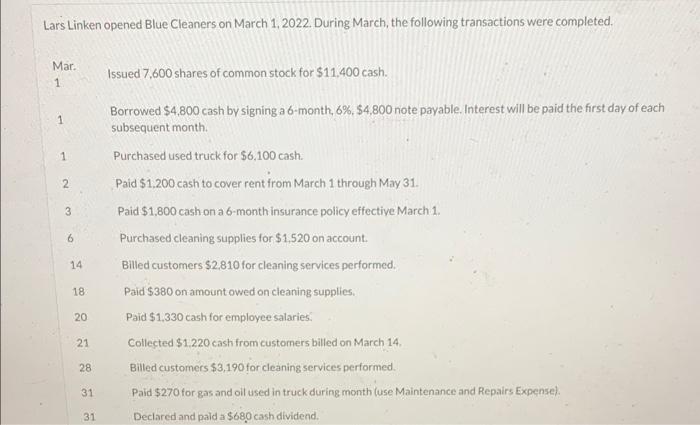

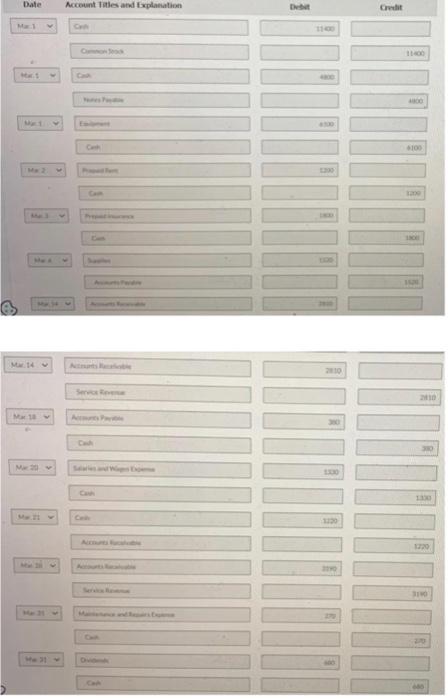

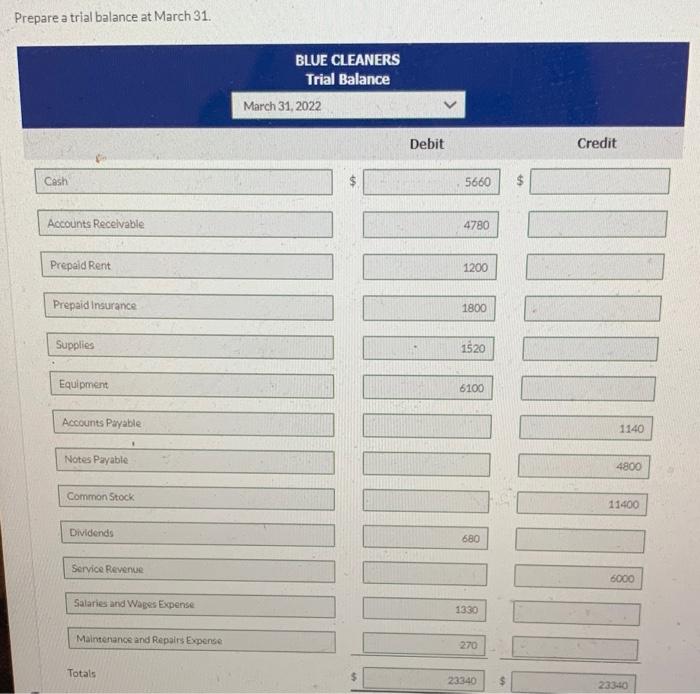

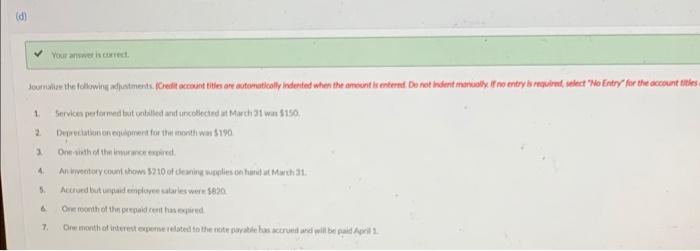

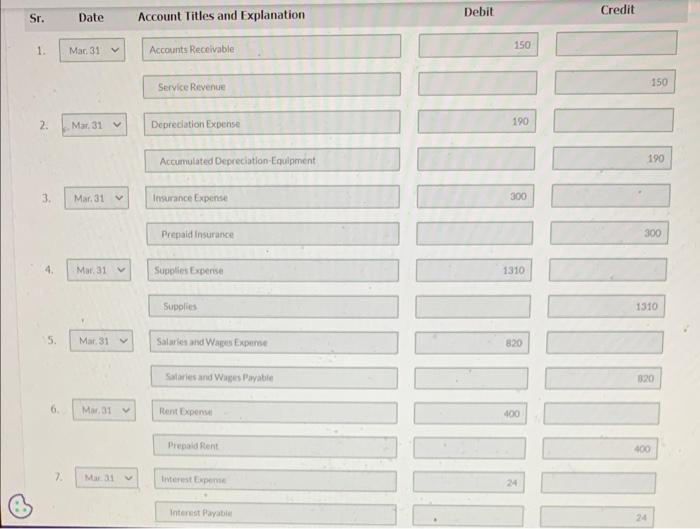

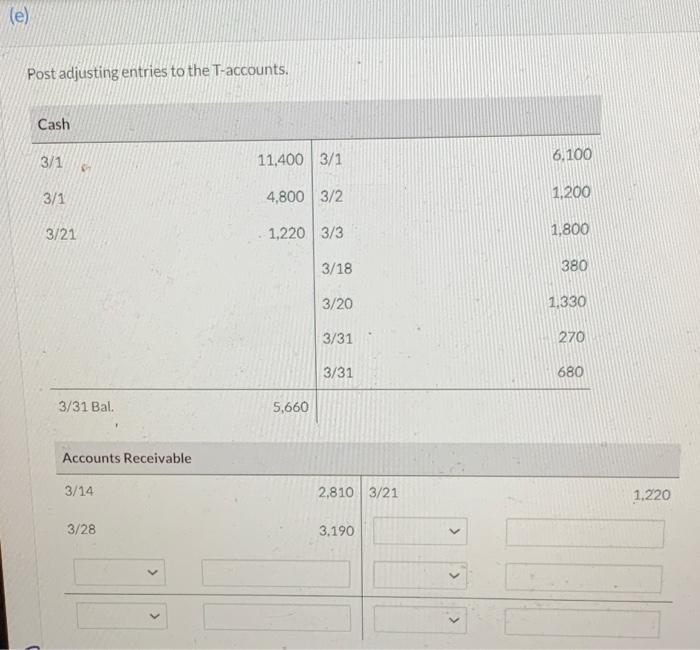

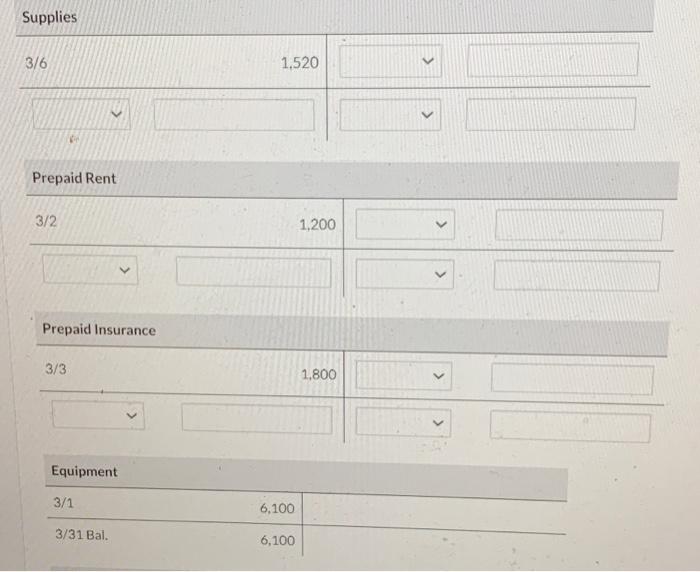

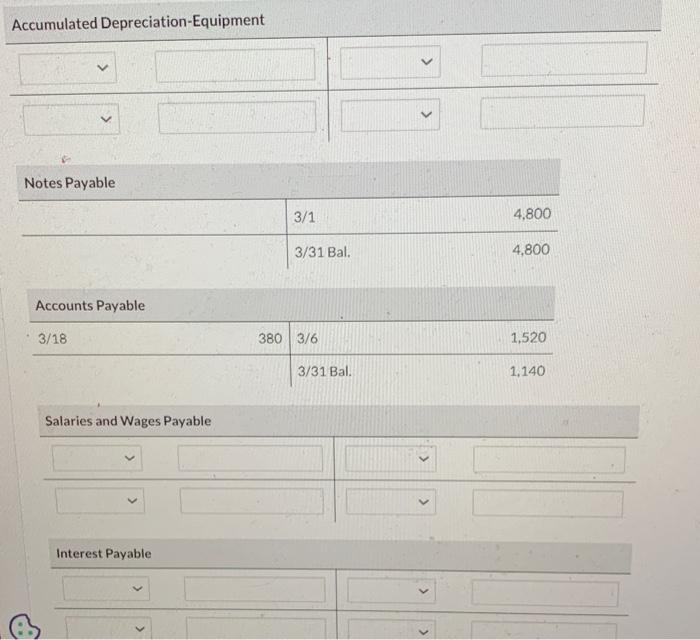

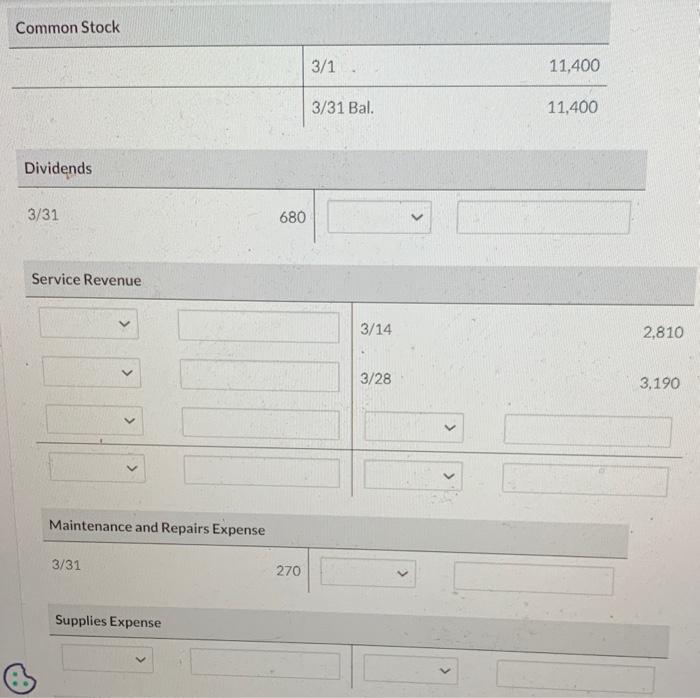

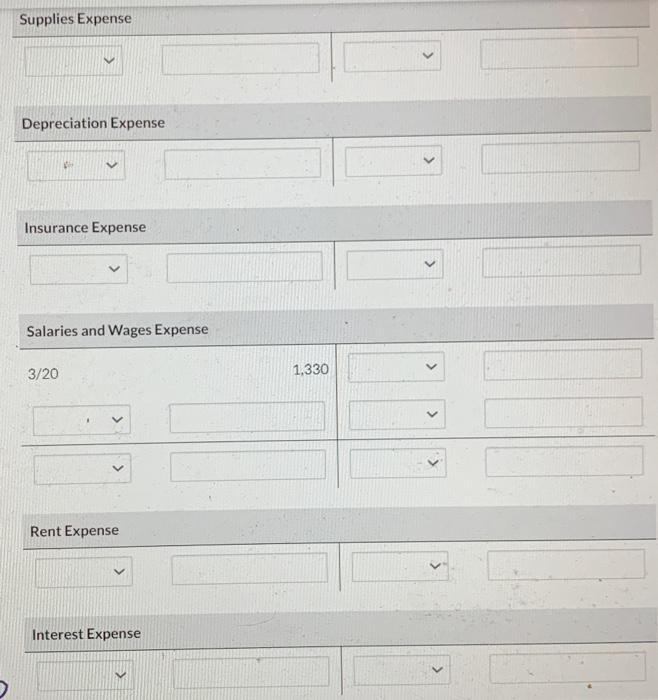

Lars Linken opened Blue Cleaners on March 1,2022. During March, the following transactions were completed. Mar. 1 Issued 7,600 shares of common stock for $11,400 cash. 1 Borrowed $4,800 cash by signing a 6 -month, 6%,$4,800 note payable. Interest will be paid the first day of each subsequent month. 1 Purchased used truck for $6,100 cash. 2 Paid $1,200 cash to cover rent from March 1 through May 31. 3 Paid $1,800 cash on a 6-month insurance policy effective March 1. 6 Purchased cleaning supplies for $1,520 on account. 14 Billed customers $2.810 for cleaning services performed. 18 Paid $380 on amount owed on cleaning supplies. 20 Paid $1,330 cash for employee salaries: 21 Collected $1.220 cash from customers billed on March 14. 28 Billed customers $3,190 for cleaning services performed. 31 Paid $270 for gas and oil used in truck during month (use Maintenance and Repairs Expense). 31 Declared and paid a $680 cash dividend. Bale Account tales atwl Ixplanation Twiset Grullt M=1 Min1 Earienter Cath 11acot Mn 2 Tan Breper werners thas kise is 1yaent Mur 14 that 11 Hernot ipoticut Me v Prepare a trial balance at March 31 . 1. Services perforned but untaled and uncoliected of March 31 wat {150. 2. Dequeciation of equeginent for the moniti was $190 2. Ore with of the invir wince ereited. 5. Ricused bit unpaid enplaree cularies were 1820 Cre momth of the prepaid cent has exitired 7. Ore tronthot intereve eveme related to the note paratie has accrued and will be pald Aseil 1. Sr. Date Account Titles and Explanation Debit Credit 1. Accounts Receivable Service Revenue 2. Mar,31 Depreclation Expense Accumulated Depreciation-Equipment 3. Imsurance Expense Prepaid insurance 4. Supplies Experse 1310 Supplies 5. Salaries and Wages Expeme Salaries and Wages Parabie 6. Rent Expensi Prepaid Rent 7. Hiverest limpe nite Interest fayabiel Post adjusting entries to the T-accounts. Supplies 3/6 1,520 Prepaid Rent 3/2 1,200 Prepaid Insurance Equipment \begin{tabular}{lr|} \hline 3/1 & 6,100 \\ \hline 3/31 Bal. & 6,100 \\ \hline \end{tabular} Accumulated Depreciation-Equipment Notes Payable \begin{tabular}{l|ll} \hline & 3/1 & 4,800 \\ \hline & 3/31Bal. & 4,800 \end{tabular} Accounts Payable \begin{tabular}{ll|ll} \hline 3/18 & 380 & 3/6 & 1,520 \\ \hline & & 3/31 Bal. & 1,140 \end{tabular} Salaries and Wages Payable Interest Payable Common Stock \begin{tabular}{l|lr} \hline & 3/1 & 11,400 \\ \hline & 3/31 Bal. \end{tabular} Dividends 3/31 Service Revenue 3/143/282,8103,190 Maintenance and Repairs Expense 3/31 270 Supplies Expense Supplies Expense Depreciation Expense Insurance Expense Salaries and Wages Expense 3/20 1,330 Rent Expense Interest Expense