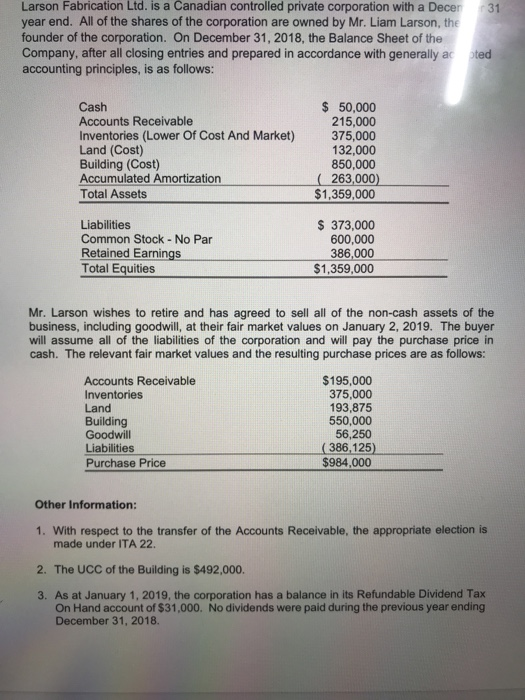

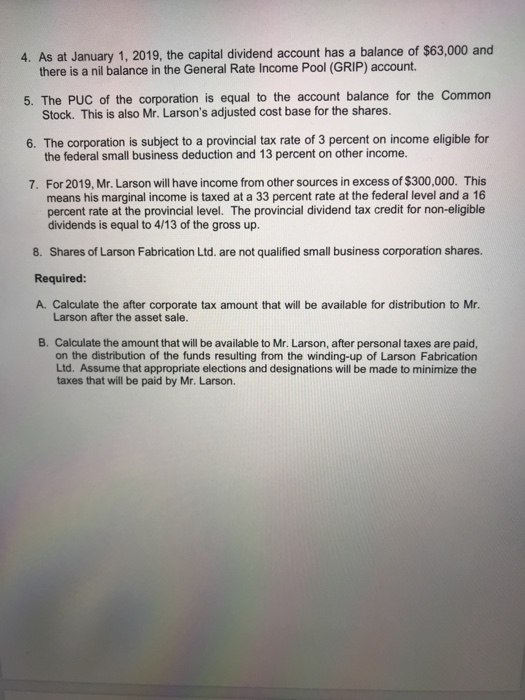

Larson Fabrication Ltd. is a Canadian controlled private corporation with a Decen 31 year end. All of the shares of the corporation are owned by Mr. Liam Larson, the founder of the corporation. On December 31, 2018, the Balance Sheet of the Company, after all closing entries and prepared in accordance with generally acted accounting principles, is as follows: Cash Accounts Receivable Inventories (Lower Of Cost And Market) Land (Cost) Building (Cost) Accumulated Amortization Total Assets $ 50,000 215,000 375,000 132,000 850,000 (263,000) $1,359,000 Liabilities Common Stock - No Par Retained Earnings Total Equities $ 373,000 600,000 386,000 $1,359,000 Mr. Larson wishes to retire and has agreed to sell all of the non-cash assets of the business, including goodwill, at their fair market values on January 2, 2019. The buyer will assume all of the liabilities of the corporation and will pay the purchase price in cash. The relevant fair market values and the resulting purchase prices are as follows: Accounts Receivable Inventories Land Building Goodwill Liabilities Purchase Price $195,000 375,000 193,875 550.000 56,250 (386,125) $984,000 Other Information: 1. With respect to the transfer of the Accounts Receivable, the appropriate election is made under ITA 22. 2. The UCC of the Building is $492,000. 3. As at January 1, 2019, the corporation has a balance in its Refundable Dividend Tax On Hand account of $31.000. No dividends were paid during the previous year ending December 31, 2018 4. As at January 1, 2019, the capital dividend account has a balance of $63,000 and there is a nil balance in the General Rate Income Pool (GRIP) account. 5. The PUC of the corporation is equal to the account balance for the Common Stock. This is also Mr. Larson's adjusted cost base for the shares. 6. The corporation is subject to a provincial tax rate of 3 percent on income eligible for the federal small business deduction and 13 percent on other income. 7. For 2019, Mr. Larson will have income from other sources in excess of $300,000. This means his marginal income is taxed at a 33 percent rate at the federal level and a 16 percent rate at the provincial level. The provincial dividend tax credit for non-eligible dividends is equal to 4/13 of the gross up. 8. Shares of Larson Fabrication Ltd, are not qualified small business corporation shares. Required: A. Calculate the after corporate tax amount that will be available for distribution to Mr. Larson after the asset sale. B. Calculate the amount that will be available to Mr. Larson, after personal taxes are paid, on the distribution of the funds resulting from the winding-up of Larson Fabrication Ltd. Assume that appropriate elections and designations will be made to minimize the taxes that will be paid by Mr. Larson. Larson Fabrication Ltd. is a Canadian controlled private corporation with a Decen 31 year end. All of the shares of the corporation are owned by Mr. Liam Larson, the founder of the corporation. On December 31, 2018, the Balance Sheet of the Company, after all closing entries and prepared in accordance with generally acted accounting principles, is as follows: Cash Accounts Receivable Inventories (Lower Of Cost And Market) Land (Cost) Building (Cost) Accumulated Amortization Total Assets $ 50,000 215,000 375,000 132,000 850,000 (263,000) $1,359,000 Liabilities Common Stock - No Par Retained Earnings Total Equities $ 373,000 600,000 386,000 $1,359,000 Mr. Larson wishes to retire and has agreed to sell all of the non-cash assets of the business, including goodwill, at their fair market values on January 2, 2019. The buyer will assume all of the liabilities of the corporation and will pay the purchase price in cash. The relevant fair market values and the resulting purchase prices are as follows: Accounts Receivable Inventories Land Building Goodwill Liabilities Purchase Price $195,000 375,000 193,875 550.000 56,250 (386,125) $984,000 Other Information: 1. With respect to the transfer of the Accounts Receivable, the appropriate election is made under ITA 22. 2. The UCC of the Building is $492,000. 3. As at January 1, 2019, the corporation has a balance in its Refundable Dividend Tax On Hand account of $31.000. No dividends were paid during the previous year ending December 31, 2018 4. As at January 1, 2019, the capital dividend account has a balance of $63,000 and there is a nil balance in the General Rate Income Pool (GRIP) account. 5. The PUC of the corporation is equal to the account balance for the Common Stock. This is also Mr. Larson's adjusted cost base for the shares. 6. The corporation is subject to a provincial tax rate of 3 percent on income eligible for the federal small business deduction and 13 percent on other income. 7. For 2019, Mr. Larson will have income from other sources in excess of $300,000. This means his marginal income is taxed at a 33 percent rate at the federal level and a 16 percent rate at the provincial level. The provincial dividend tax credit for non-eligible dividends is equal to 4/13 of the gross up. 8. Shares of Larson Fabrication Ltd, are not qualified small business corporation shares. Required: A. Calculate the after corporate tax amount that will be available for distribution to Mr. Larson after the asset sale. B. Calculate the amount that will be available to Mr. Larson, after personal taxes are paid, on the distribution of the funds resulting from the winding-up of Larson Fabrication Ltd. Assume that appropriate elections and designations will be made to minimize the taxes that will be paid by Mr. Larson