Question

Lambda Ltd uses a normal costing system and closes off all overhead variances to the cost of goods sold at the end of each year.

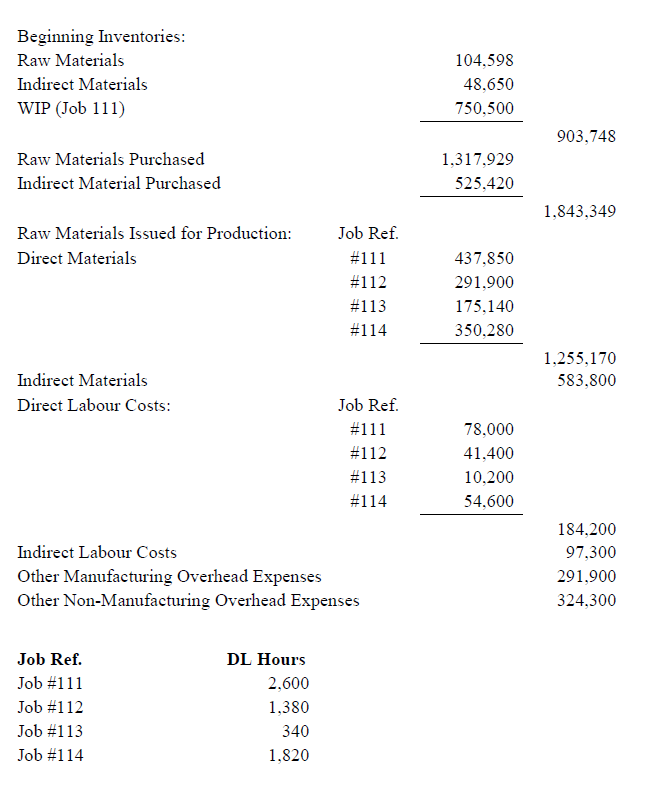

Lambda Ltd uses a normal costing system and closes off all overhead variances to the cost of goods sold at the end of each year. Its budgeted factory and non-manufacturing overhead expenses for the year were estimated to be $1,050,000 and $312,000 respectively. The budgeted direct labor hours (DLH) for the year were 7,000 hours in total. Direct labour hours have been used as the basis for overheads application. Jobs 111, 112 and 114 were completed during the year. Job 111 was invoiced in October and subsequently fully paid before the year end. Job 114 was invoiced in December and its payment was not settled as at the year-end. Job 112 was just completed but various administrative documents and certifications were outstanding at year end, and therefore, the invoice could not be issued. The following are information extracted from the accounting records:

(a) Compute the predetermined overhead rate for the normal costing purpose. (b) Use available information to compute the value of the ending work in process and finished goods at the year end, and the cost of goods sold balance after all required adjustments. Clearly show your supporting computations. (c) Write a journal entry to close the overhead variance.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started