Answered step by step

Verified Expert Solution

Question

1 Approved Answer

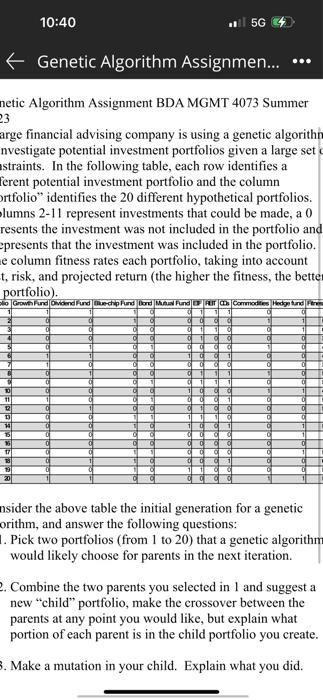

large financial advising company is using a genetic algorithm to investigate potential investment portfolios given a large set of constraints. In the following table ,

large financial advising company is using a genetic algorithm to investigate potential investment portfolios given a large set of constraints. In the following table, each row identifies a different potential investment portfolio and the column Portfolio identifies the 20 different hypothetical portfolios. Columns 2-11 represent investments that could be made, a 0 represents the investment was not included in the portfolio and a 1 represents that the investment was included in the portfolio. The column fitness rates each portfolio, taking into accountcost, risk, and projected return (the higher the fitness, the better the portfolio).

Pick two portfolios (from 1 to 20) that a genetic algorithm would likely choose for parents in the next iteration.

2. Combine the two parents you selected in 1 and suggest a new child portfolio, make the crossover between the parents at any point you would like, but explain what portion of each parent is in the child portfolio you create.

3. Make a mutation in your child. Explain what you did.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started