Answered step by step

Verified Expert Solution

Question

1 Approved Answer

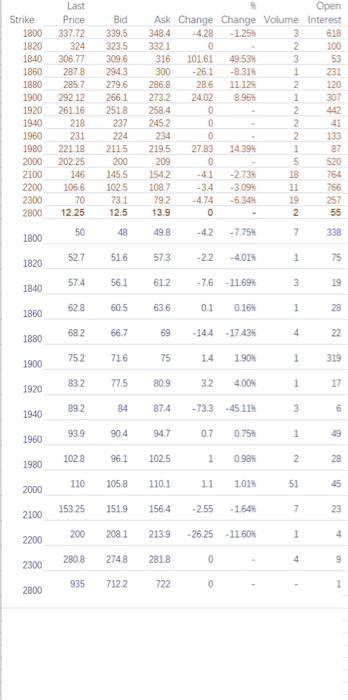

Last Open Strike Price Bid Ask Change Change Volume Interest 1800 337.72 339.5 348.4 -4.28 -1.25% 3 618 1820 324 323.5 332.1 0 2

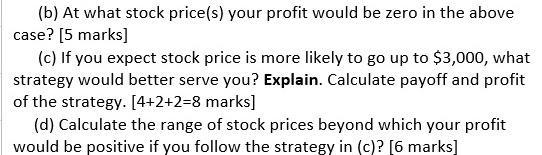

Last Open Strike Price Bid Ask Change Change Volume Interest 1800 337.72 339.5 348.4 -4.28 -1.25% 3 618 1820 324 323.5 332.1 0 2 100 1840 306.77 309.6 316 101.61 49.53% 3 53 1860 287.8 294.3 300 -26.1 -8.31% 1 231 1880 285.7 279.6 286.8 28.6 11.12% 2 120 1900 292 12 266.1 273.2 24.02 8.96% 1 307 1920 261.16 251.8 258.4 0 2 442 1940 218 237 245.2 0 2 41 1960 231 224 234 0 2 133 1980 221 18 2115 219.5 27.83 14.39% 87 2000 202.25 200 209 0 5 520 2100 146 145.5 154.2 -4.1 -2.73% 18 764 2200 106.6 102.5 108.7 -34 -3.09% 11 766 2300 70 73.1 79.2 -4.74 -6.34% 19 257 2800 12.25 12.5 13.9 0 2 55 50 48 49.8 -42 -7.75% 7 338 1800 52.7 51.6 57.3 -2.2 -4.01% 1 75 1820 57.4 56.1 61.2 -7.6 -11.69% 3 19 1840 10 62.8 60.5 63.6 0.1 0.16% 1 28 1860 68.2 66.7 18801 69 69 -14.4 -17.43% 4 22 22 75.2 716 75 14 1.90% 1 319 1900 83.2 77.5 80.9 3.2 4.00% 1 17 1920 89.2 84 87.4 -73.3 -45.11% 3 6 1940 93.9 90,4 94.7 0.7 0.75% 1 49 1960 102.8 96.1 102.5 1 0.98% 2 28 1980 110 105.8 110.1 11 1.01% 51 45 2000 153.25 151.9 2100 1564 -2.55 -1.64% 7 23 200 208.1 213.9 -26.25 -11.60% 1 4 2200 2300 2808 274.8 2818 0 4 9 935 712.2 722 0 2800 (b) At what stock price(s) your profit would be zero in the above case? [5 marks] (c) If you expect stock price is more likely to go up to $3,000, what strategy would better serve you? Explain. Calculate payoff and profit of the strategy. [4+2+2=8 marks] (d) Calculate the range of stock prices beyond which your profit would be positive if you follow the strategy in (c)? [6 marks]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started