Answered step by step

Verified Expert Solution

Question

1 Approved Answer

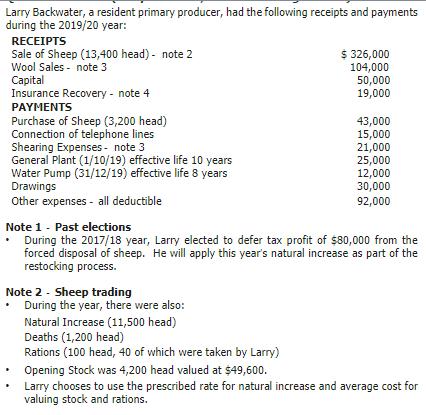

Larry Backwater, a resident primary producer, had the following receipts and payments during the 2019/20 year: RECEIPTS Sale of Sheep (13,400 head) - note

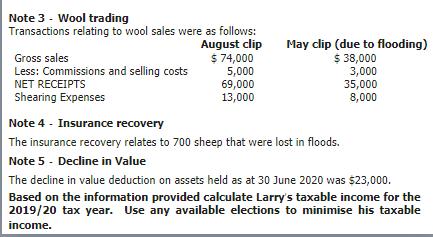

Larry Backwater, a resident primary producer, had the following receipts and payments during the 2019/20 year: RECEIPTS Sale of Sheep (13,400 head) - note 2 Wool Sales note 3 Capital Insurance Recovery - note 4 PAYMENTS Purchase of Sheep (3,200 head) Connection of telephone lines Shearing Expenses- note 3 General Plant (1/10/19) effective life 10 years Water Pump (31/12/19) effective life 8 years Drawings Other expenses all deductible Note 2- Sheep trading $ 326,000 104,000 50,000 19,000 During the year, there were also: 43,000 15,000 21,000 Note 1 - Past elections During the 2017/18 year, Larry elected to defer tax profit of $80,000 from the forced disposal of sheep. He will apply this year's natural increase as part of the restocking process. 25,000 12,000 30,000 92,000 Natural Increase (11,500 head) Deaths (1,200 head) Rations (100 head, 40 of which were taken by Larry) Opening Stock was 4,200 head valued at $49,600. Larry chooses to use the prescribed rate for natural increase and average cost for valuing stock and rations. Note 3 - Wool trading Transactions relating to wool sales were as follows: Gross sales Less: Commissions and selling costs NET RECEIPTS Shearing Expenses August clip $ 74,000 5,000 69,000 13,000 May clip (due to flooding) $ 38,000 3,000 35,000 8,000 Note 4 - Insurance recovery The insurance recovery relates to 700 sheep that were lost in floods. Note 5 - Decline in Value The decline in value deduction on assets held as at 30 June 2020 was $23,000. Based on the information provided calculate Larry's taxable income for the 2019/20 tax year. Use any available elections to minimise his taxable income.

Step by Step Solution

★★★★★

3.50 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

Calculate Larry Backwaters taxable income for the 201920 tax year Sheep Trading Note 2 Sales Receipt ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started