Answered step by step

Verified Expert Solution

Question

1 Approved Answer

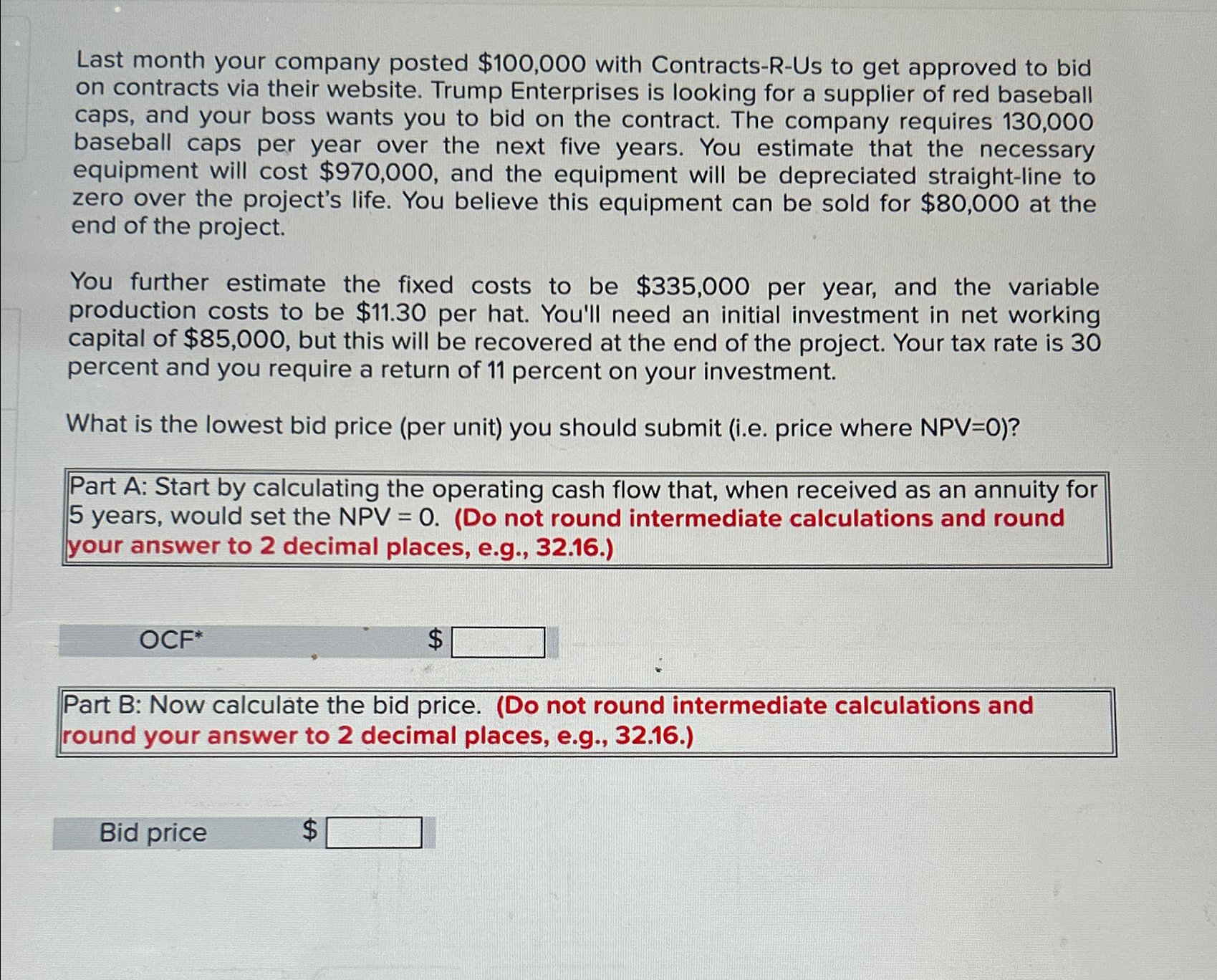

Last month your company posted $ 1 0 0 , 0 0 0 with Contracts - R - Us to get approved to bid on

Last month your company posted $ with ContractsRUs to get approved to bid on contracts via their website. Trump Enterprises is looking for a supplier of red baseball caps, and your boss wants you to bid on the contract. The company requires baseball caps per year over the next five years. You estimate that the necessary equipment will cost $ and the equipment will be depreciated straightline to zero over the project's life. You believe this equipment can be sold for $ at the end of the project.

You further estimate the fixed costs to be $ per year, and the variable production costs to be $ per hat. You'll need an initial investment in net working capital of $ but this will be recovered at the end of the project. Your tax rate is percent and you require a return of percent on your investment.

What is the lowest bid price per unit you should submit ie price where NPV

Part A: Start by calculating the operating cash flow that, when received as an annuity for years, would set the NPV Do not round intermediate calculations and round your answer to decimal places, eg

Part B: Now calculate the bid price. Do not round intermediate calculations and round your answer to decimal places, eg

Bid price

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started