Answered step by step

Verified Expert Solution

Question

1 Approved Answer

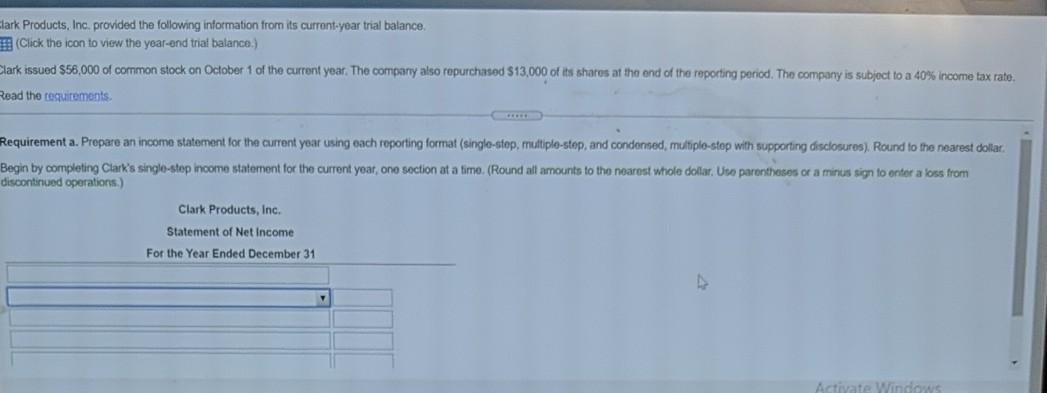

lark Products, Inc. provided the following information from its current-year trial balance. (Click the icon to view the year-end trial balance.) Clark issued $56,000 of

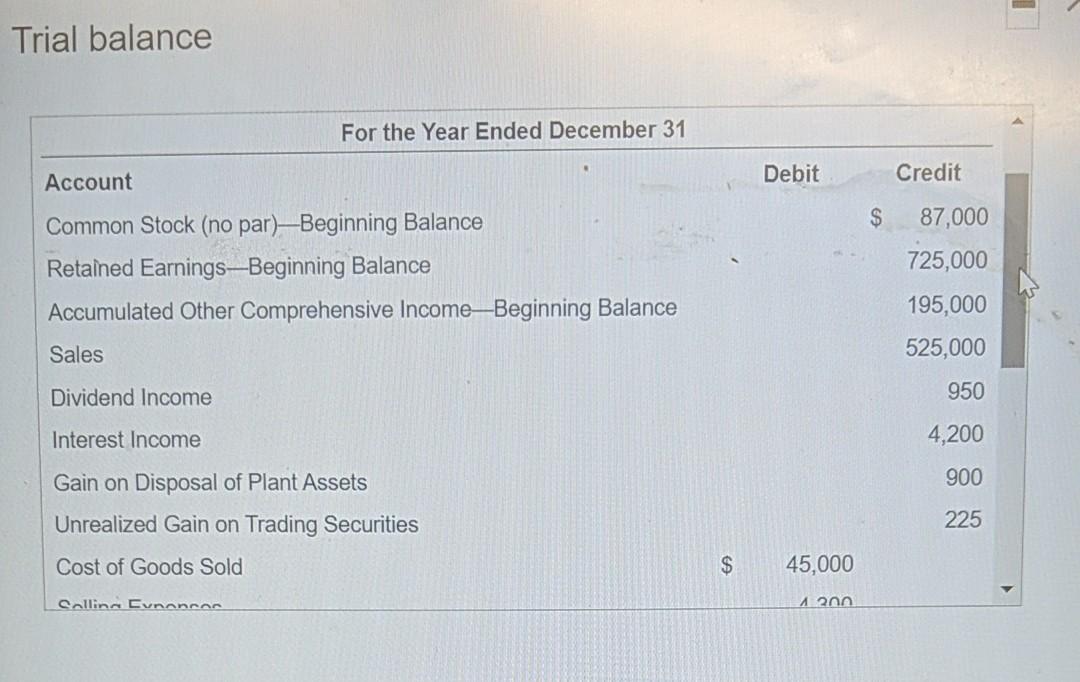

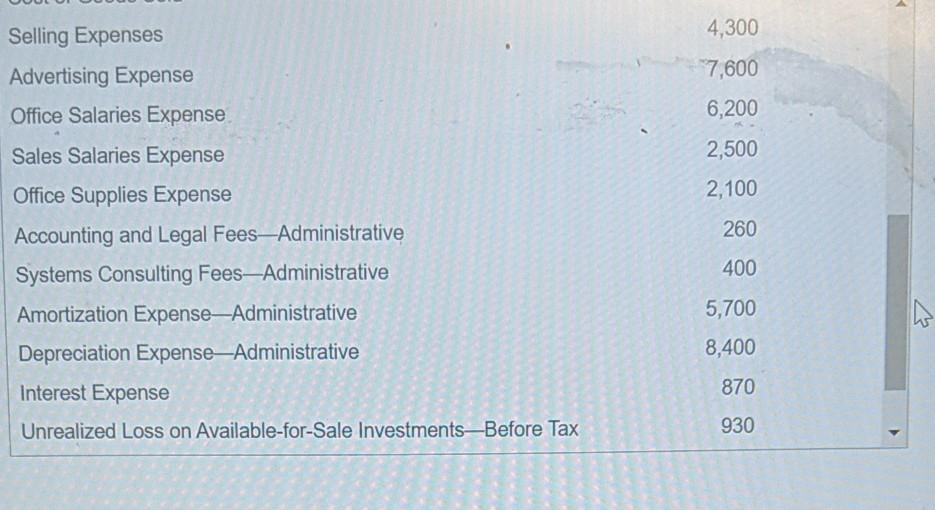

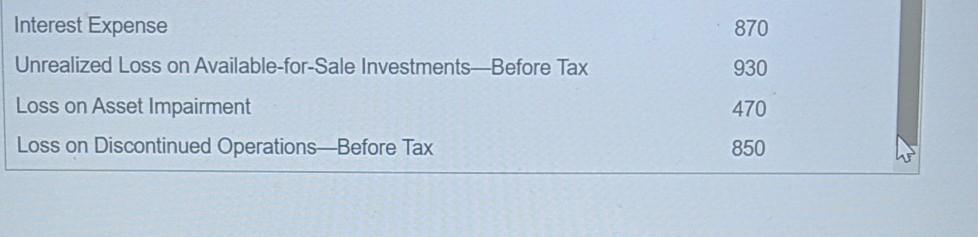

lark Products, Inc. provided the following information from its current-year trial balance. (Click the icon to view the year-end trial balance.) Clark issued $56,000 of common stock on October 1 of the current year. The company also repurchased $13,000 of its shares at the end of the reporting period. The company is subject to a 40% income tax rate. Read the tuitements Requirement a. Prepare an income statement for the current year using each reporting format (single-step, multiplo-step, and condensed, multiplo-step with supporting disclosures). Round to the nearest dollar. Begin by completing Clark's single-step income statement for the current year, ono section at a time. (Round all amounts to the nearest whole dollar. Uto parentheses or a minus sign to enter a loss from discontinued operations.) Clark Products, Inc. Statement of Net Income For the Year Ended December 31 M Activate Windows Trial balance For the Year Ended December 31 Account Debit Credit $ 87,000 Common Stock (no par)Beginning Balance Retained Earnings-Beginning Balance Accumulated Other Comprehensive IncomeBeginning Balance 725,000 195,000 525,000 Sales Dividend Income 950 Interest Income 4,200 900 Gain on Disposal of Plant Assets Unrealized Gain on Trading Securities 225 Cost of Goods Sold $ 45,000 Collins Eunancar 12nn 4,300 Selling Expenses Advertising Expense 7,600 Office Salaries Expense 6,200 2,500 2,100 260 400 Sales Salaries Expense Office Supplies Expense Accounting and Legal Fees-Administrative Systems Consulting FeesAdministrative Amortization Expense-Administrative Depreciation ExpenseAdministrative Interest Expense Unrealized Loss on Available-for-Sale Investments Before Tax 5,700 8,400 870 930 870 Interest Expense Unrealized Loss on Available-for-Sale Investments Before Tax 930 470 Loss on Asset Impairment Loss on Discontinued Operations Before Tax 850

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started