Question

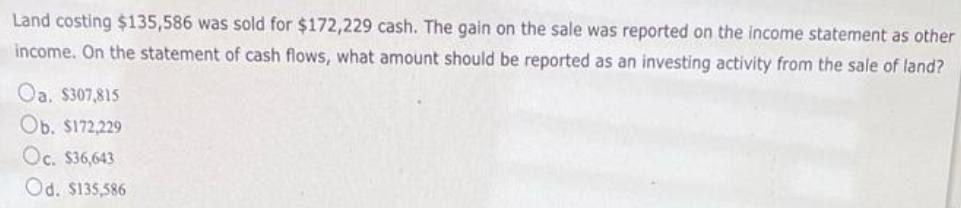

Land costing $135,586 was sold for $172,229 cash. The gain on the sale was reported on the income statement as other income. On the

Land costing $135,586 was sold for $172,229 cash. The gain on the sale was reported on the income statement as other income. On the statement of cash flows, what amount should be reported as an investing activity from the sale of land? Oa. $307,815 Ob. $172,229 Oc. $36,643 Od. $135,586

Step by Step Solution

3.48 Rating (168 Votes )

There are 3 Steps involved in it

Step: 1

Correct answer b 172229 In investing activity all ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Accounting

Authors: James D. Stice, Earl K. Stice, Fred Skousen

17th Edition

032459237X, 978-0324592375

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App