Question

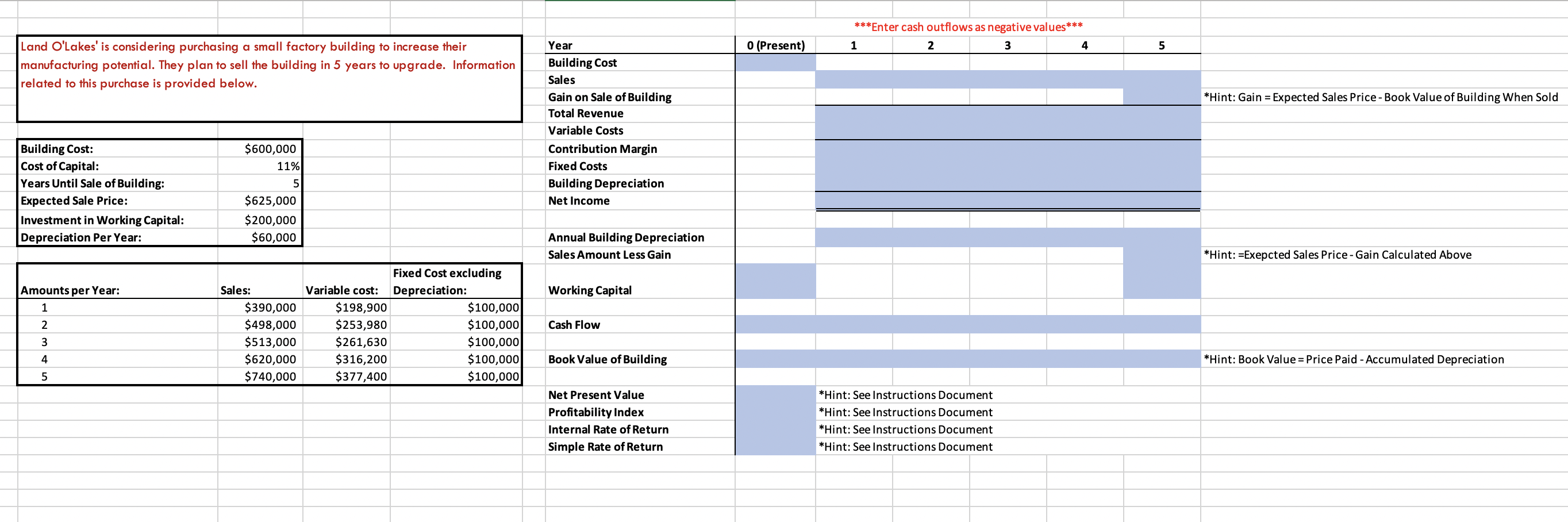

Land O'Lakes' is considering purchasing a small factory building to increase their manufacturing potential. They plan to sell the building in 5 years to upgrade.

Land O'Lakes' is considering purchasing a small factory building to increase their manufacturing potential. They plan to sell the building in 5 years to upgrade. Information related to this purchase is provided below. Year 0 (Present) 1 2 3 4 5 Building Cost Sales Gain on Sale of Building Total Revenue Variable Costs Building Cost: $600,000 Contribution Margin Cost of Capital: 11% Fixed Costs Years Until Sale of Building: 5 Building Depreciation Expected Sale Price: $625,000 Net Income Investment in Working Capital: $200,000 Depreciation Per Year: $60,000 Annual Building Depreciation Sales Amount Less Gain Amounts per Year: Sales: Variable cost: Fixed Cost excluding Depreciation: Working Capital 1 $390,000 $198,900 $100,000 2 $498,000 $253,980 $100,000 Cash Flow 3 $513,000 $261,630 $100,000 4 $620,000 $316,200 $100,000 Book Value of Building 5 $740,000 $377,400 $100,000 Net Present Value *Hint: See Instructions Document Profitability Index *Hint: See Instructions Document Internal Rate of Return *Hint: See Instructions Document Simple Rate of Return *Hint: See Instructions Document

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started