Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Large Company has several divisions, one of which is the Mini Division. Information pertaining to the division for the current fiscal year is as

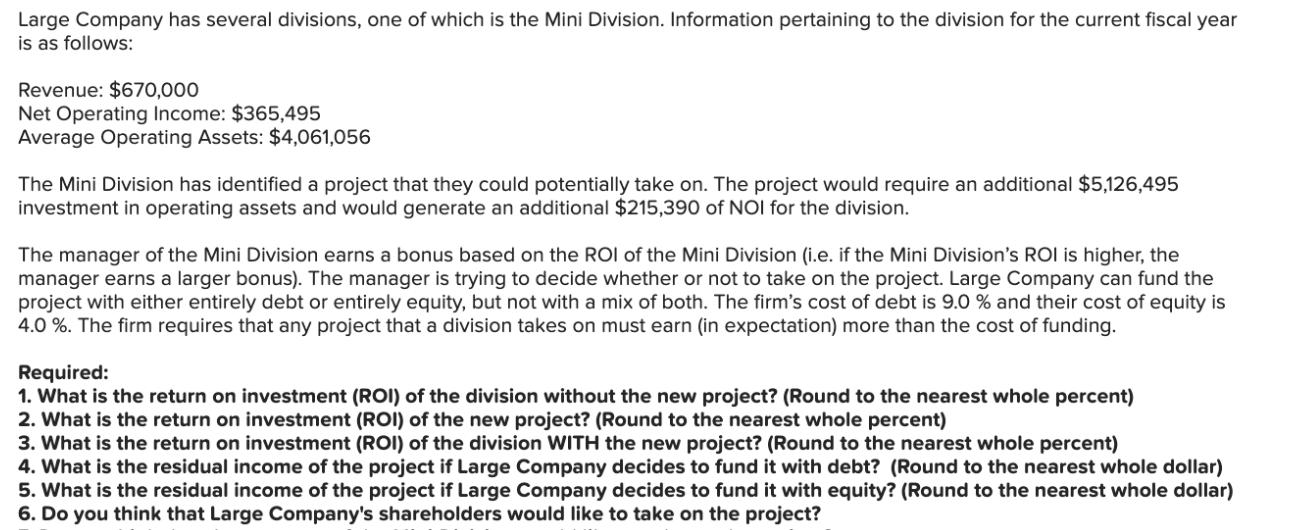

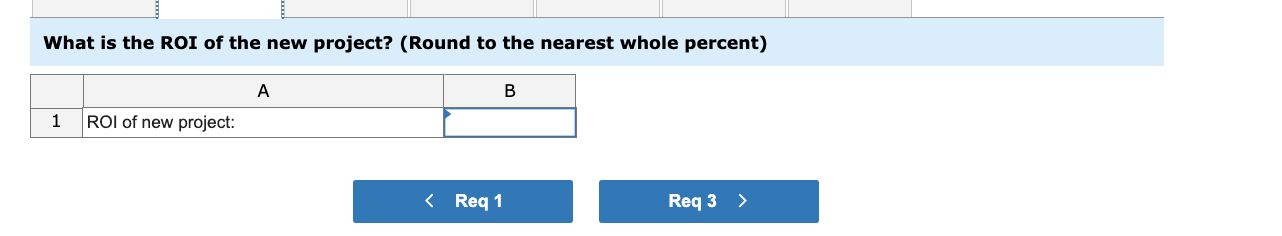

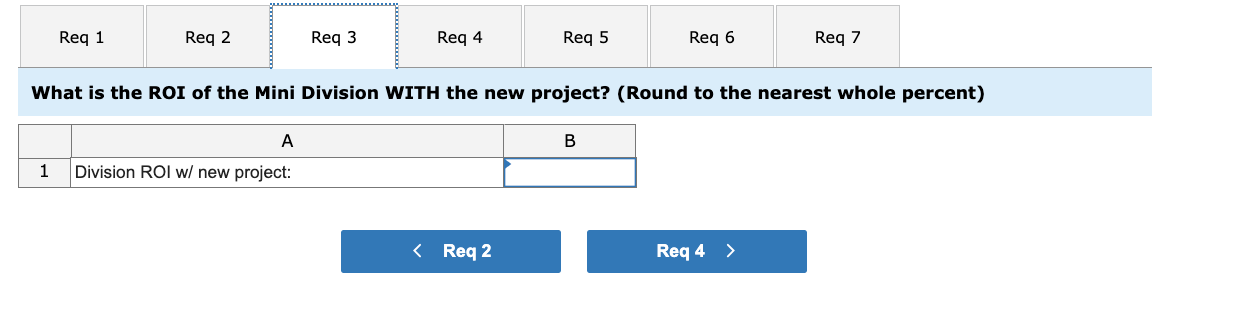

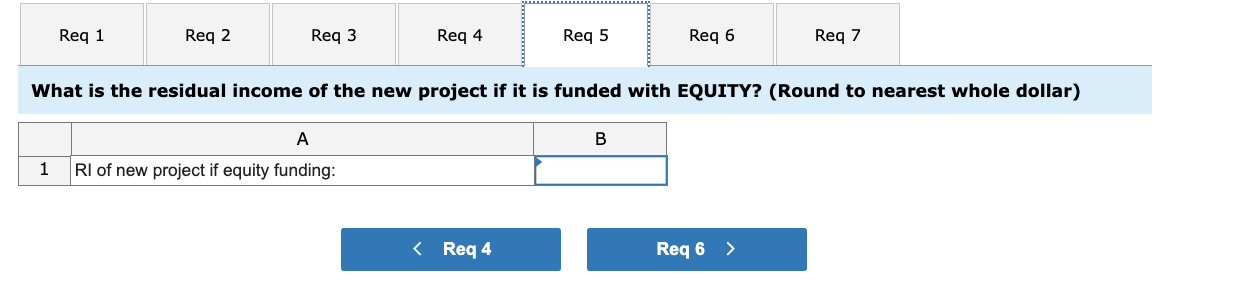

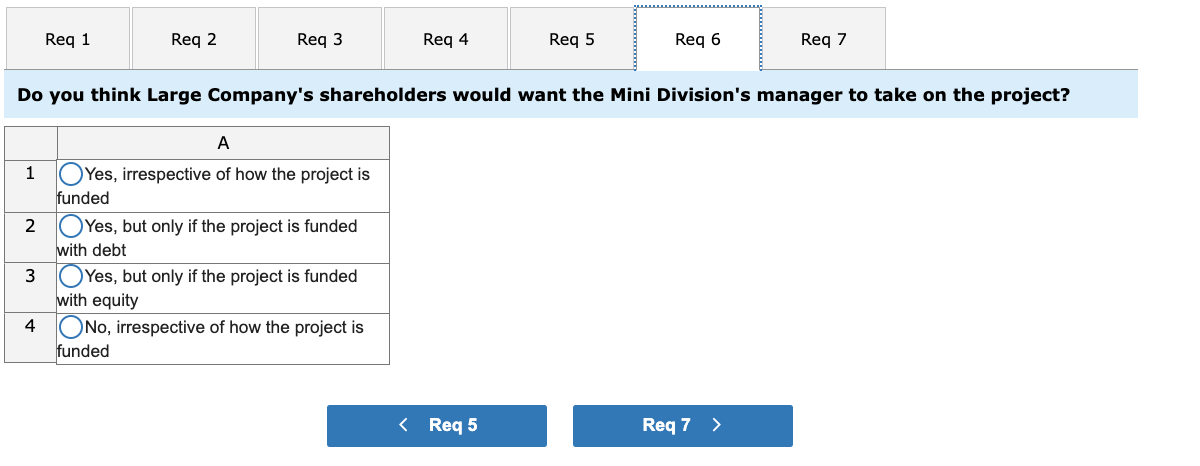

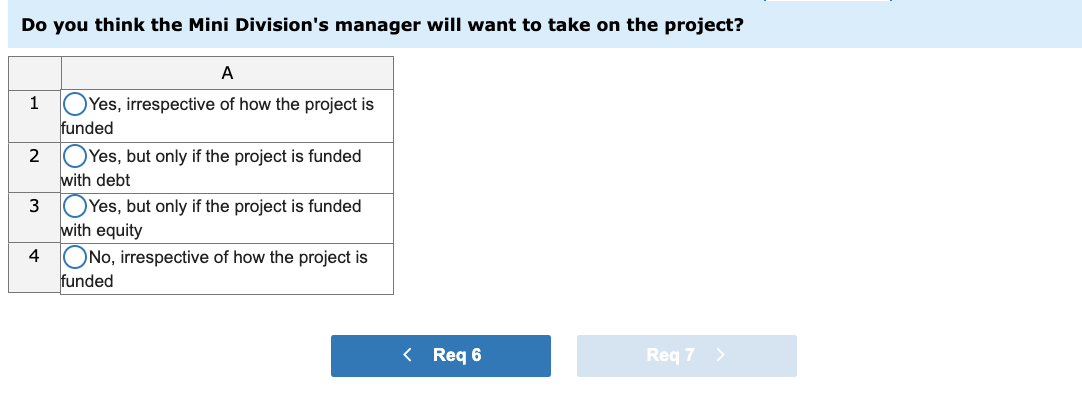

Large Company has several divisions, one of which is the Mini Division. Information pertaining to the division for the current fiscal year is as follows: Revenue: $670,000 Net Operating Income: $365,495 Average Operating Assets: $4,061,056 The Mini Division has identified a project that they could potentially take on. The project would require an additional $5,126,495 investment in operating assets and would generate an additional $215,390 of NOI for the division. The manager of the Mini Division earns a bonus based on the ROI of the Mini Division (i.e. if the Mini Division's ROI is higher, the manager earns a larger bonus). The manager is trying to decide whether or not to take on the project. Large Company can fund the project with either entirely debt or entirely equity, but not with a mix of both. The firm's cost of debt is 9.0 % and their cost of equity is 4.0%. The firm requires that any project that a division takes on must earn (in expectation) more than the cost of funding. Required: 1. What is the return on investment (ROI) of the division without the new project? (Round to the nearest whole percent) 2. What is the return on investment (ROI) of the new project? (Round to the nearest whole percent) 3. What is the return on investment (ROI) of the division WITH the new project? (Round to the nearest whole percent) 4. What is the residual income of the project if Large Company decides to fund it with debt? (Round to the nearest whole dollar) 5. What is the residual income of the project if Large Company decides to fund it with equity? (Round to the nearest whole dollar) 6. Do you think that Large Company's shareholders would like to take on the project? What is the ROI of the new project? (Round to the nearest whole percent) A 1 ROI of new project: B < Req 1 Req 3 > Req 1 Req 2 Req 3 Req 4 Req 5 Req 6 Req 7 What is the ROI of the Mini Division WITH the new project? (Round to the nearest whole percent) A 1 Division ROI w/ new project: B < Req 2 Req 4 > Req 1 Req 2 Req 3 Req 4 Req 5 Req 6 Req 7 What is the residual income of the new project if it is funded with DEBT? (Round to nearest whole dollar) A 1 RI of new project if debt funding: B < Req 3 Req 5 > Req 1 Req 2 Req 3 Req 4 Req 5 Req 6 Req 7 What is the residual income of the new project if it is funded with EQUITY? (Round to nearest whole dollar) A 1 RI of new project if equity funding: B < Req 4 Req 6 > Req 1 Req 2 Req 3 Req 4 Req 5 Req 6 Req 7 Do you think Large Company's shareholders would want the Mini Division's manager to take on the project? 1 A Yes, irrespective of how the project is funded 2 Yes, but only if the project is funded with debt 3 4 Yes, but only if the project is funded with equity No, irrespective of how the project is funded < Req 5 Req 7 > Do you think the Mini Division's manager will want to take on the project? 1 2 3 4 A Yes, irrespective of how the project is funded Yes, but only if the project is funded with debt Yes, but only if the project is funded with equity No, irrespective of how the project is funded < Req 6 Req 7 >

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started