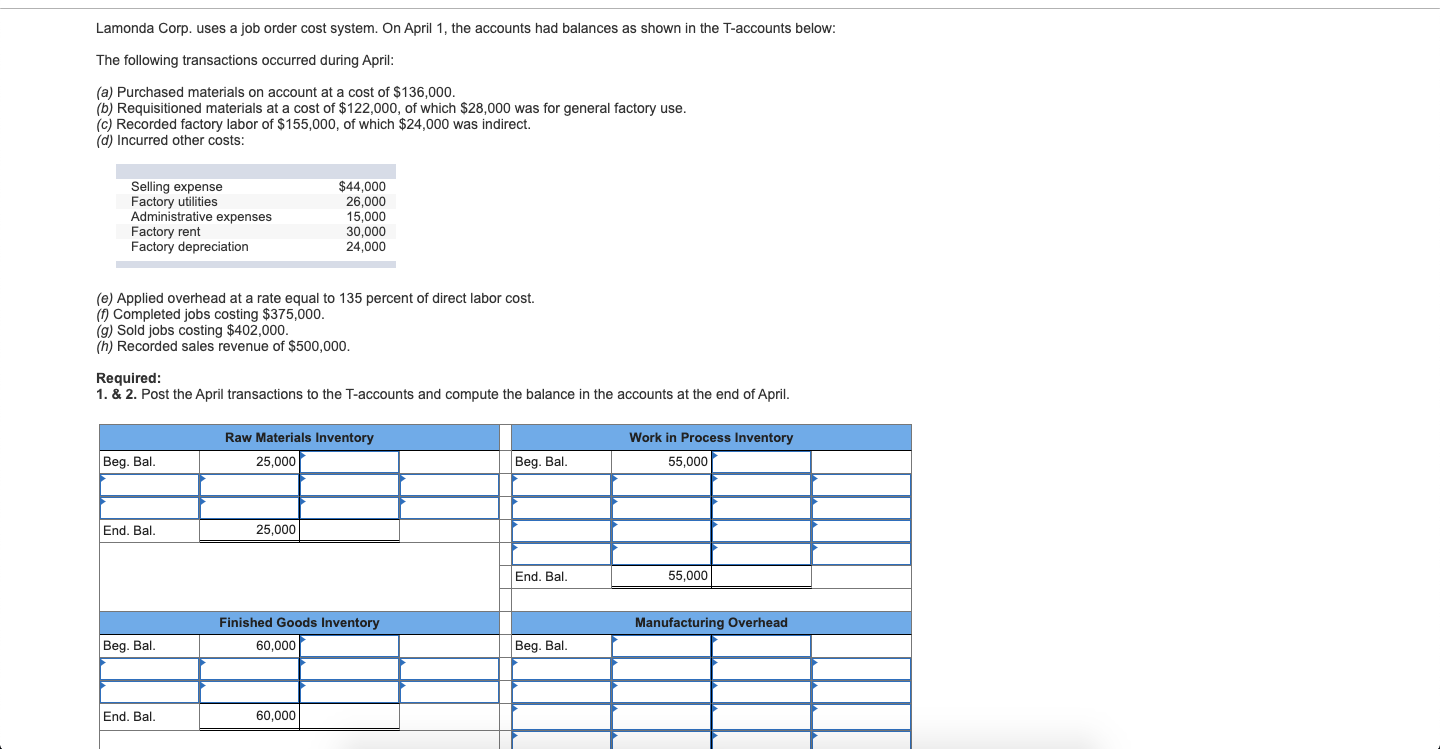

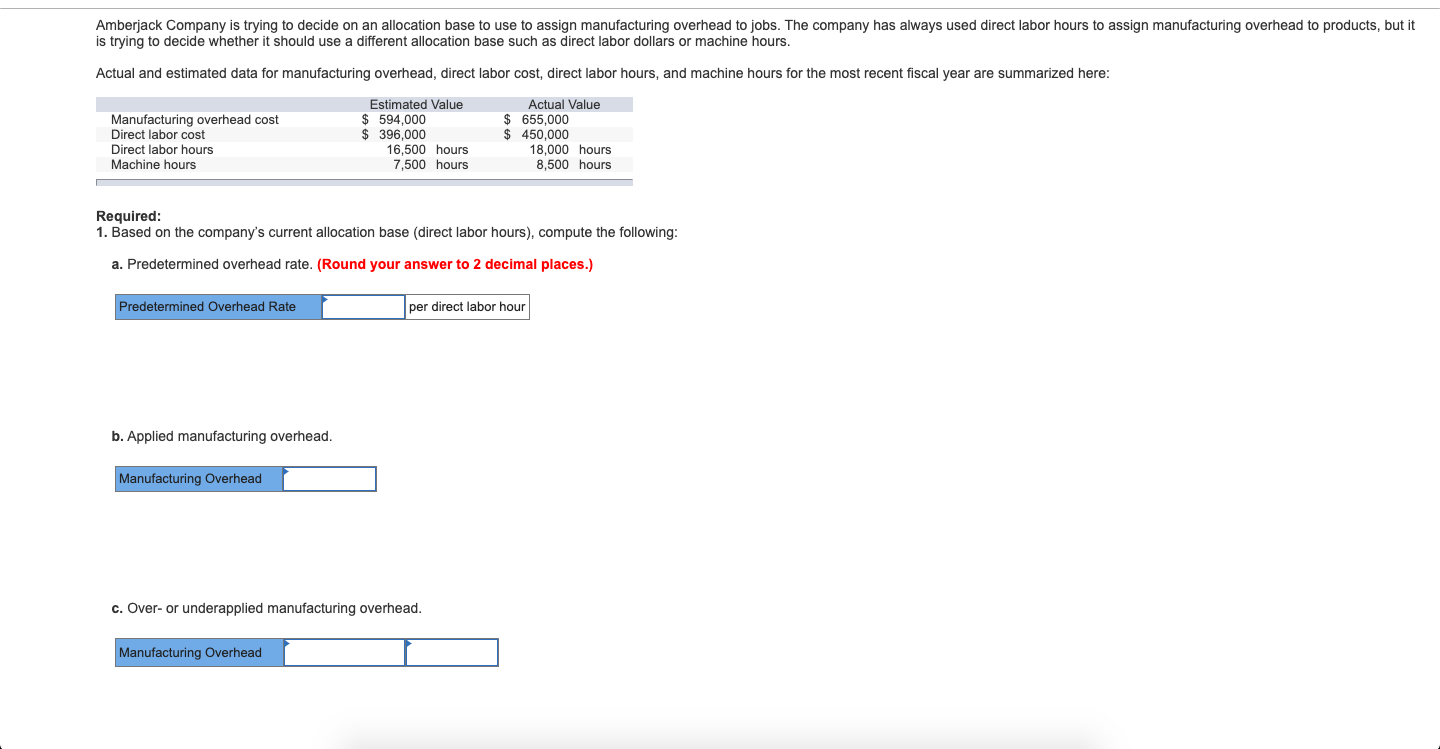

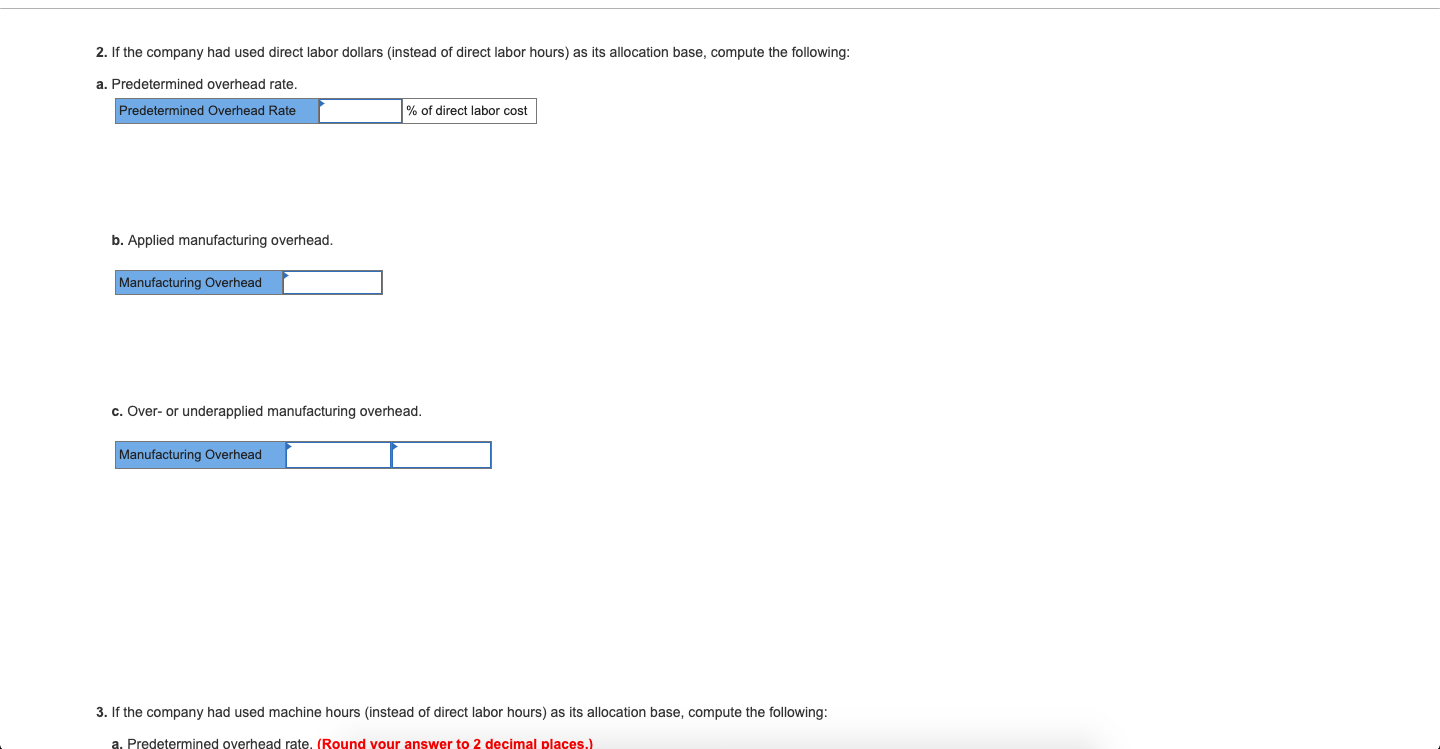

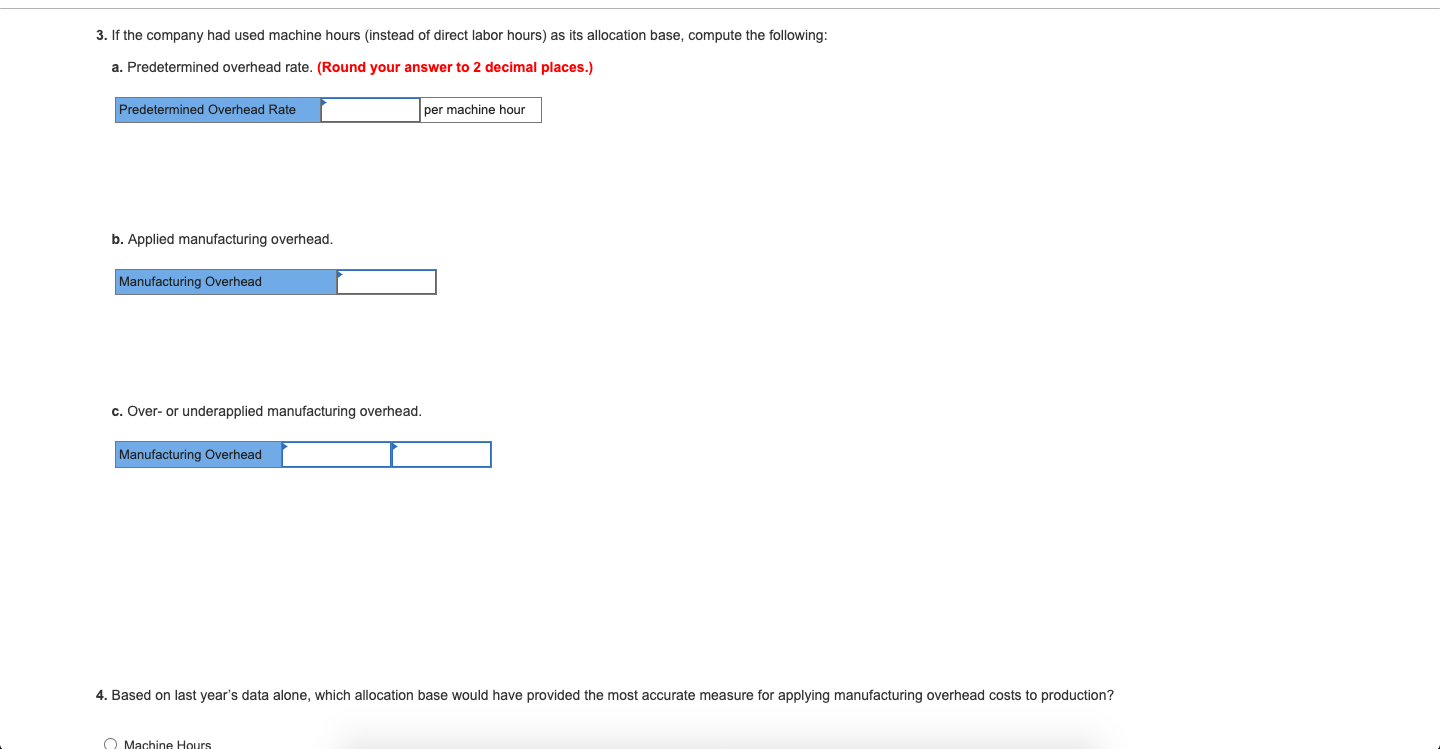

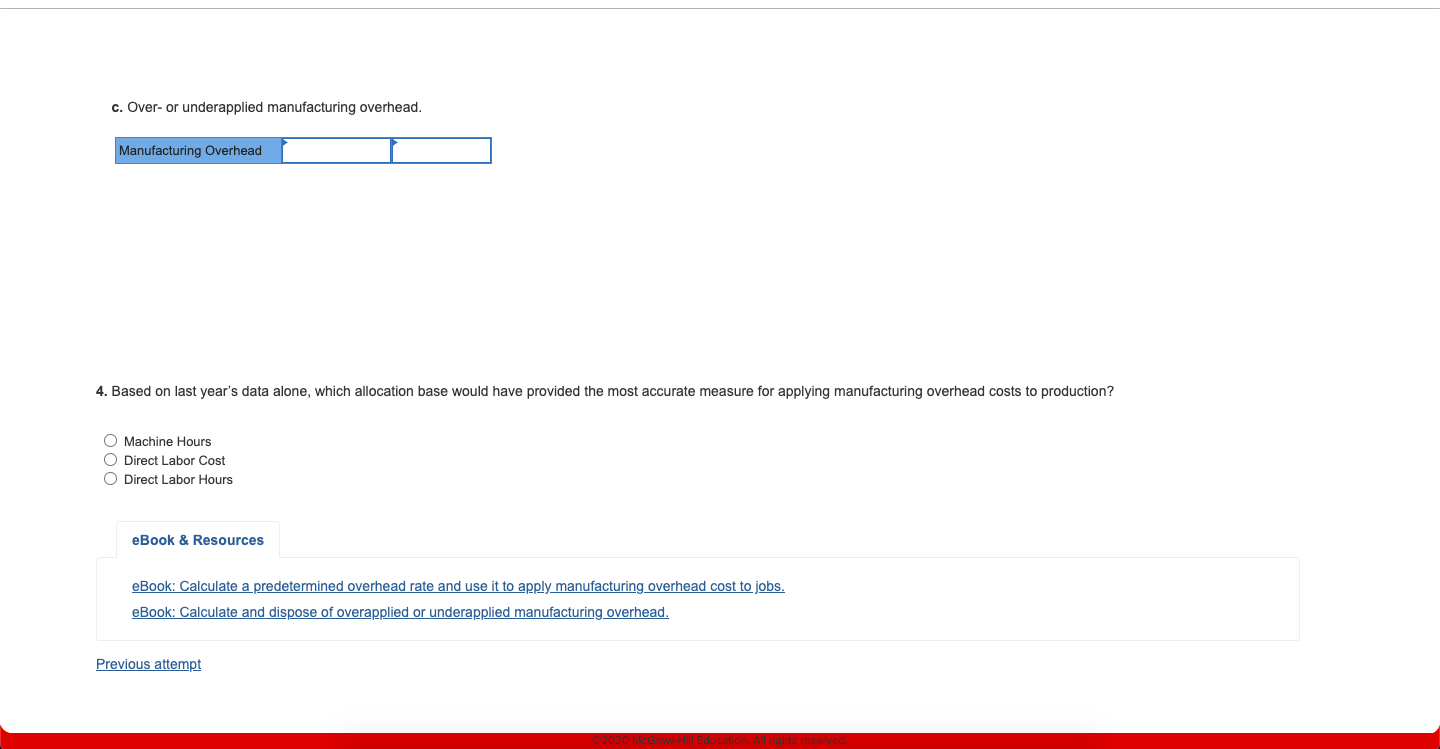

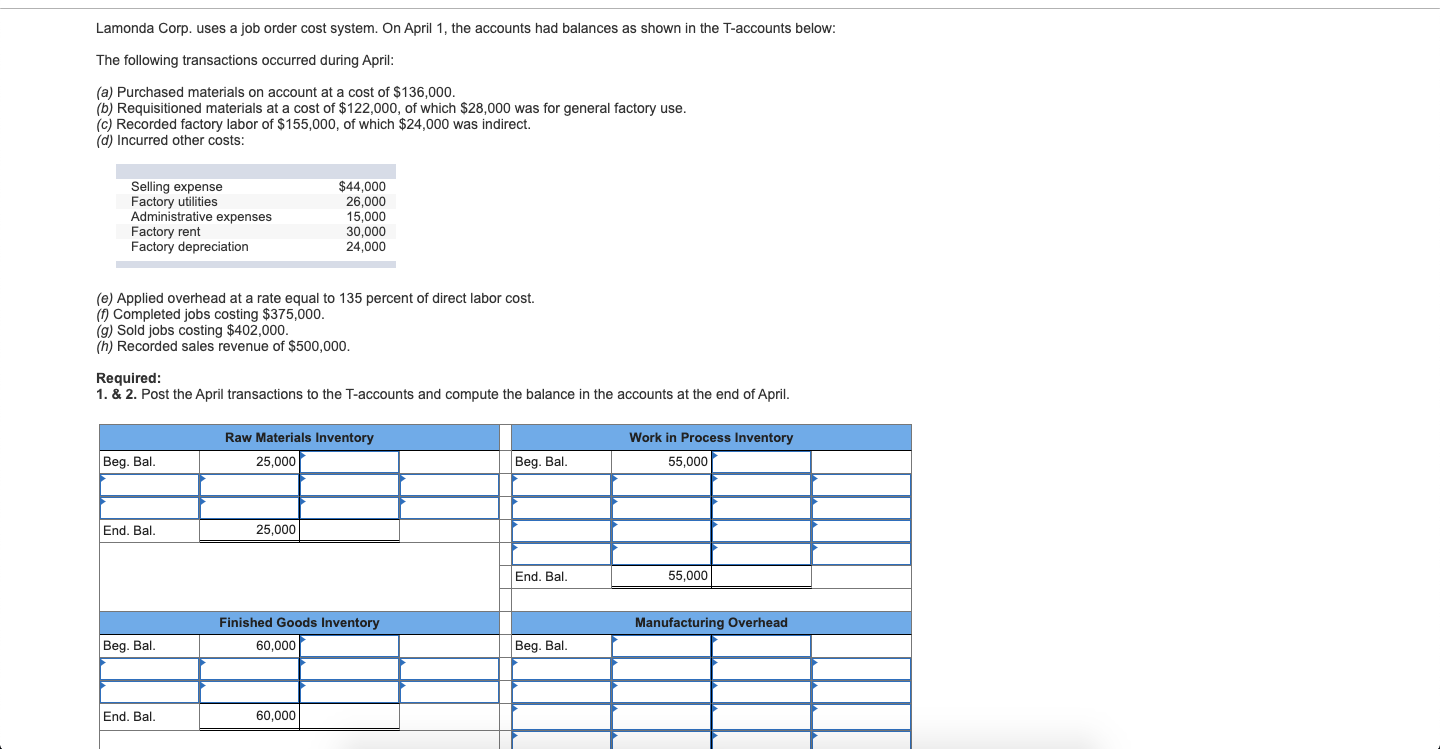

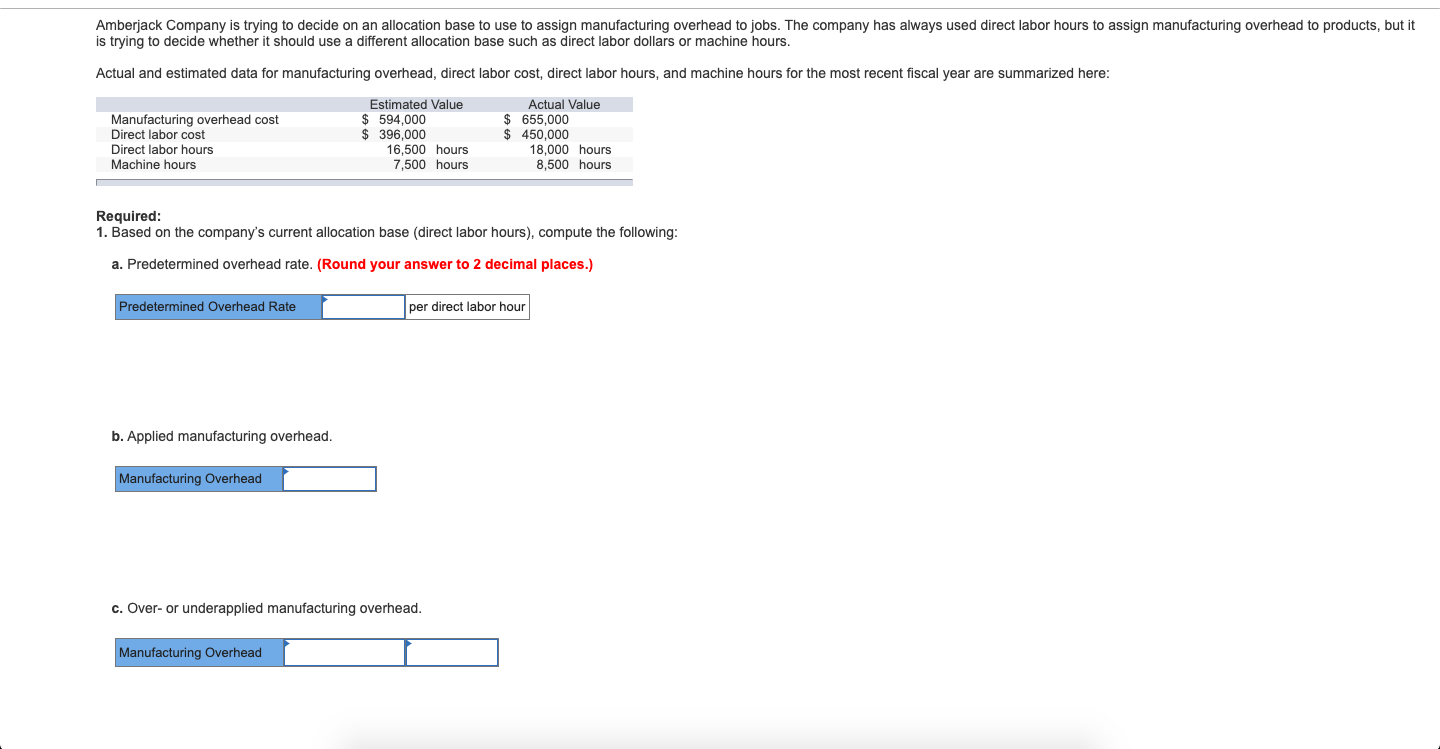

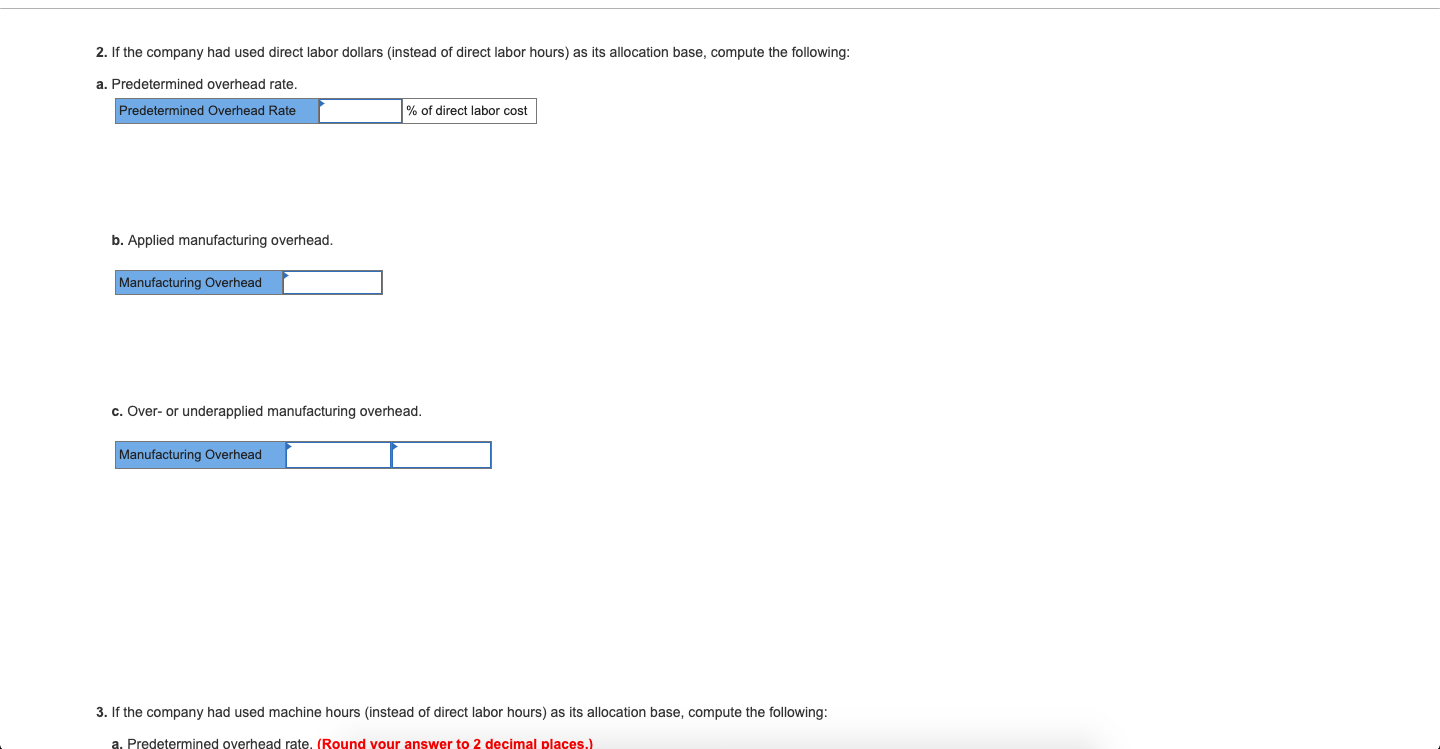

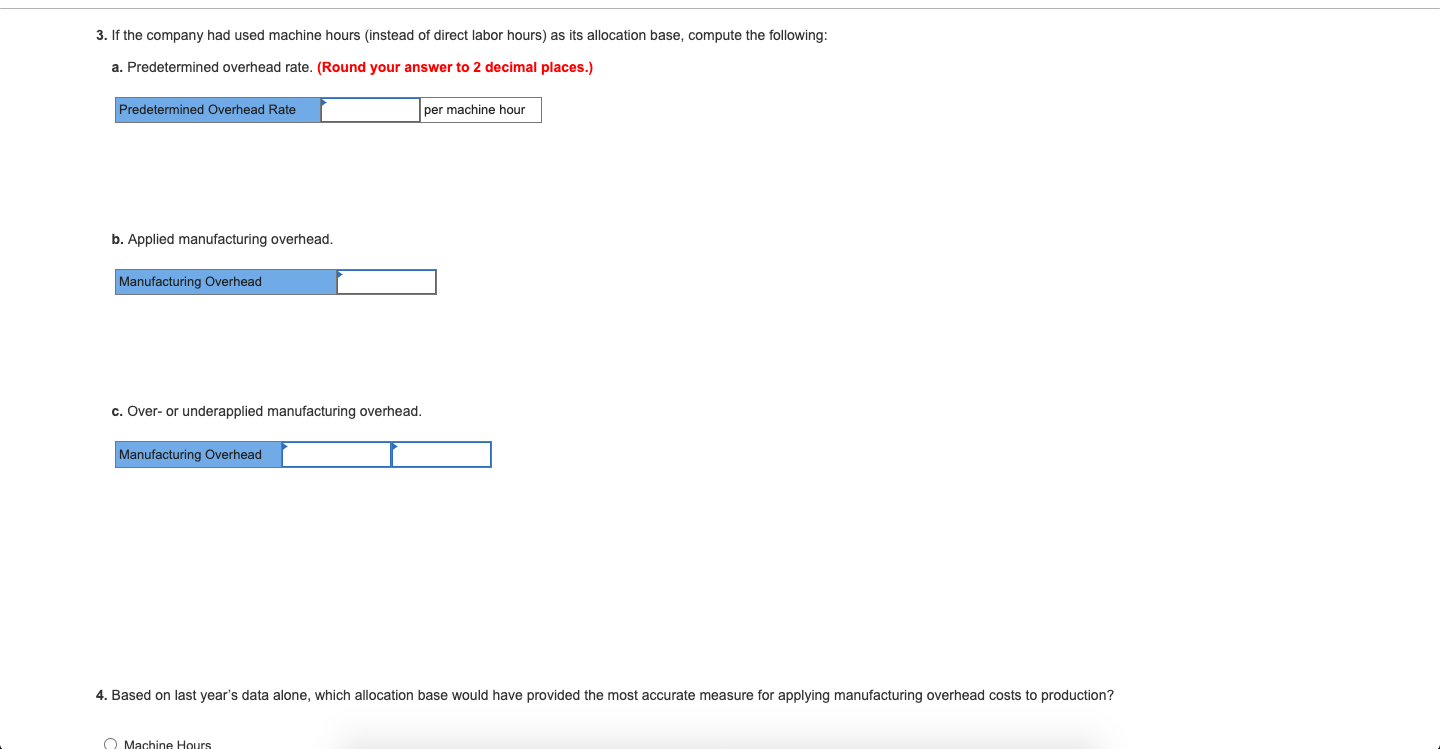

Lamonda Corp. uses a job order cost system. On April 1, the accounts had balances as shown in the T-accounts below: The following transactions occurred during April: (a) Purchased materials on account at a cost of $136,000. (b) Requisitioned materials at a cost of $122,000, of which $28,000 was for general factory use. (c) Recorded factory labor of $155,000, of which $24,000 was indirect. (d) Incurred other costs: Selling expense Factory utilities Administrative expenses Factory rent Factory depreciation $44,000 26,000 15,000 30,000 24,000 (e) Applied overhead at a rate equal to 135 percent of direct labor cost. (1) Completed jobs costing $375,000. (g) Sold jobs costing $402,000. (h) Recorded sales revenue of $500,000. Required: 1. & 2. Post the April transactions to the T-accounts and compute the balance in the accounts at the end of April. Raw Materials Inventory 25,000 Work in Process Inventory 55,000 Beg. Bal. Bal. End. Bal. 25,000 End. Bal. 55,000 Manufacturing Overhead Finished Goods Inventory 60,000 Beg. Bal. Beg. Bal. End. Bal. 60,000 Amberjack Company is trying to decide on an allocation base to use to assign manufacturing overhead to jobs. The company has always used direct labor hours to assign manufacturing overhead to products, but it is trying to decide whether it should use a different allocation base such as direct labor dollars or machine hours. Actual and estimated data for manufacturing overhead, direct labor cost, direct labor hours, and machine hours for the most recent fiscal year are summarized here: Manufacturing overhead cost Direct labor cost Direct labor hours Machine hours Estimated Value $ 594,000 $ 396,000 16,500 hours 7,500 hours Actual Value $ 655,000 $ 450,000 18,000 hours 8,500 hours Required: 1. Based on the company's current allocation base (direct labor hours), compute the following: a. Predetermined overhead rate. (Round your answer to 2 decimal places.) Predetermined Overhead Rate per direct labor hour b. Applied manufacturing overhead. Manufacturing Overhead c. Over- or underapplied manufacturing overhead. Manufacturing Overhead 2. If the company had used direct labor dollars (instead of direct labor hours) as its allocation base, compute the following: a. Predetermined overhead rate. Predetermined Overhead Rate % of direct labor cost b. Applied manufacturing overhead. Manufacturing Overhead c. Over- or underapplied manufacturing overhead. Manufacturing Overhead 3. If the company had used machine hours instead of direct labor hours) as its allocation base, compute the following: a. Predetermined overhead rate. (Round your answer to 2 decimal places.) 3. If the company had used machine hours (instead of direct labor hours) as its allocation base, compute the following: a. Predetermined overhead rate. (Round your answer 2 decimal places.) Predetermined Overhead Rate per machine hour b. Applied manufacturing overhead. Manufacturing Overhead c. Over- or underapplied manufacturing overhead. Manufacturing Overhead 4. Based on last year's data alone, which allocation base would have provided the most accurate measure for applying manufacturing overhead costs to production? Machine Hours c. Over- or underapplied manufacturing overhead. Manufacturing Overhead 4. Based on last year's data alone, which allocation base would have provided the most accurate measure for applying manufacturing overhead costs to production? O Machine Hours O Direct Labor Cost O Direct Labor Hours eBook & Resources eBook: Calculate a predetermined overhead rate and use it to apply manufacturing overhead cost to jobs. eBook: Calculate and dispose of overapplied or underapplied manufacturing overhead. Previous attempt