Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Langston Hayes runs a part-time catering service. All sales are billed to clients with a credit terms that stipulate payment must be received 30

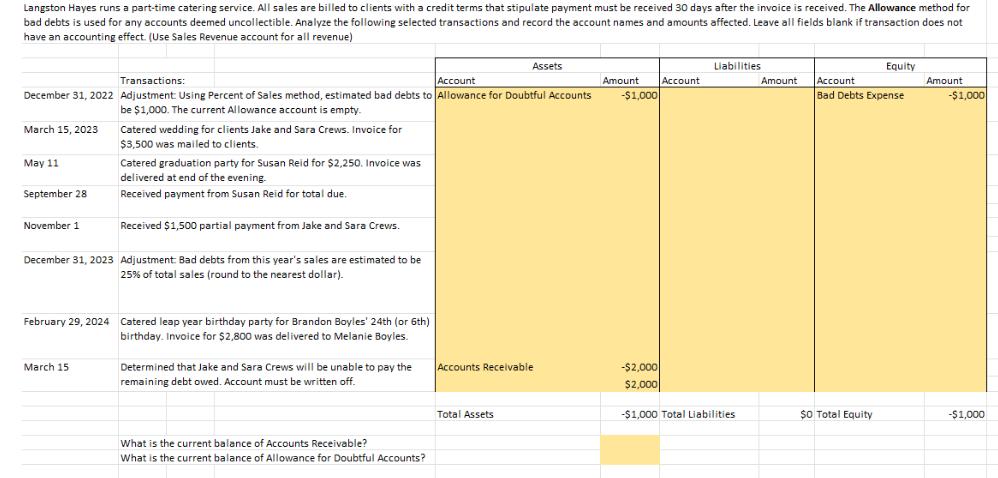

Langston Hayes runs a part-time catering service. All sales are billed to clients with a credit terms that stipulate payment must be received 30 days after the invoice is received. The Allowance method for bad debts is used for any accounts deemed uncollectible. Analyze the following selected transactions and record the account names and amounts affected. Leave all fields blank if transaction does not have an accounting effect. (Use Sales Revenue account for all revenue) Assets Liabilities Equity Transactions: Account Amount Account Amount Account Amount December 31, 2022 Adjustment: Using Percent of Sales method, estimated bad debts to Allowance for Doubtful Accounts be $1,000. The current Allowance account is empty. -$1,000 Bad Debts Expense -$1,000 March 15, 2023 Catered wedding for clients Jake and Sara Crews. Invoice for $3,500 was mailed to clients. May 11 Catered graduation party for Susan Reid for $2,250. Invoice was delivered at end of the evening. September 28 Received payment from Susan Reid for total due. November 1 Received $1,500 partial payment from Jake and Sara Crews. December 31, 2023 Adjustment: Bad debts from this year's sales are estimated to be 25% of total sales (round to the nearest dollar). February 29, 2024 Catered leap year birthday party for Brandon Boyles' 24th (or 6th) birthday. Invoice for $2,800 was delivered to Melanie Boyles. March 15 Determined that Jake and Sara Crews will be unable to pay the remaining debt owed. Account must be written off. Accounts Receivable -$2,000 $2,000 Total Assets -$1,000 Total Liabilities $0 Total Equity -$1,000 What is the current balance of Accounts Receivable? What is the current balance of Allowance for Doubtful Accounts?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Here are the account names and amounts affected for the selected transactions 1 December 31 2022 Acc...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started