Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Lardo Incorporated plans to build a new manufacturing plant in either Country X or Country Y. It projects gross revenue in either location of $4

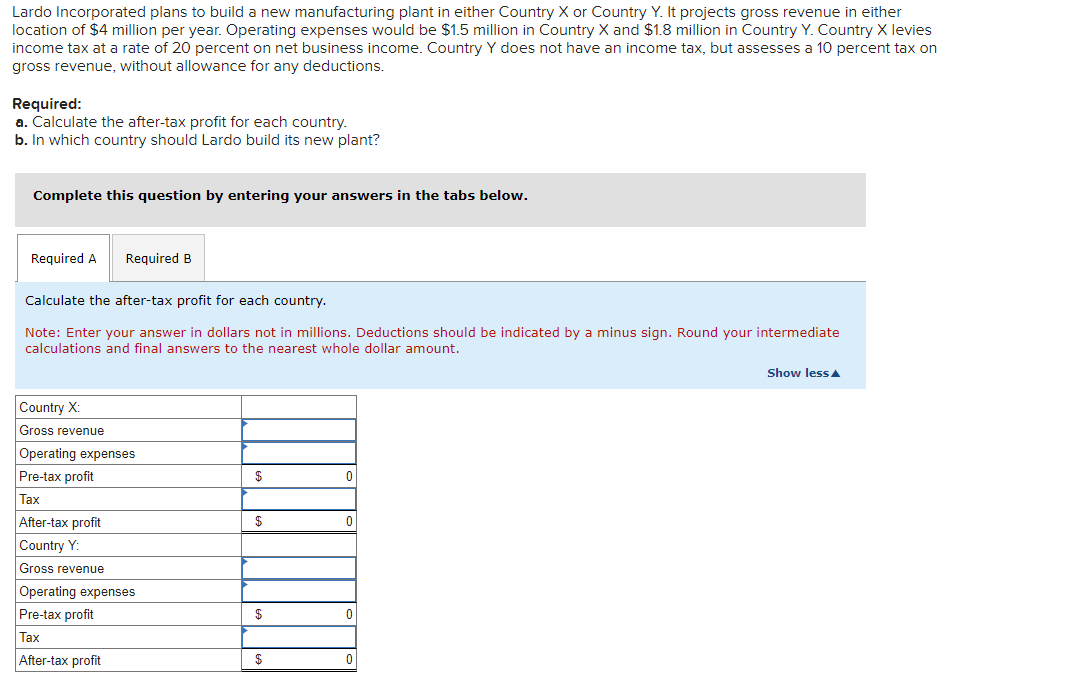

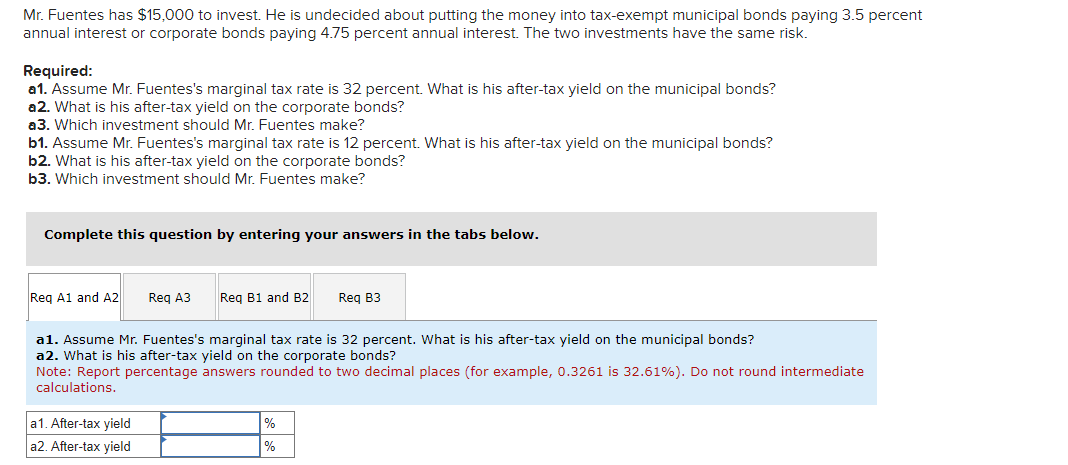

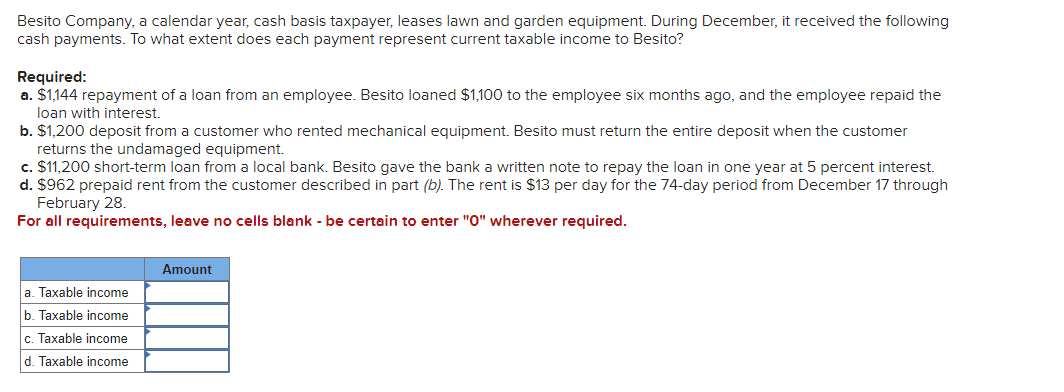

Lardo Incorporated plans to build a new manufacturing plant in either Country X or Country Y. It projects gross revenue in either location of $4 million per year. Operating expenses would be $1.5 million in Country X and $1.8 million in Country Y. Country X levies income tax at a rate of 20 percent on net business income. Country Y does not have an income tax, but assesses a 10 percent tax 0 gross revenue, without allowance for any deductions. Required: a. Calculate the after-tax profit for each country. b. In which country should Lardo build its new plant? Complete this question by entering your answers in the tabs below. Calculate the after-tax profit for each country. Note: Enter your answer in dollars not in millions. Deductions should be indicated by a minus sign. Round your intermediate calculations and final answers to the nearest whole dollar amount. Mr. Fuentes has $15,000 to invest. He is undecided about putting the money into tax-exempt municipal bonds paying 3.5 percer annual interest or corporate bonds paying 4.75 percent annual interest. The two investments have the same risk. Required: a1. Assume Mr. Fuentes's marginal tax rate is 32 percent. What is his after-tax yield on the municipal bonds? a2. What is his after-tax yield on the corporate bonds? a3. Which investment should Mr. Fuentes make? b1. Assume Mr. Fuentes's marginal tax rate is 12 percent. What is his after-tax yield on the municipal bonds? b2. What is his after-tax yield on the corporate bonds? b3. Which investment should Mr. Fuentes make? Complete this question by entering your answers in the tabs below. a1. Assume Mr. Fuentes's marginal tax rate is 32 percent. What is his after-tax yield on the municipal bonds? a2. What is his after-tax yield on the corporate bonds? Note: Report percentage answers rounded to two decimal places (for example, 0.3261 is 32.61% ). Do not round intermediate calculations. Besito Company, a calendar year, cash basis taxpayer, leases lawn and garden equipment. During December, it received the following cash payments. To what extent does each payment represent current taxable income to Besito? Required: a. $1,144 repayment of a loan from an employee. Besito loaned $1,100 to the employee six months ago, and the employee repaid the loan with interest. b. $1,200 deposit from a customer who rented mechanical equipment. Besito must return the entire deposit when the customer returns the undamaged equipment. c. $11,200 short-term loan from a local bank. Besito gave the bank a written note to repay the loan in one year at 5 percent interest. d. $962 prepaid rent from the customer described in part (b). The rent is $13 per day for the 74-day period from December 17 through February 28. For all requirements, leave no cells blank - be certain to enter "0" wherever required

Lardo Incorporated plans to build a new manufacturing plant in either Country X or Country Y. It projects gross revenue in either location of $4 million per year. Operating expenses would be $1.5 million in Country X and $1.8 million in Country Y. Country X levies income tax at a rate of 20 percent on net business income. Country Y does not have an income tax, but assesses a 10 percent tax 0 gross revenue, without allowance for any deductions. Required: a. Calculate the after-tax profit for each country. b. In which country should Lardo build its new plant? Complete this question by entering your answers in the tabs below. Calculate the after-tax profit for each country. Note: Enter your answer in dollars not in millions. Deductions should be indicated by a minus sign. Round your intermediate calculations and final answers to the nearest whole dollar amount. Mr. Fuentes has $15,000 to invest. He is undecided about putting the money into tax-exempt municipal bonds paying 3.5 percer annual interest or corporate bonds paying 4.75 percent annual interest. The two investments have the same risk. Required: a1. Assume Mr. Fuentes's marginal tax rate is 32 percent. What is his after-tax yield on the municipal bonds? a2. What is his after-tax yield on the corporate bonds? a3. Which investment should Mr. Fuentes make? b1. Assume Mr. Fuentes's marginal tax rate is 12 percent. What is his after-tax yield on the municipal bonds? b2. What is his after-tax yield on the corporate bonds? b3. Which investment should Mr. Fuentes make? Complete this question by entering your answers in the tabs below. a1. Assume Mr. Fuentes's marginal tax rate is 32 percent. What is his after-tax yield on the municipal bonds? a2. What is his after-tax yield on the corporate bonds? Note: Report percentage answers rounded to two decimal places (for example, 0.3261 is 32.61% ). Do not round intermediate calculations. Besito Company, a calendar year, cash basis taxpayer, leases lawn and garden equipment. During December, it received the following cash payments. To what extent does each payment represent current taxable income to Besito? Required: a. $1,144 repayment of a loan from an employee. Besito loaned $1,100 to the employee six months ago, and the employee repaid the loan with interest. b. $1,200 deposit from a customer who rented mechanical equipment. Besito must return the entire deposit when the customer returns the undamaged equipment. c. $11,200 short-term loan from a local bank. Besito gave the bank a written note to repay the loan in one year at 5 percent interest. d. $962 prepaid rent from the customer described in part (b). The rent is $13 per day for the 74-day period from December 17 through February 28. For all requirements, leave no cells blank - be certain to enter "0" wherever required Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started