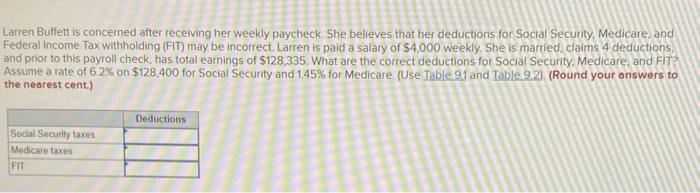

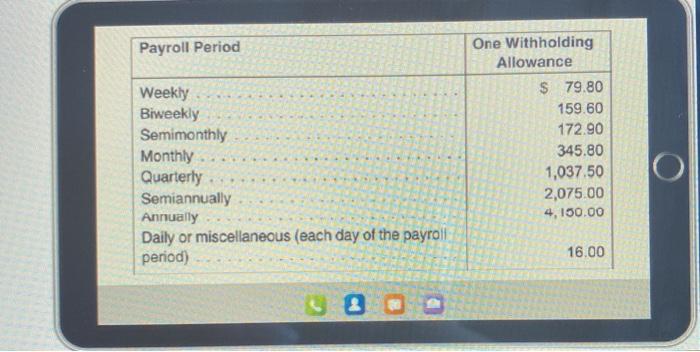

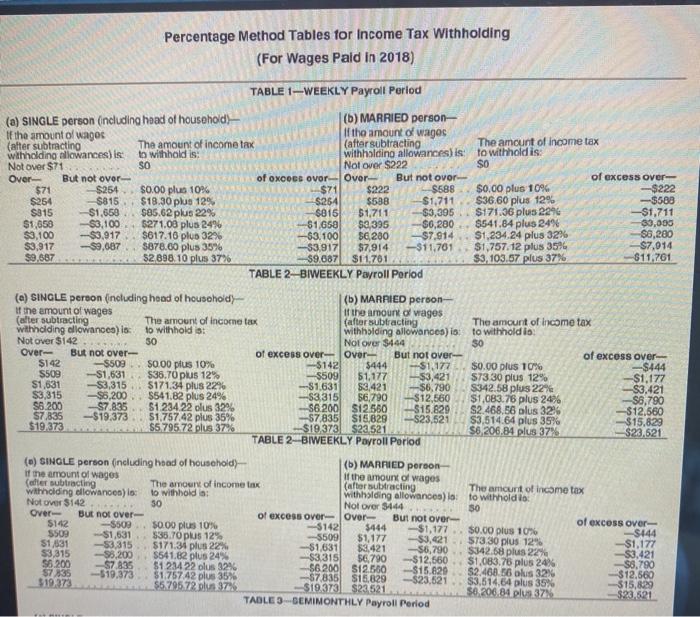

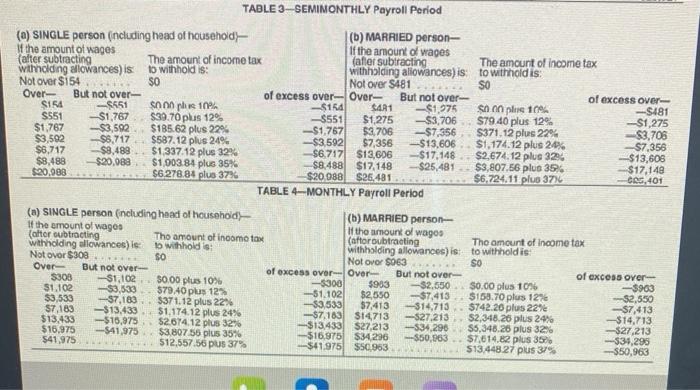

Larren Buffett is concerned after receiving her weekly paycheck. She believes that her deductions for Social Security Medicare, and Federal Income Tax withholding (FIT) may be incorrect. Larren is paid a salary of $4,000 weekly. She is married, claims 4 deductions, and prior to this payroll check, has total earnings of $128,335. What are the correct deductions for Social Security Medicare and FIT? Assume a rate of 6.2% on $128.400 for Social Security and 145% for Medicare (Use Table 91 and Table 9.2) (Round your answers to the nearest cent.) Deductions Social Security taxes Medicare taxes FIT Payroll Period Weekly Biweekly Semimonthly Monthly Quarterly Semiannually Annually Daily or miscellaneous (each day of the payroll period) One Withholding Allowance $ 79.80 159.60 172.90 345.80 1,037.50 2,075.00 4,150.00 16.00 Percentage Method Tables for Income Tax Withholding (For Wages Pald in 2018) TABLE 1-WEEKLY Payroll Period (a) SINGLE person (including head of household)- (b) MARRIED person- If the amount of wagos If the amount of wagos (after subtracting The amount of income tax (after subtracting The amount of income tax withholding allowances) is: to withhold is: withholdino allowance is to withholdis: Not over $71 SO Not Over $222 SO Over- But not over of Oxoss ovor Over But not ovor of excess over $71 -S254 $0.00 plus 10% $71 $222 - $588 $0.00 plus 10% -$222 $254 - $815 $18.30 plus 12% $254 $588 $1,711 $36.60 plus 12% -$588 $315 $1,650 $85.62 plus 22% S016 $1,711 $3,395 $171.36 plus 2297 -$1,711 $1,658 $3,100 5271.08 plus 24% -$1.658 $9,395 $6,200 $541.84 plus 24% 30,000 $3,100 $3.917 $617.10 plus 32% -53.100 $6,280 $7.914 $1,234.24 plus 32% $6,280 $3,917 -$9,087 $878.60 plus 3596 -$3.917 $7,914 -$11,761 $1,757.12 plus 3596 $7,014 59,587 $2,898.10 plus 37% -$9.687 $11,701 $3, 103.57 plus 37% $11,761 TABLE 2-BIWEEKLY Payroll Period (C) SINGLE Person (ncluding head of household) (6) MARRIED person- If the amount of wages If the amount of wages (after subtracting The amount of income tax (after subtracting The amount of income tax withholding allowances) is to withhold is: withholding allowances) is: to withholdio Not over $142 30 Not Over $444 30 Over But not over of excess over- Over- But not over of excess over $142 -5509 $0.00 plus 10% $142 $444 $1,177 $0.00 plus 10% $444 5509 ---S1,631 $36.70 plus 12% $509 51,177 -53,421 $73 30 plus 12% $1,177 $1,631 $3,315 $171.34 plus 22% -81.631 $3,421 -$6,790 $342.58 plus 22% -S3.421 $3,315 $5,200 $541.82 plus 24% $3,315 56.790 -$12,560 $1,083.76 plus 24% -$8,790 $6.200 $7.835 $1.234.22 olus 32% S6.200 $12560 $15.829 S2.468,56 plus 326 -$12.560 $7.835 --$19.373 $1,757.42 plus 35% -57835 $15.829 -S23,521 $3,514.64 plus 35% $15.829 $19.373 55 795 72 plus 37% $19.373 $23.521 $6, 206.84 plus 37% $23,521 TABLE 2- BIWEEKLY Payroll Period (6) SINGLE person (including hood of household) (6) MARRIED person- of the amount of wages If the amount of wages (oder subtracting The amount of income tax Withholding allowances): The amount of income tax to withholds withholding allowancea) lo to withholdilo Not Over $142 SO Not Over $444 50 Over- But not over- of excess over-Over But not over $142 -$500 $0.00 plus 10% of excess over- --$142 $444 -$1,177 $0.00 plus 10% S509 $1,631 $35.70 plus 12% 5509 -S144 $1,177 -$3,42157330 plus 12% 51,031 -$3,315 $171.31 plus 22% $1,177 $1,631 $3,421 -6,790 $3,315 -$5,200 $541.82 plus 24% $342.58 plus 22% -$3,421 $3,315 $6.790 $6.200 37.835 -$12,660 $1,083.76 plus 24% $1 234 22 olus 32% $6 2001 $12.500 57835 -S3,790 $15.629 -519.373 $1757 42 plus 35% $2.468.56 blus 32% -57835 $15.829 $12,560 $19,373 --$23,521 $3.514.64 plus 35% $579572 plus 37% $19.373 $23.521 -315,829 $0.206.84 plus 37% $23.821 TABLE 3-GEMIMONTHLY Payroll Period TABLE 3-SEMIMONTHLY Payroll Period () SINGLE person (ncluding head of household (b) MARRIED person- If the amount of wages If the amount of wages (after subtracting The amount of income tax (after subtracting The amount of income tax withholding allowances) is: to withholdis: withholding allowances) is: to withhold is: Not over $154 $0 Not over $481 SO Over- But not over of excess over-- Over- But not over of excess over $154 -$551 Sono pre 10% -$154 $481 -$1,975 Shople 10 -S481 S551 $1,767 $39.70 plus 12 -$551 $1,275 -$3,706 579 40 plus 12 -$1,275 $1,767 $3,592 $185.62 plus 229 -$1,767 53.706 --$7,356 S371.12 plus 22% -$3,706 $3,592 $5.717 $587.12 plus 24% -$3.592 $7,356 -$13.606 $1,174.12 plus 24% 57,356 $6.717 $9,489 $1.337.12 plus 329 -$6.717 $13,606 -$17.148 $2,674.12 plus 32% -$13,606 $8.488 $20.083 $1,903.84 plus 35% $8,488 $17,148 -$25,481 $3,807.56 plus 35% $17,140 $20.988 $6278.84 plus 37% $20.988 $26.481 $6.724.11 plus 374 GOG, 401 TABLE 4-MONTHLY Payroll Period (*) SINGLE person (including head of household - (b) MARRIED person If the amount of wagos If the amount of wagos (after subtracting Tho amount of income tax (aftoroubtracting The amount of Income tax withholding allowances) is to withholdis: withholding allowances) is to withhold is: Not over $308 SO Not over 5063 SO Over But not over of excess over Over But not over of excess over- S303 -$1,102 $0.00 plus 10% -5306 $903 -$2,350 So.co plus 10% $903 $1.102 $3,533 $79.40 plus 12% -51.1021 $2.550 --$7,413 $158.70 plus 12% ---$2,550 $3,533 --37,183 3371.12 plus 22% -33,533 $7,413 $7.189 -$14,713 $742.20 plus 22% -S7,413 -$13,439 $1.174.12 plus 24% -$7.1831 $14,713 -$27.213 $13.433 $2,348,26 plus 29% -$14,713 -$16.975 52.674.12 plus 32% $13.4331 $27,213 -$34.290 S5,348.26 plus 32% $16.975 -$41,975 -$27,213 $3.807.56 plus 35% -$16.975 $34 296 $41,975 --$50,903 .. $7,614.82 plus 352 -339,295 512,557.56 US 37% -$41.975 $50.963 $13.448 27 plus 37% --$50,963