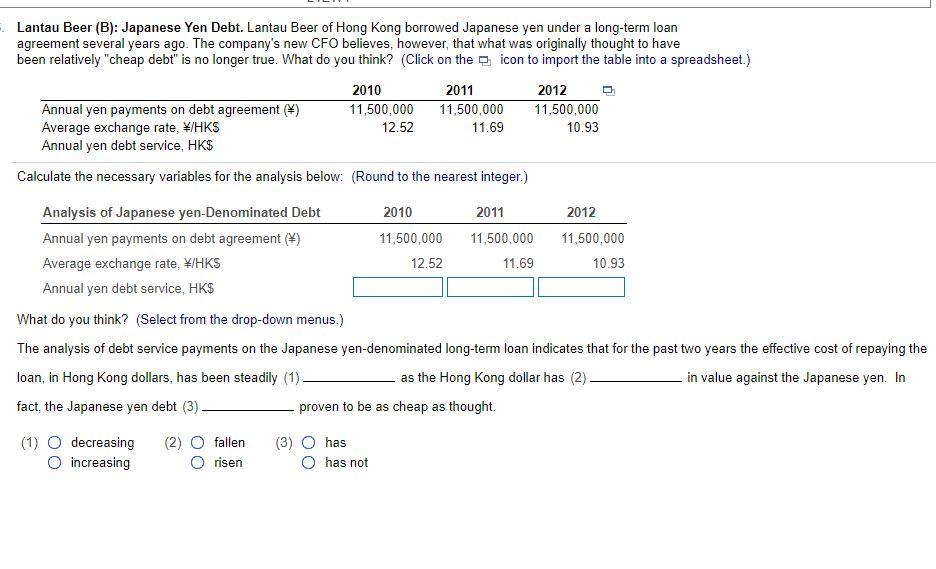

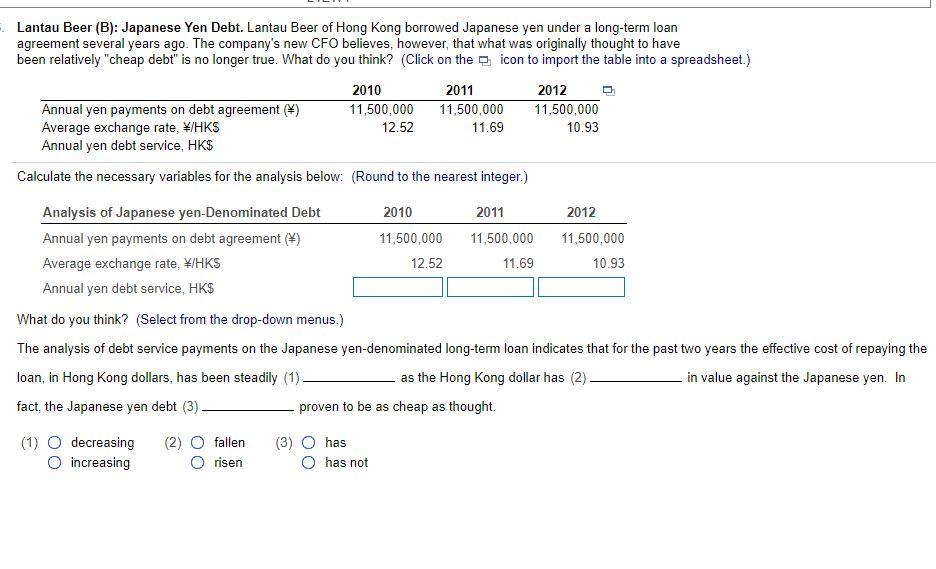

. Lantau Beer (B): Japanese Yen Debt. Lantau Beer of Hong Kong borrowed Japanese yen under a long-term loan agreement several years ago. The company's new CFO believes, however, that what was originally thought to have been relatively "cheap debt" is no longer true. What do you think? (Click on the icon to import the table into a spreadsheet.) 2010 2011 2012 Annual yen payments on debt agreement (*) 11,500,000 11,500,000 11,500,000 Average exchange rate, /HKS 12.52 11.69 10.93 Annual yen debt service, HK$ Calculate the necessary variables for the analysis below: (Round to the nearest integer.) 10.93 Analysis of Japanese yen-Denominated Debt 2010 2011 2012 Annual yen payments on debt agreement () 11,500,000 11,500,000 11,500,000 Average exchange rate, W/HKS 12.52 11.69 Annual yen debt service, HK$ What do you think? (Select from the drop-down menus.) The analysis of debt service payments on the Japanese yen-denominated long-term loan indicates that for the past two years the effective cost of repaying the loan, in Hong Kong dollars, has been steadily (1) as the Hong Kong dollar has (2) in value against the Japanese yen. In fact, the Japanese yen debt (3) proven to be as cheap as thought (2) (1) O decreasing o increasing fallen risen (3) O has has not . Lantau Beer (B): Japanese Yen Debt. Lantau Beer of Hong Kong borrowed Japanese yen under a long-term loan agreement several years ago. The company's new CFO believes, however, that what was originally thought to have been relatively "cheap debt" is no longer true. What do you think? (Click on the icon to import the table into a spreadsheet.) 2010 2011 2012 Annual yen payments on debt agreement (*) 11,500,000 11,500,000 11,500,000 Average exchange rate, /HKS 12.52 11.69 10.93 Annual yen debt service, HK$ Calculate the necessary variables for the analysis below: (Round to the nearest integer.) 10.93 Analysis of Japanese yen-Denominated Debt 2010 2011 2012 Annual yen payments on debt agreement () 11,500,000 11,500,000 11,500,000 Average exchange rate, W/HKS 12.52 11.69 Annual yen debt service, HK$ What do you think? (Select from the drop-down menus.) The analysis of debt service payments on the Japanese yen-denominated long-term loan indicates that for the past two years the effective cost of repaying the loan, in Hong Kong dollars, has been steadily (1) as the Hong Kong dollar has (2) in value against the Japanese yen. In fact, the Japanese yen debt (3) proven to be as cheap as thought (2) (1) O decreasing o increasing fallen risen (3) O has has not