Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Larimer Larry has a moderate-sized truck farming operation in north-central Colorado. He has experience growing food crops in open fields, under shade covers, and

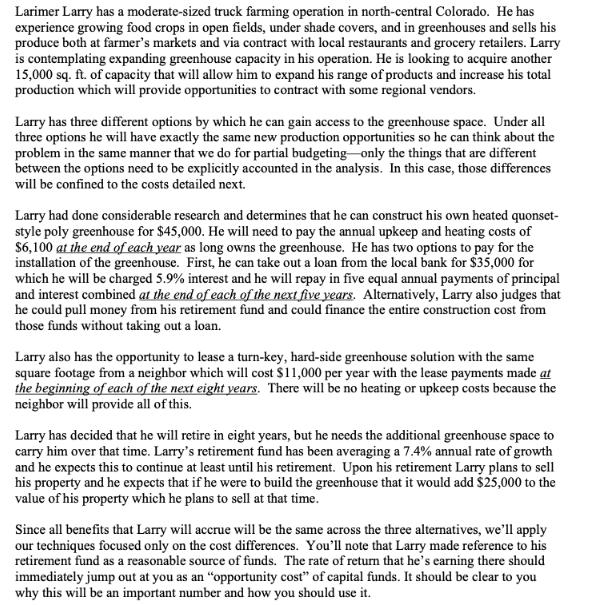

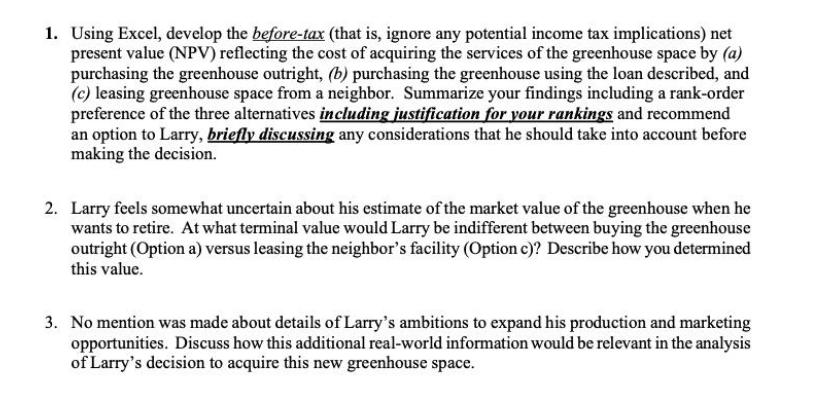

Larimer Larry has a moderate-sized truck farming operation in north-central Colorado. He has experience growing food crops in open fields, under shade covers, and in greenhouses and sells his produce both at farmer's markets and via contract with local restaurants and grocery retailers. Larry is contemplating expanding greenhouse capacity in his operation. He is looking to acquire another 15,000 sq. ft. of capacity that will allow him to expand his range of products and increase his total production which will provide opportunities to contract with some regional vendors. Larry has three different options by which he can gain access to the greenhouse space. Under all three options he will have exactly the same new production opportunities so he can think about the problem in the same manner that we do for partial budgeting only the things that are different between the options need to be explicitly accounted in the analysis. In this case, those differences will be confined to the costs detailed next. Larry had done considerable research and determines that he can construct his own heated quonset- style poly greenhouse for $45,000. He will need to pay the annual upkeep and heating costs of $6,100 at the end of each year as long owns the greenhouse. He has two options to pay for the installation of the greenhouse. First, he can take out a loan from the local bank for $35,000 for which he will be charged 5.9% interest and he will repay in five equal annual payments of principal and interest combined at the end of each of the next five years. Alternatively, Larry also judges that he could pull money from his retirement fund and could finance the entire construction cost from those funds without taking out a loan. Larry also has the opportunity to lease a turn-key, hard-side greenhouse solution with the same square footage from a neighbor which will cost $11,000 per year with the lease payments made at the beginning of each of the next eight years. There will be no heating or upkeep costs because the neighbor will provide all of this. Larry has decided that he will retire in eight years, but he needs the additional greenhouse space to carry him over that time. Larry's retirement fund has been averaging a 7.4% annual rate of growth and he expects this to continue at least until his retirement. Upon his retirement Larry plans to sell his property and he expects that if he were to build the greenhouse that it would add $25,000 to the value of his property which he plans to sell at that time. Since all benefits that Larry will accrue will be the same across the three alternatives, we'll apply our techniques focused only on the cost differences. You'll note that Larry made reference to his retirement fund as a reasonable source of funds. The rate of return that he's earning there should immediately jump out at you as an "opportunity cost" of capital funds. It should be clear to you why this will be an important number and how you should use it. 1. Using Excel, develop the before-tax (that is, ignore any potential income tax implications) net present value (NPV) reflecting the cost of acquiring the services of the greenhouse space by (a) purchasing the greenhouse outright, (b) purchasing the greenhouse using the loan described, and (c) leasing greenhouse space from a neighbor. Summarize your findings including a rank-order preference of the three alternatives including justification for your rankings and recommend an option to Larry, briefly discussing any considerations that he should take into account before making the decision. 2. Larry feels somewhat uncertain about his estimate of the market value of the greenhouse when he wants to retire. At what terminal value would Larry be indifferent between buying the greenhouse outright (Option a) versus leasing the neighbor's facility (Option c)? Describe how you determined this value. 3. No mention was made about details of Larry's ambitions to expand his production and marketing opportunities. Discuss how this additional real-world information would be relevant in the analysis of Larry's decision to acquire this new greenhouse space. For all NPV analysis, create your own discount factors, display them, and use them. DO NOT use the NPV function in Excel for anything

Step by Step Solution

★★★★★

3.44 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

In this scenario Larry is considering three options to gain access to additional greenhouse space for his truck farming operation The options are as f...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started