Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Lassen Ltd., a company incorporated in Alberta, is an annual filer for GST purposes. Alberta does not participate in the HST and does not

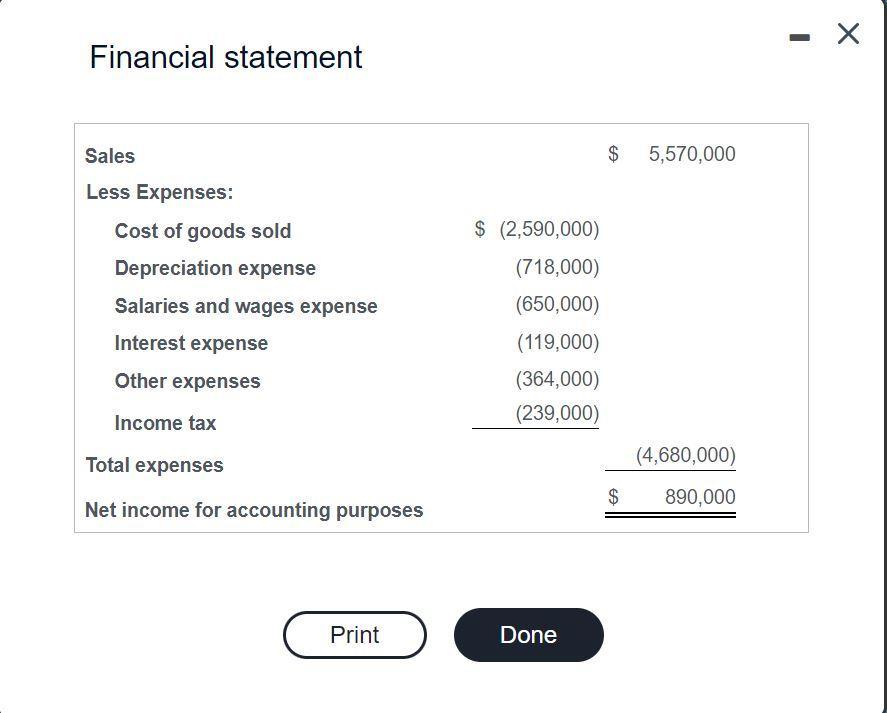

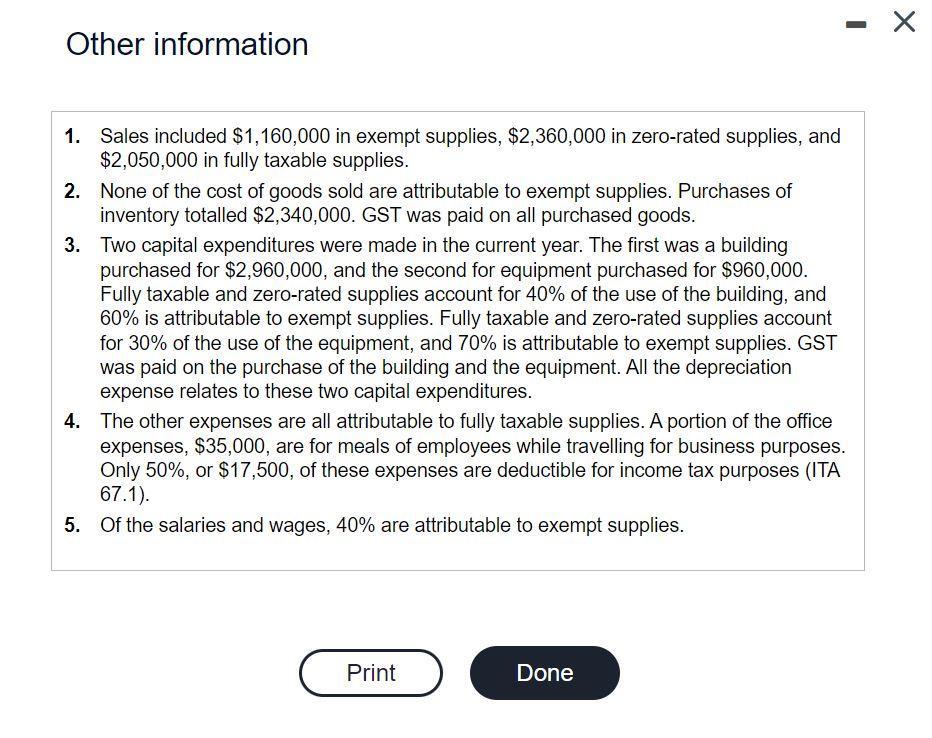

Lassen Ltd., a company incorporated in Alberta, is an annual filer for GST purposes. Alberta does not participate in the HST and does not have a provincial sales tax. The following is a summary of the financial statement information for the current year. None of the amounts shown include GST. (Click the icon to view the financial statement information.) i (Click the icon to view other information.) Required Calculate Lassen's GST payable or GST refund for the current year. Determine Lassen's GST payable (GST refund) for the current year. (Round your answer to the nearest dollar. Use parentheses or a minus sign for a GST refund.) Lassen's GST payable (GST refund) for the current year is $ Financial statement Sales Less Expenses: Cost of goods sold Depreciation expense Salaries and wages expense Interest expense Other expenses Income tax Total expenses Net income for accounting purposes Print $ (2,590,000) (718,000) (650,000) (119,000) (364,000) (239,000) Done $ 5,570,000 $ (4,680,000) 890,000 - X Other information 1. Sales included $1,160,000 in exempt supplies, $2,360,000 in zero-rated supplies, and $2,050,000 in fully taxable supplies. 2. None of the cost of goods sold are attributable to exempt supplies. Purchases of inventory totalled $2,340,000. GST was paid on all purchased goods. 3. Two capital expenditures were made in the current year. The first was a building purchased for $2,960,000, and the second for equipment purchased for $960,000. Fully taxable and zero-rated supplies account for 40% of the use of the building, and 60% is attributable to exempt supplies. Fully taxable and zero-rated supplies account for 30% of the use of the equipment, and 70% is attributable to exempt supplies. GST was paid on the purchase of the building and the equipment. All the depreciation expense relates to these two capital expenditures. 4. The other expenses are all attributable to fully taxable supplies. A portion of the office expenses, $35,000, are for meals of employees while travelling for business purposes. Only 50%, or $17,500, of these expenses are deductible for income tax purposes (ITA 67.1). 5. Of the salaries and wages, 40% are attributable to exempt supplies. Print Done X

Step by Step Solution

★★★★★

3.57 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Calculation of GST Payable or Refund Particulars Amount GST on Outward Supplies Sales Fully Taxable ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started