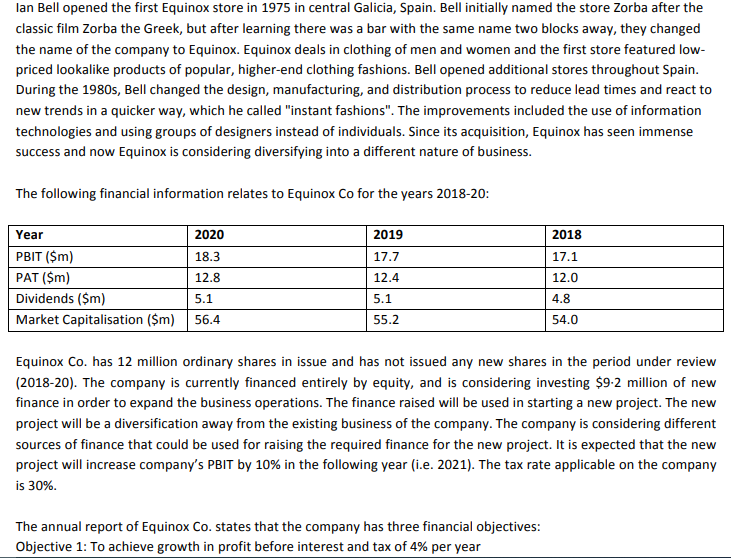

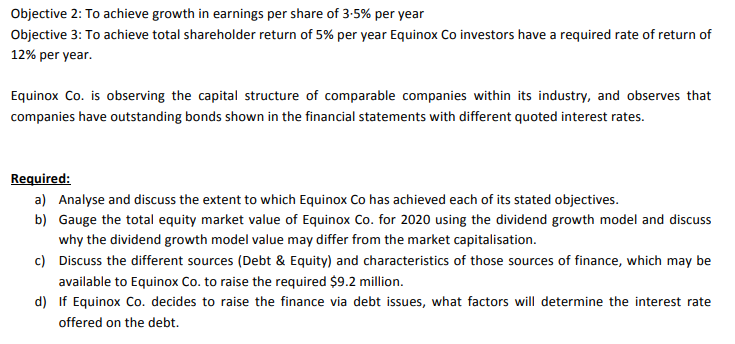

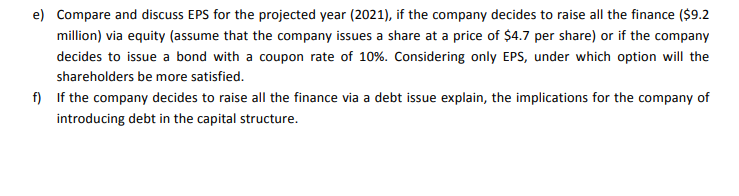

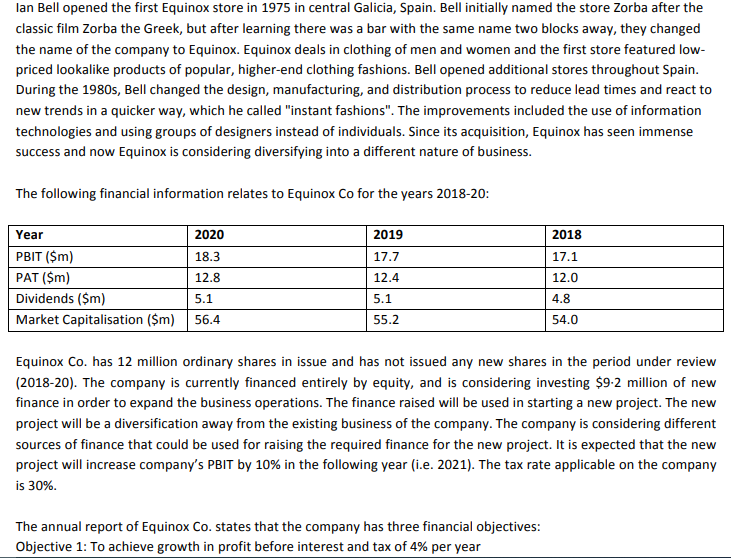

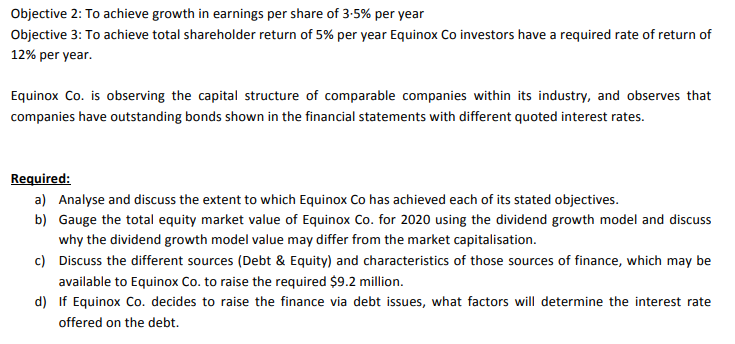

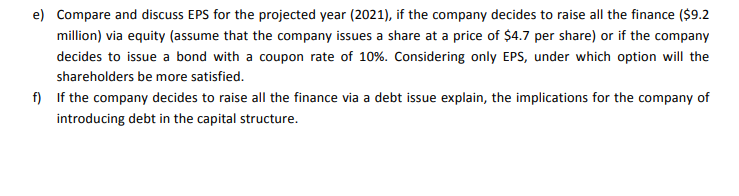

lan Bell opened the first Equinox store in 1975 in central Galicia, Spain. Bell initially named the store Zorba after the classic film Zorba the Greek, but after learning there was a bar with the same name two blocks away, they changed the name of the company to Equinox. Equinox deals in clothing of men and women and the first store featured low- priced lookalike products of popular, higher-end clothing fashions. Bell opened additional stores throughout Spain. During the 1980s, Bell changed the design, manufacturing, and distribution process to reduce lead times and react to new trends in a quicker way, which he called "instant fashions". The improvements included the use of information technologies and using groups of designers instead of individuals. Since its acquisition, Equinox has seen immense success and now Equinox is considering diversifying into a different nature of business. The following financial information relates to Equinox Co for the years 2018-20: 2019 2018 17.7 17.1 Year 2020 PBIT ($m) 18.3 PAT ($m) 12.8 Dividends ($m) 5.1 Market Capitalisation ($m) 56.4 12.0 12.4 5.1 55.2 4.8 54.0 Equinox Co. has 12 million ordinary shares in issue and has not issued any new shares in the period under review (2018-20). The company is currently financed entirely by equity, and is considering investing $9.2 million of new finance in order to expand the business operations. The finance raised will be used in starting a new project. The new project will be a diversification away from the existing business of the company. The company is considering different sources of finance that could be used for raising the required finance for the new project. It is expected that the new project will increase company's PBIT by 10% in the following year (i.e. 2021). The tax rate applicable on the company is 30%. The annual report of Equinox Co. states that the company has three financial objectives: Objective 1: To achieve growth in profit before interest and tax of 4% per year Objective 2: To achieve growth in earnings per share of 3-5% per year Objective 3: To achieve total shareholder return of 5% per year Equinox Co investors have a required rate of return of 12% per year. Equinox Co. is observing the capital structure of comparable companies within its industry, and observes that companies have outstanding bonds shown in the financial statements with different quoted interest rates. Required: a) Analyse and discuss the extent to which Equinox Co has achieved each of its stated objectives. b) Gauge the total equity market value of Equinox Co. for 2020 using the dividend growth model and discuss why the dividend growth model value may differ from the market capitalisation. c) Discuss the different sources (Debt & Equity) and characteristics of those sources of finance, which may be available to Equinox Co. to raise the required $9.2 million. d) If Equinox Co. decides to raise the finance via debt issues, what factors will determine the interest rate offered on the debt. e) Compare and discuss EPS for the projected year (2021), if the company decides to raise all the finance ($9.2 million) via equity (assume that the company issues a share at a price of $4.7 per share) or if the company decides to issue a bond with a coupon rate of 10%. Considering only EPS, under which option will the shareholders be more satisfied. f) If the company decides to raise all the finance via a debt issue explain, the implications for the company of introducing debt in the capital structure. lan Bell opened the first Equinox store in 1975 in central Galicia, Spain. Bell initially named the store Zorba after the classic film Zorba the Greek, but after learning there was a bar with the same name two blocks away, they changed the name of the company to Equinox. Equinox deals in clothing of men and women and the first store featured low- priced lookalike products of popular, higher-end clothing fashions. Bell opened additional stores throughout Spain. During the 1980s, Bell changed the design, manufacturing, and distribution process to reduce lead times and react to new trends in a quicker way, which he called "instant fashions". The improvements included the use of information technologies and using groups of designers instead of individuals. Since its acquisition, Equinox has seen immense success and now Equinox is considering diversifying into a different nature of business. The following financial information relates to Equinox Co for the years 2018-20: 2019 2018 17.7 17.1 Year 2020 PBIT ($m) 18.3 PAT ($m) 12.8 Dividends ($m) 5.1 Market Capitalisation ($m) 56.4 12.0 12.4 5.1 55.2 4.8 54.0 Equinox Co. has 12 million ordinary shares in issue and has not issued any new shares in the period under review (2018-20). The company is currently financed entirely by equity, and is considering investing $9.2 million of new finance in order to expand the business operations. The finance raised will be used in starting a new project. The new project will be a diversification away from the existing business of the company. The company is considering different sources of finance that could be used for raising the required finance for the new project. It is expected that the new project will increase company's PBIT by 10% in the following year (i.e. 2021). The tax rate applicable on the company is 30%. The annual report of Equinox Co. states that the company has three financial objectives: Objective 1: To achieve growth in profit before interest and tax of 4% per year Objective 2: To achieve growth in earnings per share of 3-5% per year Objective 3: To achieve total shareholder return of 5% per year Equinox Co investors have a required rate of return of 12% per year. Equinox Co. is observing the capital structure of comparable companies within its industry, and observes that companies have outstanding bonds shown in the financial statements with different quoted interest rates. Required: a) Analyse and discuss the extent to which Equinox Co has achieved each of its stated objectives. b) Gauge the total equity market value of Equinox Co. for 2020 using the dividend growth model and discuss why the dividend growth model value may differ from the market capitalisation. c) Discuss the different sources (Debt & Equity) and characteristics of those sources of finance, which may be available to Equinox Co. to raise the required $9.2 million. d) If Equinox Co. decides to raise the finance via debt issues, what factors will determine the interest rate offered on the debt. e) Compare and discuss EPS for the projected year (2021), if the company decides to raise all the finance ($9.2 million) via equity (assume that the company issues a share at a price of $4.7 per share) or if the company decides to issue a bond with a coupon rate of 10%. Considering only EPS, under which option will the shareholders be more satisfied. f) If the company decides to raise all the finance via a debt issue explain, the implications for the company of introducing debt in the capital structure