Answered step by step

Verified Expert Solution

Question

1 Approved Answer

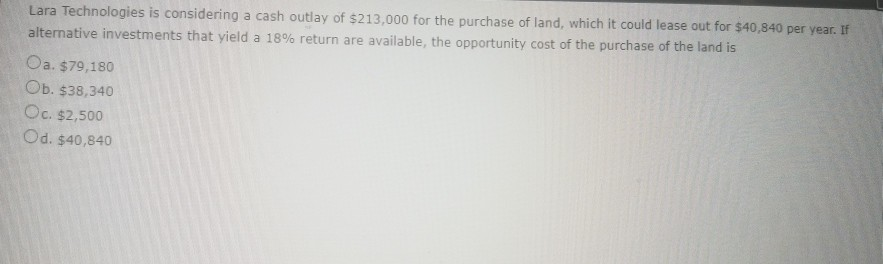

Lara Technologies is considering a cash outlay of $213,000 for the purchase of land, which it could lease out for $40,840 per year. If alternative

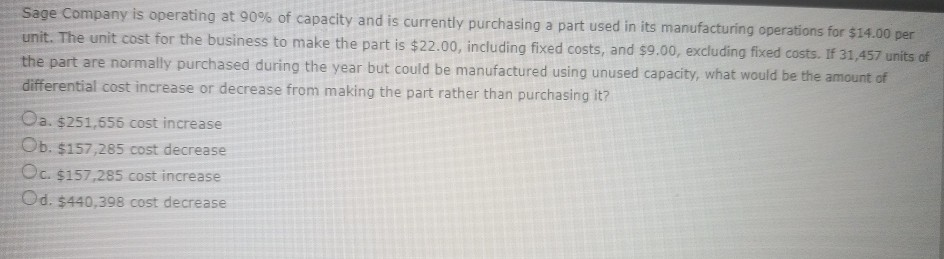

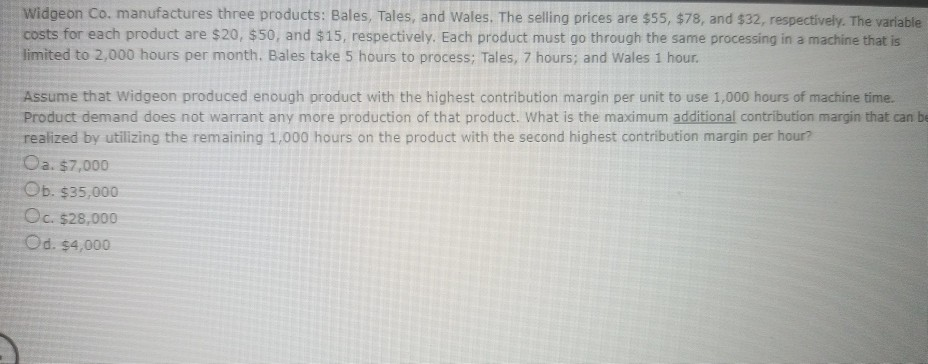

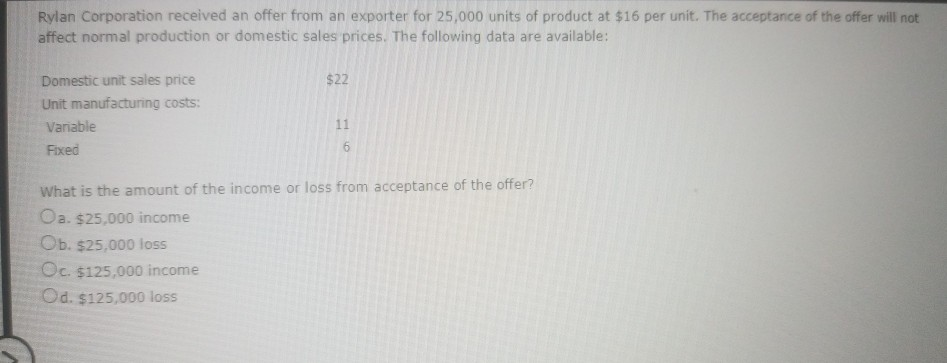

Lara Technologies is considering a cash outlay of $213,000 for the purchase of land, which it could lease out for $40,840 per year. If alternative investments that yield a 18% return are available, the opportunity cost of the purchase of the land is Oa. $79,180 Ob. $38,340 Oc. $2,500 Od. $40,840 Sage Company is operating at 90% of capacity and is currently purchasing a part used in its manufacturing operations for $14.00 per unit. The unit cost for the business to make the part is $22.00, including fixed costs, and $9.00, excluding fixed costs. IF 31,457 units of the part are normally purchased during the year but could be manufactured using unused capacity, what would be the amount of differential cost increase or decrease from making the part rather than purchasing it? Oa. $251,655 cost increase Ob. $157,285 cost decrease Oc. $157,285 cost increase Od. $440,398 cost decrease Widgeon Co. manufactures three products: Bales, Tales, and Wales. The selling prices are $55, $78, and $32, respectively. The variable costs for each product are $20, $50, and $15, respectively. Each product must go through the same processing in a machine that is limited to 2,000 hours per month. Bales take 5 hours to process; Tales, 7 hours; and Wales 1 hour. Assume that widgeon produced enough product with the highest contribution margin per unit to use 1,000 hours of machine time. Product demand does not warrant any more production of that product. What is the maximum additional contribution margin that can be realized by utilizing the remaining 1,000 hours on the product with the second highest contribution margin per hour? Oa. $7,000 Ob. $35,000 Oc. $28,000 Od. $4,000 Rylan Corporation received an offer from an exporter for 25,000 units of product at $16 per unit. The acceptance of the offer will not affect normal production or domestic sales prices. The following data are available: $22 Domestic unit sales price Unit manufacturing costs: Variable Fixed 11 6 What is the amount of the income or loss from acceptance of the offer? Oa. $25,000 income Ob. $25,000 loss Oc. $125,000 income Od. $125,000 loss

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started