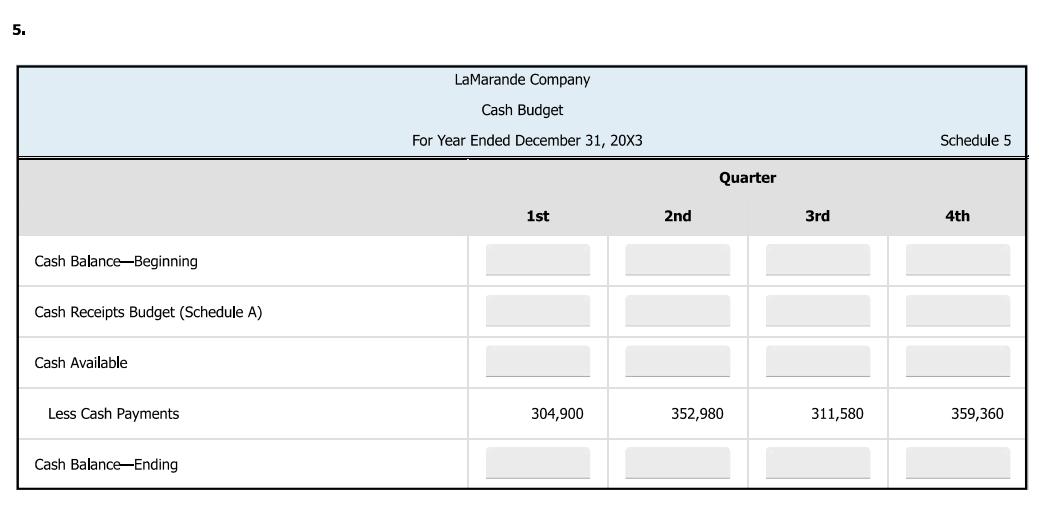

LaMarande Company is preparing a budgeted income statement and cash budget for the year ended December 31, 20X3. Selected information is already shown on the forms. Use the following additional information. All unit amounts are rounded to the nearest 100 units and dollar amounts to the nearest $10.00 a. The unit sales price will remain at $8.00. b. The number of units sold is projected to increase 5%. c. Unit costs in 20X2 were $5.30; unit costs are projected to be $5.80 in 20X3. The cost of inventory on hand January 1, 20X3, is $5.30 per unit. The ending inventory for 20X2 is 25,800 units. d. In each quarter, cash sales are 10% and collections of accounts receivable are 50% of the projected net sales for the current quarter. Collections from the preceding quarter's net sales are 39% of that quarter. Uncollectible accounts are 1% of net sales. e. The balance of cash on hand January 1, 20X3, is $37,000.00. Instructions: 1. Complete the sales budget. 2. Complete the purchases budget. 3. Complete the budgeted income statement. 4. Complete the cash receipts budget. 5. Complete the cash budget. 1. Actual Unit Sales, 20X2 Sales Percentage by Quarter Projected Unit Sales, 20X3 Times Unit Sales Price Net Sales LaMarande Company Sales Budget For Year Ended December 31, 20X3 Annual Budget 160,000 1st 33,900 2nd Quarter 42,700 3rd 38,400 Schedule 1 4th 45,000 2. Unit Sales for Quarter Ending Inventory Required Total Units Needed Less Beginning Inventory Purchases Times Unit Cost Cost of Purchases LaMarande Company Purchases Budget For Year Ended December 31, 20X3 1st 18,000 1st 2nd Quarter 16,100 2nd Quarter 3rd 18,800 3rd Schedule 2 4th 19,200 4th 3. Operating Revenue: Net Sales (Schedule 1) Cost of Merchandise Sold: Beginning Inventory Purchases (Schedule 2) Total Merchandise Available Less Ending Inventory Cost of Merchandise Sold Gross Profit on Sales Operating Expenses: Selling Expenses (Schedule 3) Admin. Expenses (Schedule 4) Total Operating Expenses Income from Operations Other Expenses (Schedule 5) Net Income before Federal Income Tax Federal Income Tax Expense Net Income after Federal Income Tax LaMarande Company Budgeted Income Statement For Year Ended December 31, 20X3 Annual Budget $120,600 202,580 $323,180 6,000 11,200 Annual Budget 1st $26,980 49,140 $76,120 1,500 2,860 1st 2nd $31,600 50,800 Quarter $82,400 1,500 3,120 2nd Quarter 3rd $29,380 49,560 $78,940 1,500 1,730 3rd Schedule 3 4th $32,640 53,080 $85,720 1,500 3,490 4th 4. Cash Receipts from Sales: Prior Year's 4th-Quarter Sales 1st-Quarter Sales ($284,800) 2nd-Quarter Sales ($359,200) 3rd-Quarter Sales ($322,400) 4th-Quarter Sales ($377,600) Total Cash Receipts from Sales Cash Receipts from Other Sources: Note Payable to Bank Total Cash Receipts LaMarande Company Cash Receipts Budget For Year Ended December 31, 20X3 1st $140,400 17,800 2nd Quarter 3rd Schedule 4 4th 5. Cash Balance Beginning Cash Receipts Budget (Schedule A) Cash Available Less Cash Payments Cash Balance-Ending LaMarande Company Cash Budget For Year Ended December 31, 20X3 1st 304,900 2nd Quarter 352,980 3rd 311,580 Schedule 5 4th 359,360

Step by Step Solution

★★★★★

3.46 Rating (169 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started