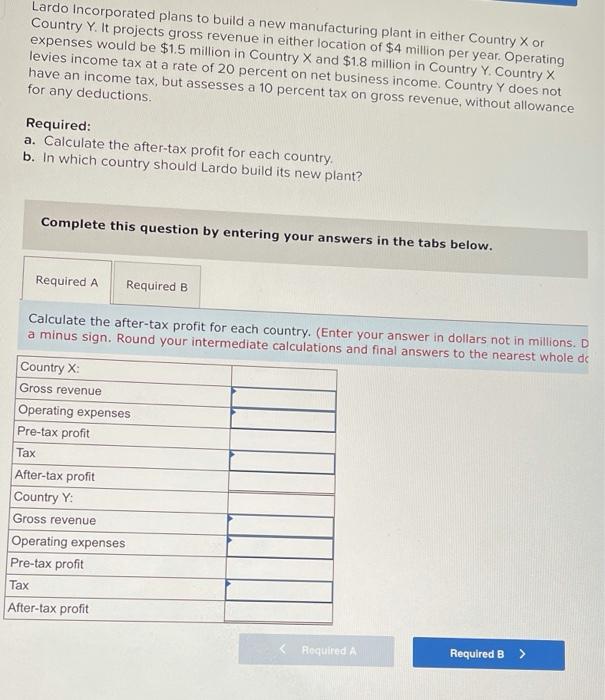

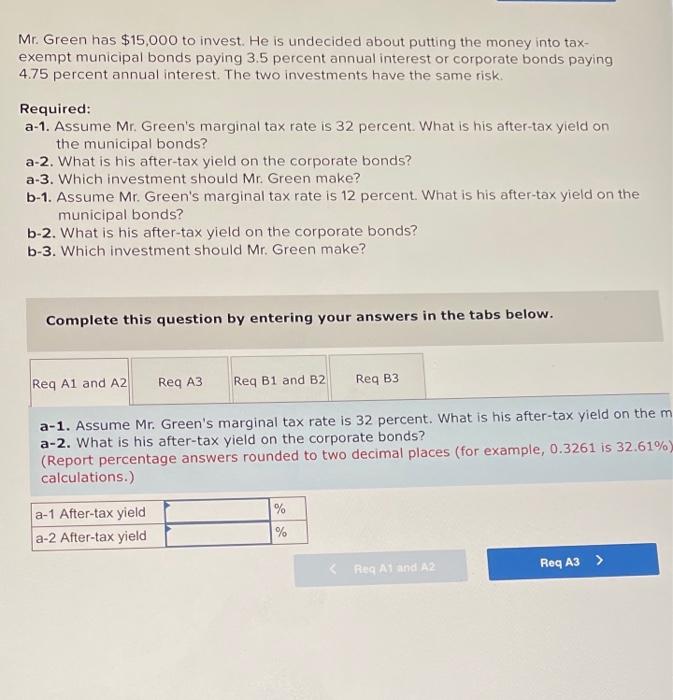

Lardo Incorporated plans to build a new manufacturing plant in either Country Xor Country Y. It projects gross revenue in either location of $4 million per year. Operating expenses would be $1.5 million in Country X and $1.8 million in Country Y. Country X levies income tax at a rate of 20 percent on net business income. Country Y does not have an income tax, but assesses a 10 percent tax on gross revenue, without allowance for any deductions. Required: a. Calculate the after-tax profit for each country. b. In which country should Lardo build its new plant? Complete this question by entering your answers in the tabs below. Required A Required B Calculate the after-tax profit for each country. (Enter your answer in dollars not in millions. D a minus sign. Round your intermediate calculations and final answers to the nearest whole de Country X: Gross revenue Operating expenses Pre-tax profit Tax After-tax profit Country Y: Gross revenue Operating expenses Pre-tax profit Tax After-tax profit Required Required B Mr. Green has $15,000 to invest. He is undecided about putting the money into tax- exempt municipal bonds paying 3.5 percent annual interest or corporate bonds paying 4.75 percent annual interest. The two investments have the same risk Required: a-1. Assume Mr. Green's marginal tax rate is 32 percent. What is his after-tax yield on the municipal bonds? a-2. What is his after-tax yield on the corporate bonds? a-3. Which investment should Mr. Green make? b-1. Assume Mr. Green's marginal tax rate is 12 percent. What is his after-tax yield on the municipal bonds? b-2. What is his after-tax yield on the corporate bonds? b-3. Which investment should Mr. Green make? Complete this question by entering your answers in the tabs below. Req Al and A2 Req A3 Req B1 and B2 Req B3 a-1. Assume Mr. Green's marginal tax rate is 32 percent. What is his after-tax yield on the m a-2. What is his after-tax yield on the corporate bonds? (Report percentage answers rounded to two decimal places (for example, 0.3261 is 32.61%) calculations.) a-1 After-tax yield a-2 After-tax yield % % Reg Al and A2 Req A3 >