Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Last month your company posted $100,000 with Contracts-R-Us to get approved to bid on contracts via their website. Trump Enterprises is looking for a

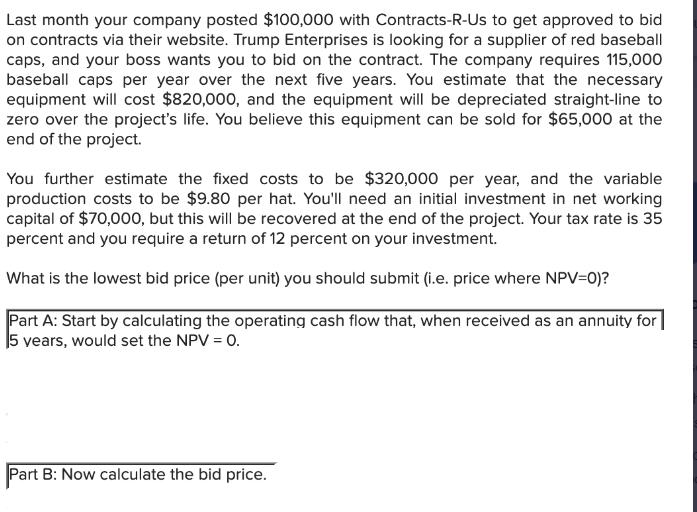

Last month your company posted $100,000 with Contracts-R-Us to get approved to bid on contracts via their website. Trump Enterprises is looking for a supplier of red baseball caps, and your boss wants you to bid on the contract. The company requires 115,000 baseball caps per year over the next five years. You estimate that the necessary equipment will cost $820,000, and the equipment will be depreciated straight-line to zero over the project's life. You believe this equipment can be sold for $65,000 at the end of the project. You further estimate the fixed costs to be $320,000 per year, and the variable production costs to be $9.80 per hat. You'll need an initial investment in net working capital of $70,000, but this will be recovered at the end of the project. Your tax rate is 35 percent and you require a return of 12 percent on your investment. What is the lowest bid price (per unit) you should submit (i.e. price where NPV=0)? Part A: Start by calculating the operating cash flow that, when received as an annuity for 5 years, would set the NPV = 0. Part B: Now calculate the bid price.

Step by Step Solution

★★★★★

3.48 Rating (171 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION Part A To find the operating cash flow that would set the NPV equal to zero we need to calc...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started