Question

LAN Lord is considering the purchase of component AB, which it requires to manufacture its products. Component AB is currently being manufactured internally. However, a

LAN Lord is considering the purchase of component AB, which it requires to manufacture its products.

Component AB is currently being manufactured internally. However, a potential external supplier is offering a price of $55 per unit for the 20,000 units that LAN Lord requires per year. The estimated average cost to manufacture 20,000 units of this component internally is $80 per unit, based on the following:

- Material A (20,000 kilograms) - $200,000

- Material B (10,000 kilograms) - $270,000

- Direct labour - $416,000

- Variable manufacturing overhead - $150,000

- Division managers' annual salary - $77,000

- Allocated other manufacturing overhead - $267,000

Other Relevant Information

- Material A: 60,000 kilograms currently sit in raw materials inventory, with a book value of $720,000 on the balance sheet. The replacement cost is $8 per kilogram.

- Material B: No Material B sits in raw materials inventory. The replacement cost is $27 per kilogram. The net realizable value is $25 per kilogram.

- No change is expected in direct labour or variable overhead rates for the next three years.

- If Component AB is purchased, the internal division that manufactures it will shut down. However, the manager will be transferred to head office. Head office is currently searching for someone with a similar skill set as the manager.

- Equipment in the internal manufacturing division currently has a book value of $660,000 on the balance sheet and three years of useful life remaining (Zero salvage value). If the internal manufacturing division is closed, the equipment has no other use. The equipment can be sold for $500,000. Its replacement cost is $1,900,000 if it was to be acquired brand new.

- The accounting department did not feel that it was fair to allocate other manufacturing overhead to other products if component AB is purchased from the outside supplier, so it will continue to allocate $150,000 to the cost of the purchased components.

- Assume that annual cash flows occur at the end of the year, while lump sum cash flows occur at the beginning of the related year.

Required.

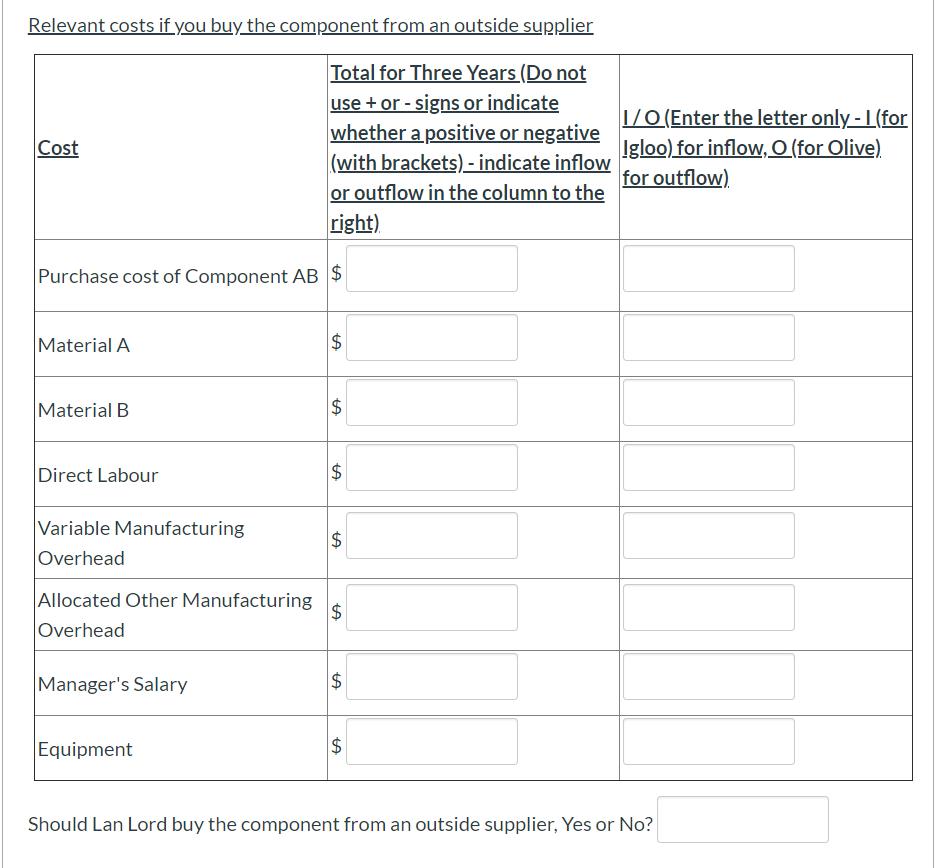

Using the grid below, calculate the relevant cashflows if you decide to purchase Component AB from an external supplier rather than continuing to manufacture it internally. All numbers should be the total inflow or outflow over a total of three years. Enter 0 if something should be not be included. Do not use + and - signs. Show negative cash flows by putting an O in the right column, positive cash flows by putting an I in the right column, and NA if there is no effect. Do not use $ signs in your final answers.

Relevant costs if you buy the component from an outside supplier Total for Three Years (Do not use + or - signs or indicate whether a positive or negative (with brackets) - indicate inflow or outflow in the column to the right) 1/0 (Enter the letter only -1 (for Igloo) for inflow, O (for Olive) for outflow) Cost Purchase cost of Component AB $ Material A $ Material B $ Direct Labour Variable Manufacturing Overhead Allocated Other Manufacturing Overhead Manager's Salary Equipment $ Should Lan Lord buy the component from an outside supplier, Yes or No? %24 %24 %24 %24 %24 %24 %24

Step by Step Solution

3.41 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Statement of relevant cash flows ifwe decide to purchase component AB from external supplier Cost Total for 3 years IO Purchase Cost of component AB 3...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started