Answered step by step

Verified Expert Solution

Question

1 Approved Answer

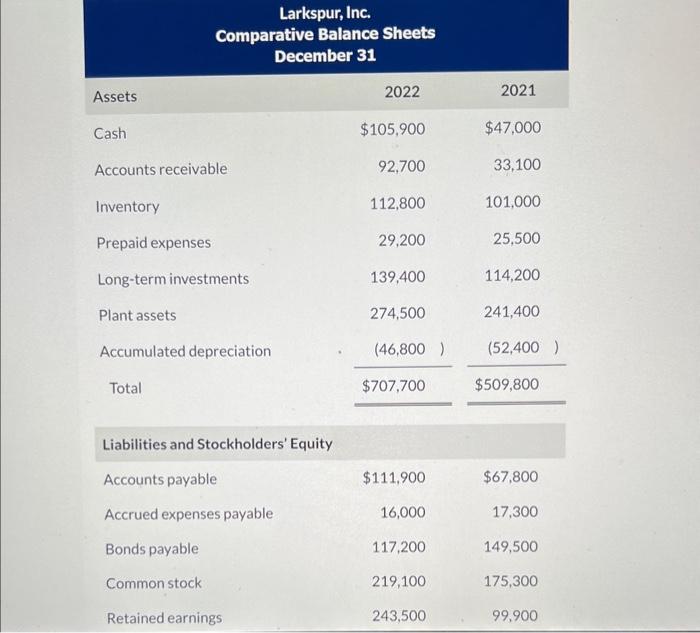

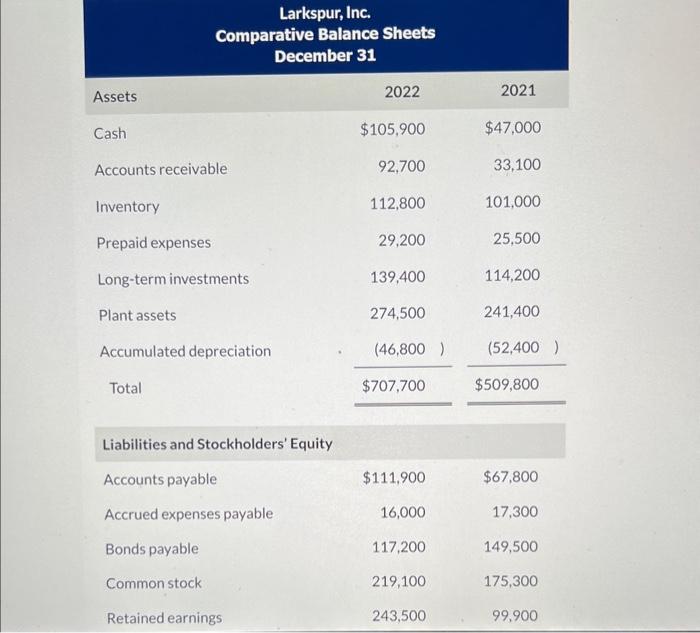

Larkspur, Inc. Comparative Balance Sheets December 31 AssetsCashAccountsreceivableInventoryPrepaidexpensesLong-terminvestmentsPlantassetsAccumulateddepreciation2022$105,90092,700112,80029,200139,400274,500(46,800)$707,7002021$47,00033,100101,00025,500114,200241,400(52,400)$509,800) Liabilities and Stockholders' Equity Accounts payable $111,900$67,800 Accruedexpensespayable16,00017,300 Bonds payable 117,200149,500 Commonstock 219,100175,300 Retainedearnings243,50099,900 Additional information: 1.

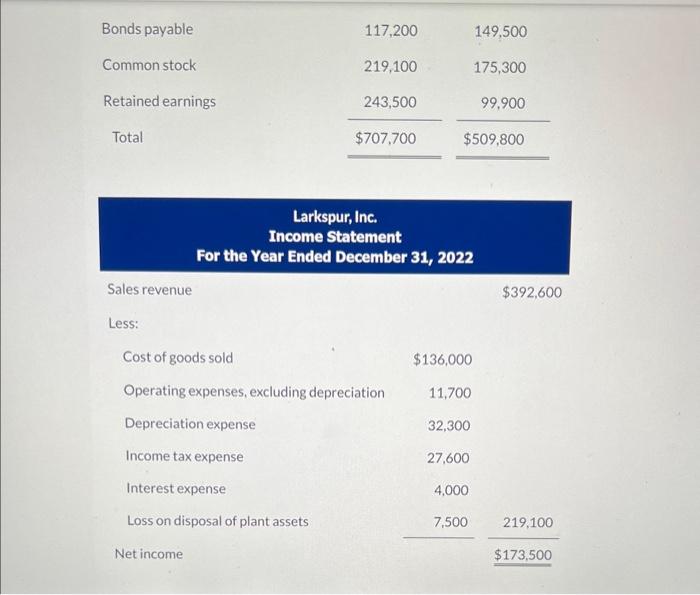

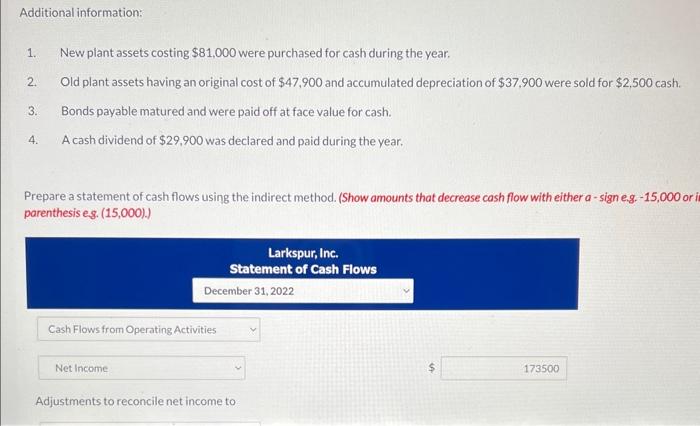

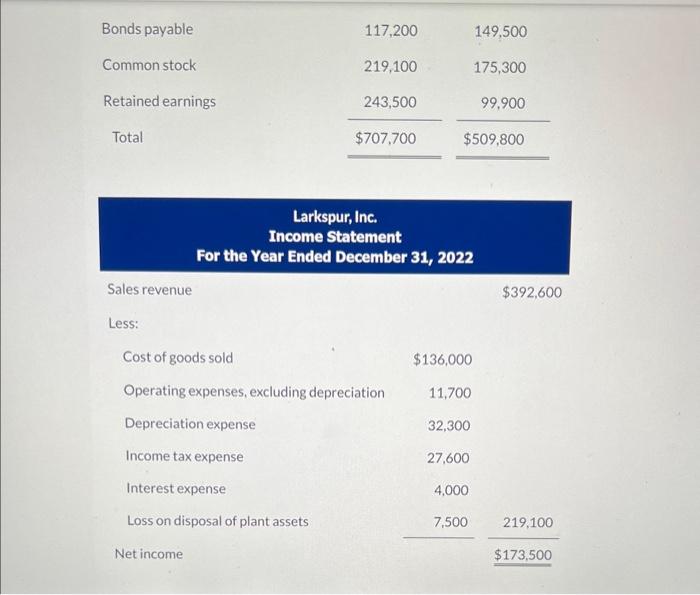

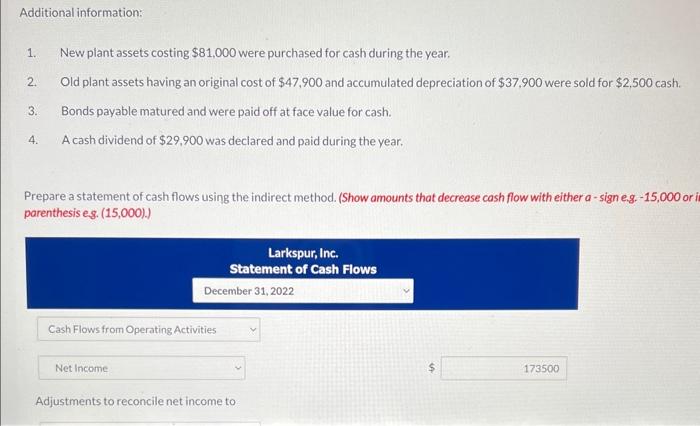

Larkspur, Inc. Comparative Balance Sheets December 31 AssetsCashAccountsreceivableInventoryPrepaidexpensesLong-terminvestmentsPlantassetsAccumulateddepreciation2022$105,90092,700112,80029,200139,400274,500(46,800)$707,7002021$47,00033,100101,00025,500114,200241,400(52,400)$509,800) Liabilities and Stockholders' Equity Accounts payable $111,900$67,800 Accruedexpensespayable16,00017,300 Bonds payable 117,200149,500 Commonstock 219,100175,300 Retainedearnings243,50099,900 Additional information: 1. New plant assets costing $81,000 were purchased for cash during the year. 2. Old plant assets having an original cost of $47,900 and accumulated depreciation of $37,900 were sold for $2,500 cash. 3. Bonds payable matured and were paid off at face value for cash. 4. A cash dividend of $29,900 was deciared and paid during the year. Prepare a statement of cash flows using the indirect method. (Show amounts that decrease cash flow with either a - sign e.g. 15,000 or parenthesis eg. (15,000).)

Larkspur, Inc. Comparative Balance Sheets December 31 AssetsCashAccountsreceivableInventoryPrepaidexpensesLong-terminvestmentsPlantassetsAccumulateddepreciation2022$105,90092,700112,80029,200139,400274,500(46,800)$707,7002021$47,00033,100101,00025,500114,200241,400(52,400)$509,800) Liabilities and Stockholders' Equity Accounts payable $111,900$67,800 Accruedexpensespayable16,00017,300 Bonds payable 117,200149,500 Commonstock 219,100175,300 Retainedearnings243,50099,900 Additional information: 1. New plant assets costing $81,000 were purchased for cash during the year. 2. Old plant assets having an original cost of $47,900 and accumulated depreciation of $37,900 were sold for $2,500 cash. 3. Bonds payable matured and were paid off at face value for cash. 4. A cash dividend of $29,900 was deciared and paid during the year. Prepare a statement of cash flows using the indirect method. (Show amounts that decrease cash flow with either a - sign e.g. 15,000 or parenthesis eg. (15,000).)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started