Answered step by step

Verified Expert Solution

Question

1 Approved Answer

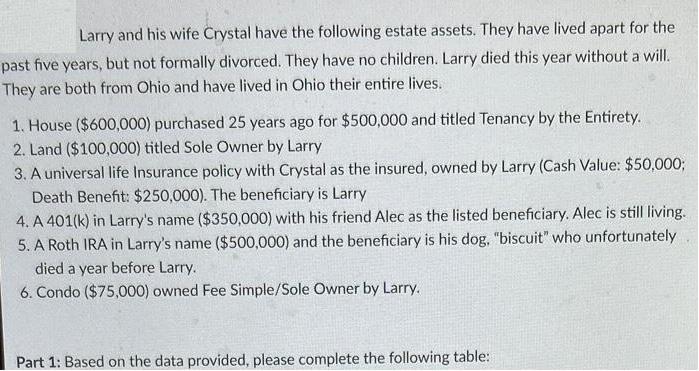

Larry and his wife Crystal have the following estate assets. They have lived apart for the past five years, but not formally divorced. They

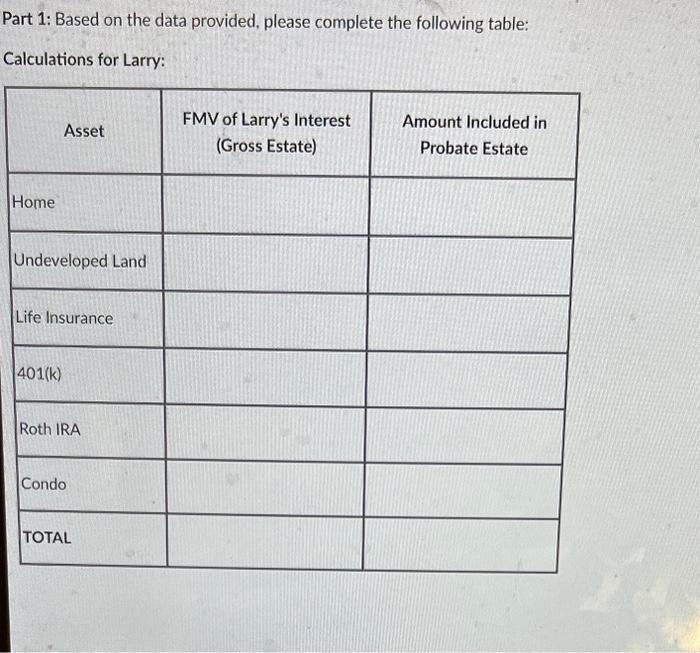

Larry and his wife Crystal have the following estate assets. They have lived apart for the past five years, but not formally divorced. They have no children. Larry died this year without a will. They are both from Ohio and have lived in Ohio their entire lives. 1. House ($600,000) purchased 25 years ago for $500,000 and titled Tenancy by the Entirety. 2. Land ($100,000) titled Sole Owner by Larry 3. A universal life Insurance policy with Crystal as the insured, owned by Larry (Cash Value: $50,000; Death Benefit: $250,000). The beneficiary is Larry 4. A 401(k) in Larry's name ($350,000) with his friend Alec as the listed beneficiary. Alec is still living. 5. A Roth IRA in Larry's name ($500,000) and the beneficiary is his dog, "biscuit" who unfortunately died a year before Larry. 6. Condo ($75,000) owned Fee Simple/Sole Owner by Larry. Part 1: Based on the data provided, please complete the following table: Part 1: Based on the data provided, please complete the following table: Calculations for Larry: Home Asset Undeveloped Land Life Insurance 401(k) Roth IRA Condo TOTAL FMV of Larry's Interest (Gross Estate) Amount Included in Probate Estate

Step by Step Solution

★★★★★

3.46 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Step 11 Calculations for Larry Asset Home Undeveloped Land Life Insurance 401k No of wedding ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started