Answered step by step

Verified Expert Solution

Question

1 Approved Answer

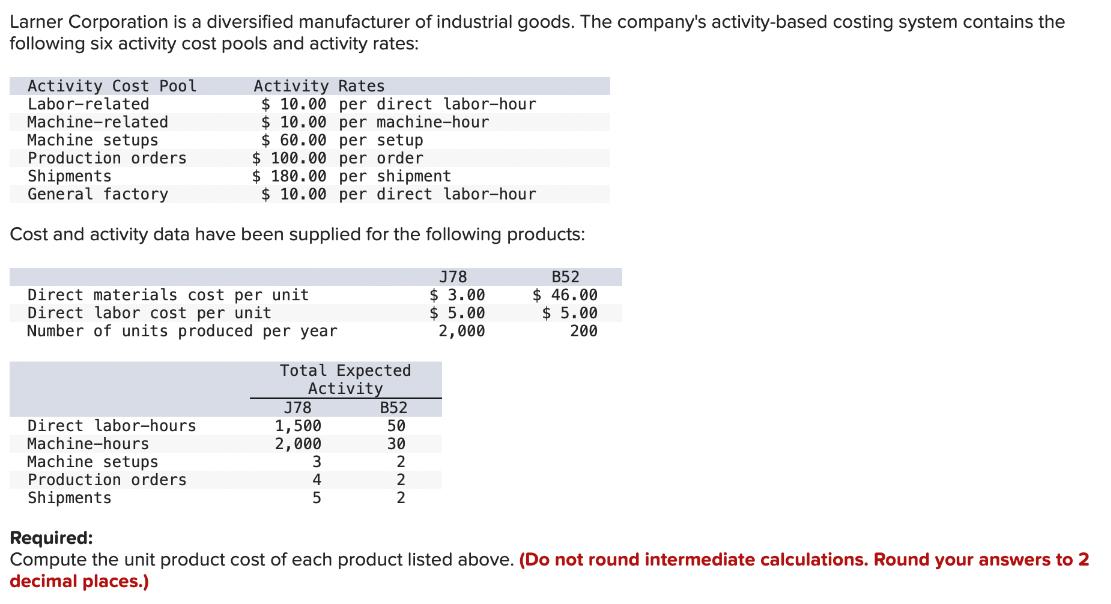

Larner Corporation is a diversified manufacturer of industrial goods. The company's activity-based costing system contains the following six activity cost pools and activity rates:

Larner Corporation is a diversified manufacturer of industrial goods. The company's activity-based costing system contains the following six activity cost pools and activity rates: Activity Cost Pool Labor-related Machine-related Machine setups Production orders Shipments General factory Activity Rates $ 10.00 per direct labor-hour $ 10.00 per machine-hour $ 60.00 per setup $ 100.00 per order $ 180.00 per shipment $ 10.00 per direct labor-hour Cost and activity data have been supplied for the following products: Direct materials cost per unit Direct labor cost per unit J78 $ 3.00 B52 $ 46.00 $ 5.00 2,000 $ 5.00 200 Number of units produced per year Total Expected Activity J78 B52 Direct labor-hours 1,500 50 Machine-hours 2,000 30 Machine setups 3 2 Production orders 4 2 5 2 Shipments Required: Compute the unit product cost of each product listed above. (Do not round intermediate calculations. Round your answers to 2 decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer To compute the unit product cost for each product we need to calculate the total cost for each activity cost pool and then allocate those costs ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

663e6f8054d2e_956266.pdf

180 KBs PDF File

663e6f8054d2e_956266.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started