Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Landis Ltd. began its corporate services business in 2010. Since then, it has acquired and disposed of various assets which are all in Class

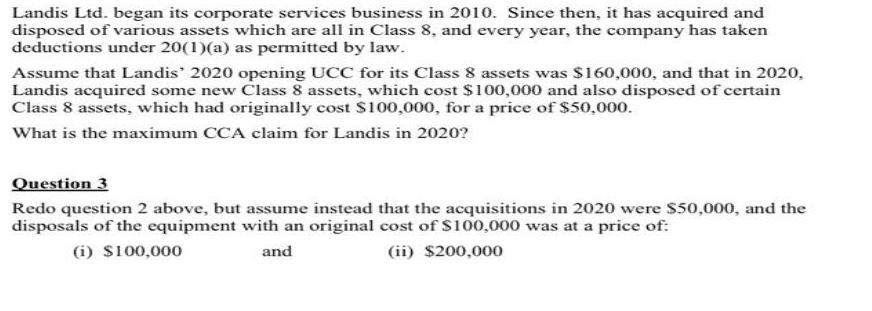

Landis Ltd. began its corporate services business in 2010. Since then, it has acquired and disposed of various assets which are all in Class 8, and every year, the company has taken deductions under 20(1)(a) as permitted by law. Assume that Landis' 2020 opening UCC for its Class 8 assets was $160,000, and that in 2020, Landis acquired some new Class 8 assets, which cost $100,000 and also disposed of certain Class 8 assets, which had originally cost S100,000, for a price of $50,000. What is the maximum CCA claim for Landis in 2020? Question 3 Redo question 2 above, but assume instead that the acquisitions in 2020 were $50,000, and the disposals of the equipment with an original cost of $100,000 was at a price of: (i) S100,000 and (ii) $200,000

Step by Step Solution

★★★★★

3.44 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

a Calculation Taxable Amount Opening class e Acset 160000 acquired New Class 8 Assets I 00 000 26...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started