Answered step by step

Verified Expert Solution

Question

1 Approved Answer

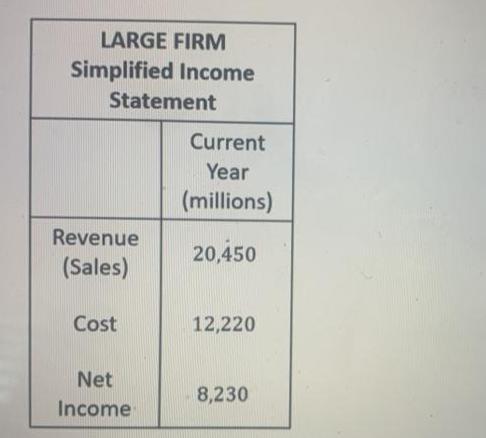

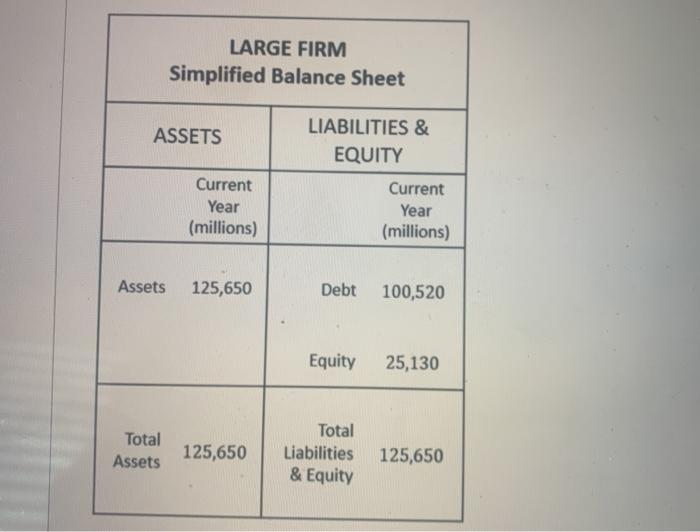

LARGE FIRM Simplified Income Statement Current Year (millions) Revenue 20,450 (Sales) Cost 12,220 Net 8,230 Income LARGE FIRM Simplified Balance Sheet ASSETS Current LIABILITIES

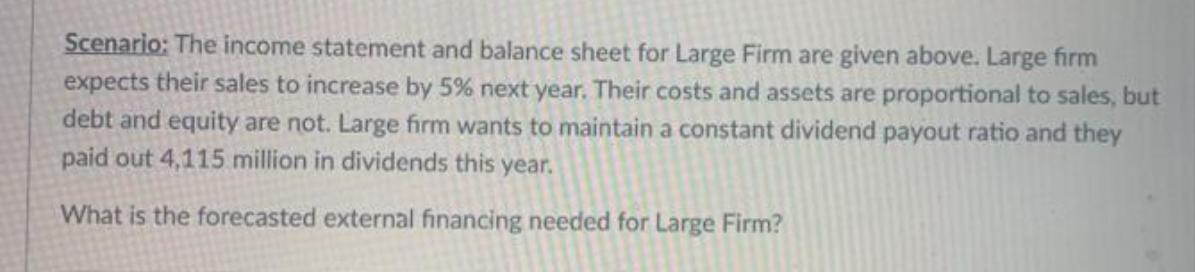

LARGE FIRM Simplified Income Statement Current Year (millions) Revenue 20,450 (Sales) Cost 12,220 Net 8,230 Income LARGE FIRM Simplified Balance Sheet ASSETS Current LIABILITIES & EQUITY Current Year (millions) Year (millions) Assets 125,650 Debt 100,520 Total Assets Equity 25,130 Total 125,650 Liabilities 125,650 & Equity Scenario: The income statement and balance sheet for Large Firm are given above. Large firm expects their sales to increase by 5% next year. Their costs and assets are proportional to sales, but debt and equity are not. Large firm wants to maintain a constant dividend payout ratio and they paid out 4,115 million in dividends this year. What is the forecasted external financing needed for Large Firm?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started