Answered step by step

Verified Expert Solution

Question

1 Approved Answer

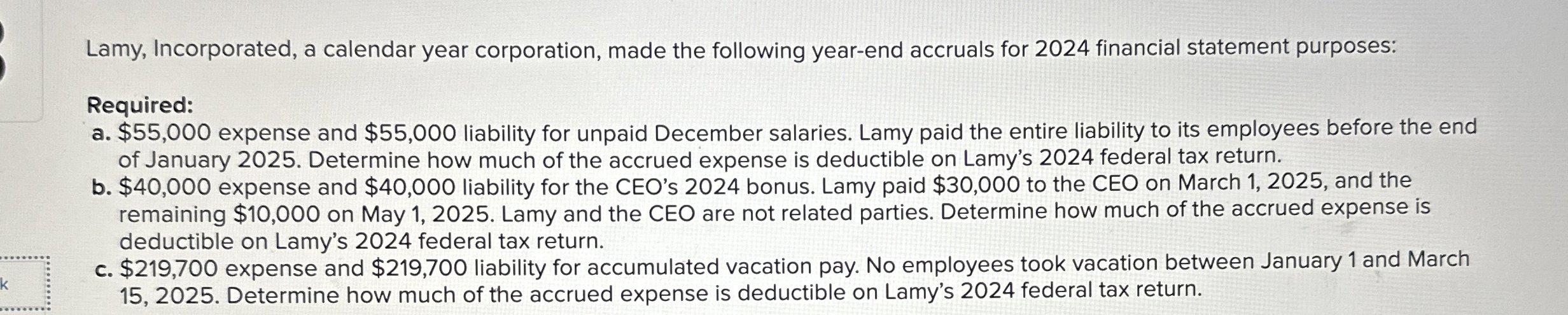

Lamy, Incorporated, a calendar year corporation, made the following year - end accruals for 2 0 2 4 financial statement purposes: Required: a . $

Lamy, Incorporated, a calendar year corporation, made the following yearend accruals for financial statement purposes:

Required:

a $ expense and $ liability for unpaid December salaries. Lamy paid the entire liability to its employees before the end

of January Determine how much of the accrued expense is deductible on Lamy's federal tax return.

b $ expense and $ liability for the CEO's bonus. Lamy paid $ to the CEO on March and the

remaining $ on May Lamy and the CEO are not related parties. Determine how much of the accrued expense is

deductible on Lamy's federal tax return.

c $ expense and $ liability for accumulated vacation pay. No employees took vacation between January and March

Determine how much of the accrued expense is deductible on Lamy's federal tax return.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started