Answered step by step

Verified Expert Solution

Question

1 Approved Answer

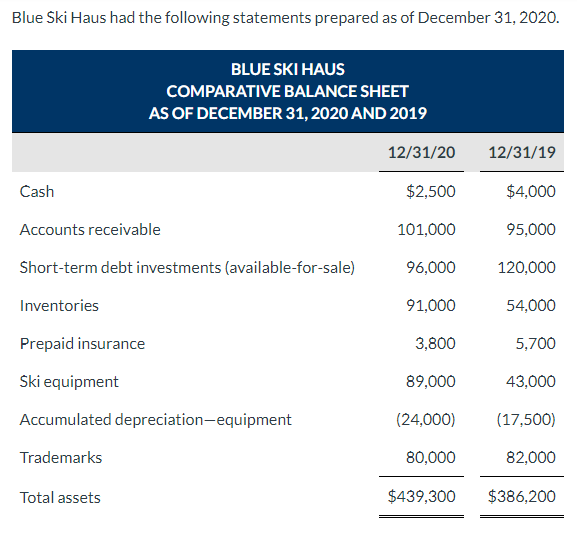

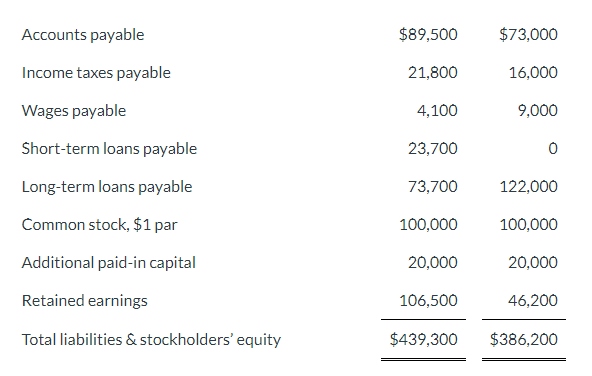

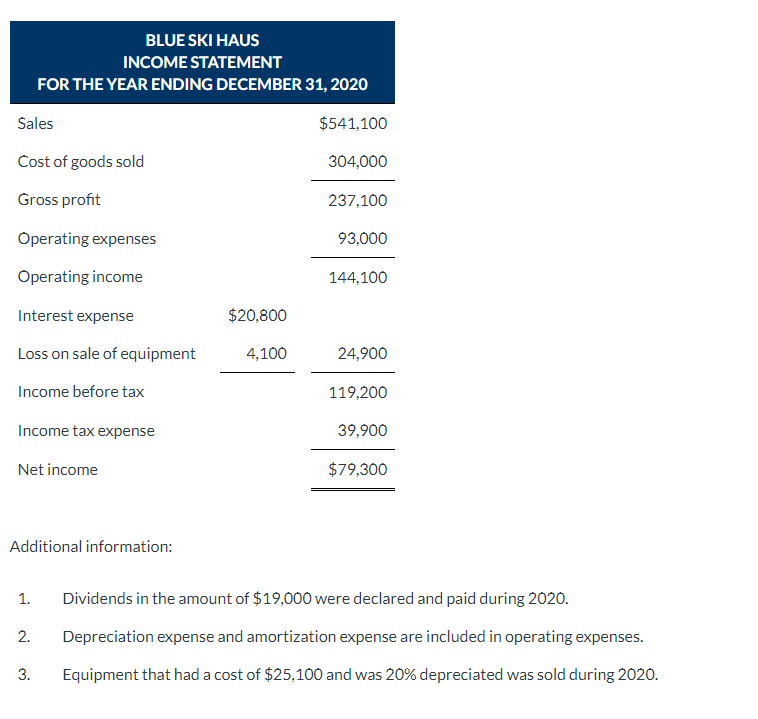

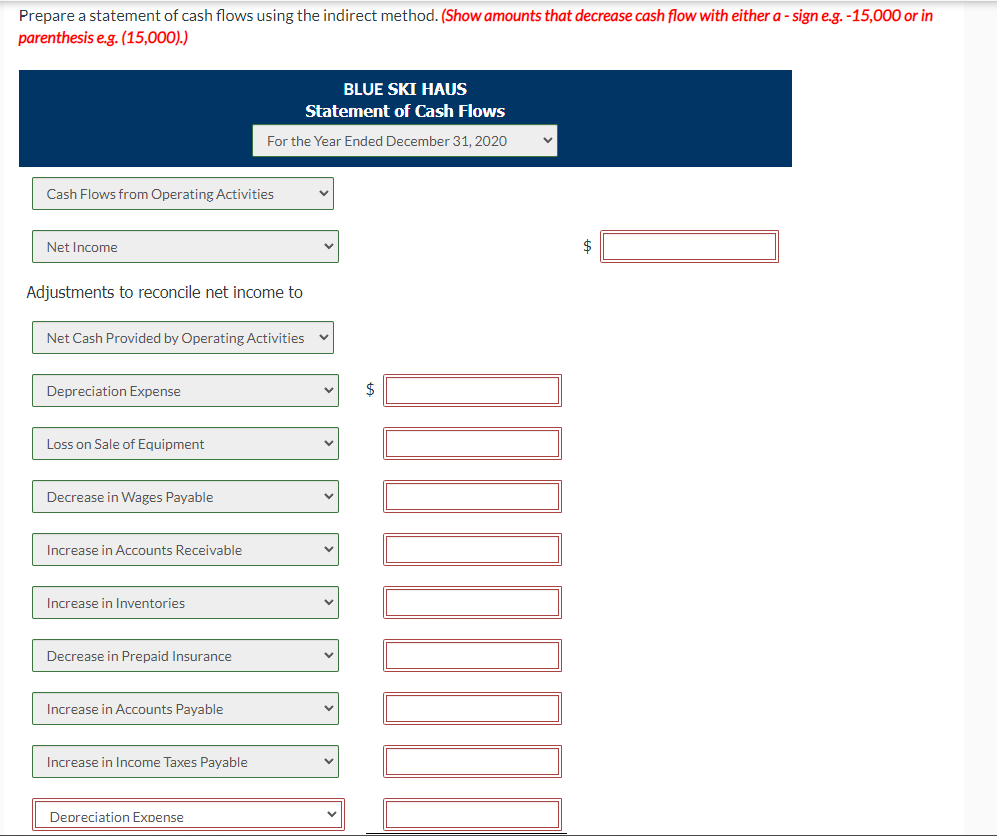

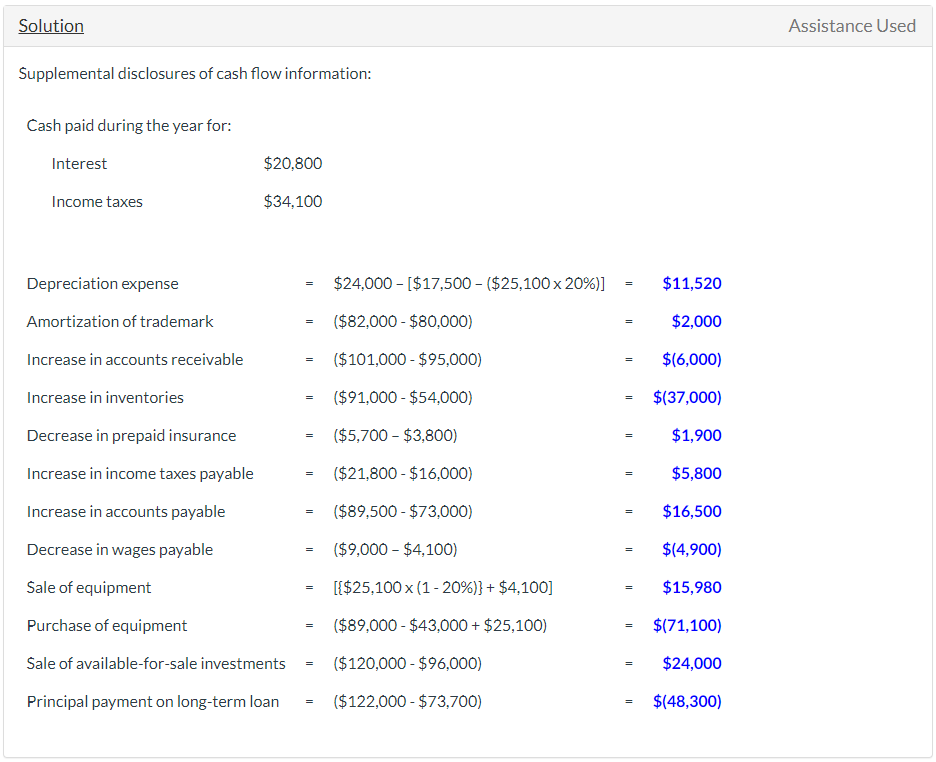

LAST IMAGE PROVIDES SOLUTIONS ALL YOU NEED TO DO IS FILL OUT THE ACCOUNTS AND PUT THE NUMBERS WHERE APPROPRIATE! Blue Ski Haus had the

LAST IMAGE PROVIDES SOLUTIONS ALL YOU NEED TO DO IS FILL OUT THE ACCOUNTS AND PUT THE NUMBERS WHERE APPROPRIATE!

Blue Ski Haus had the following statements prepared as of December 31, 2020. Additional information: 1. Dividends in the amount of $19,000 were declared and paid during 2020. 2. Depreciation expense and amortization expense are included in operating expenses. 3. Equipment that had a cost of $25,100 and was 20% depreciated was sold during 2020 . Prepare a statement of cash flows using the indirect method. (Show amounts that decrease cash flow with either a sign e.g. 15,000 or in Solution Assistance Used Supplemental disclosures of cash flow information: Cash paid during the year for: Interest $20,800 Income taxes $34,100 Depreciation expense =$24,000[$17,500($25,10020%)]=$11,520 Amortization of trademark =($82,000$80,000)=$2,000 Increase in accounts receivable =($101,000$95,000)=$(6,000) Increase in inventories =($91,000$54,000)=$(37,000) Decrease in prepaid insurance =($5,700$3,800)=$1,900 Increase in income taxes payable =($21,800$16,000)=$5,800 Increase in accounts payable =($89,500$73,000)=$16,500 Decrease in wages payable =($9,000$4,100)=$(4,900) Sale of equipment =[{$25,100(120%)}+$4,100]=$15,980 Purchase of equipment =($89,000$43,000+$25,100)=$(71,100) Sale of available-for-sale investments =($120,000$96,000)=$24,000 Principal payment on long-term loan =($122,000$73,700)=$(48,300)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started