Answered step by step

Verified Expert Solution

Question

1 Approved Answer

last pic is the question Net present value (NPV) is a method used to determine the current value of all future cash flows generated by

last pic is the question

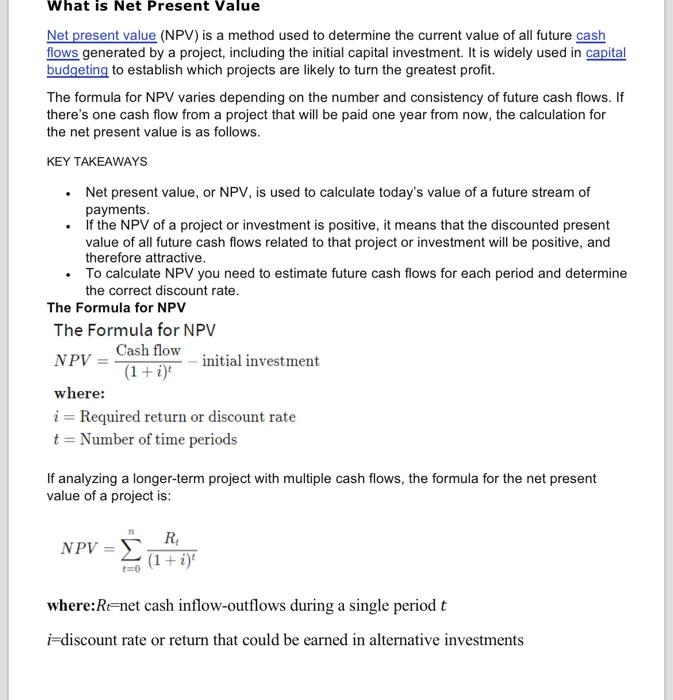

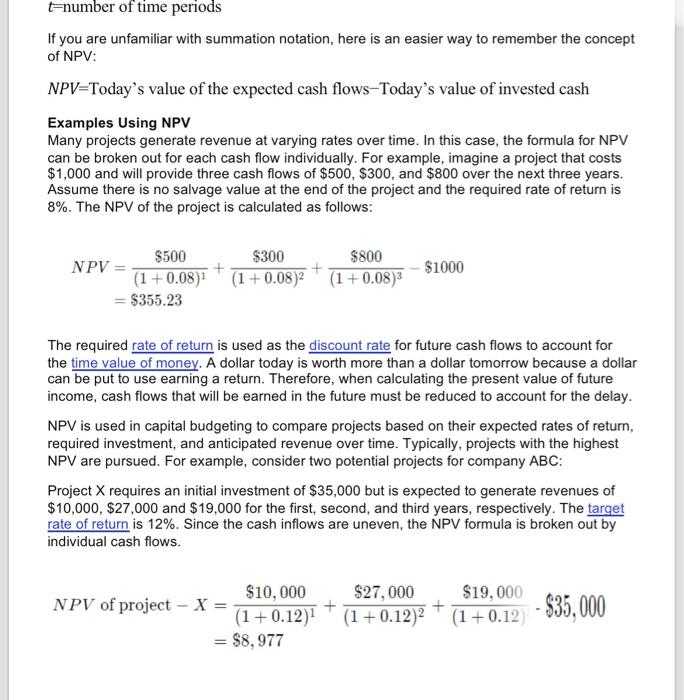

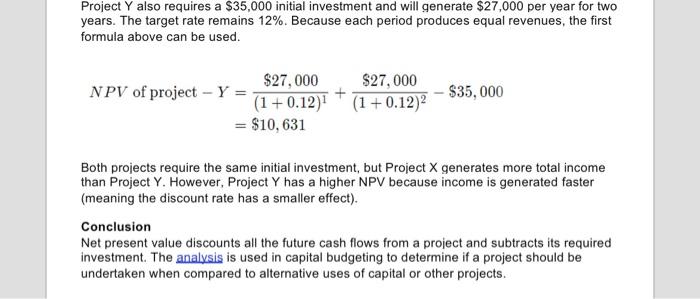

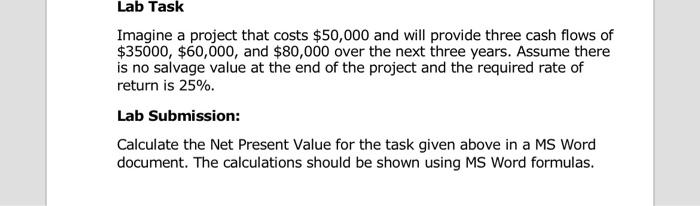

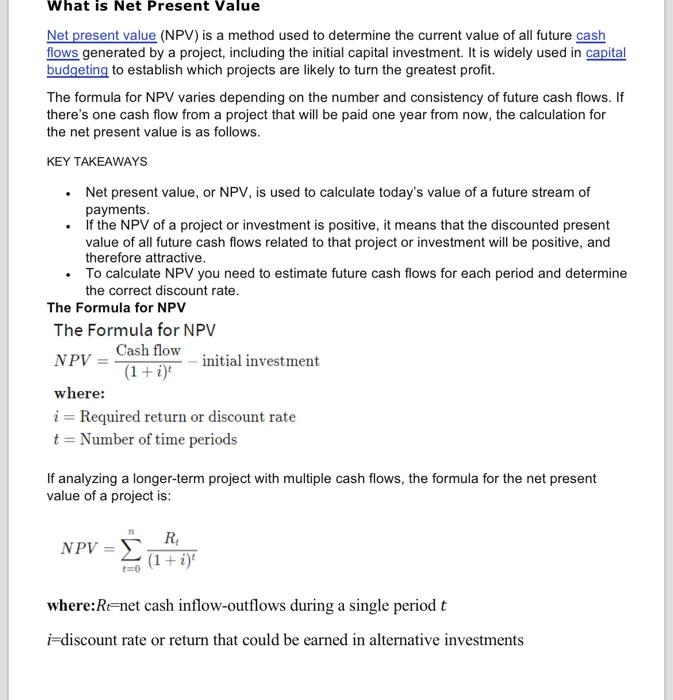

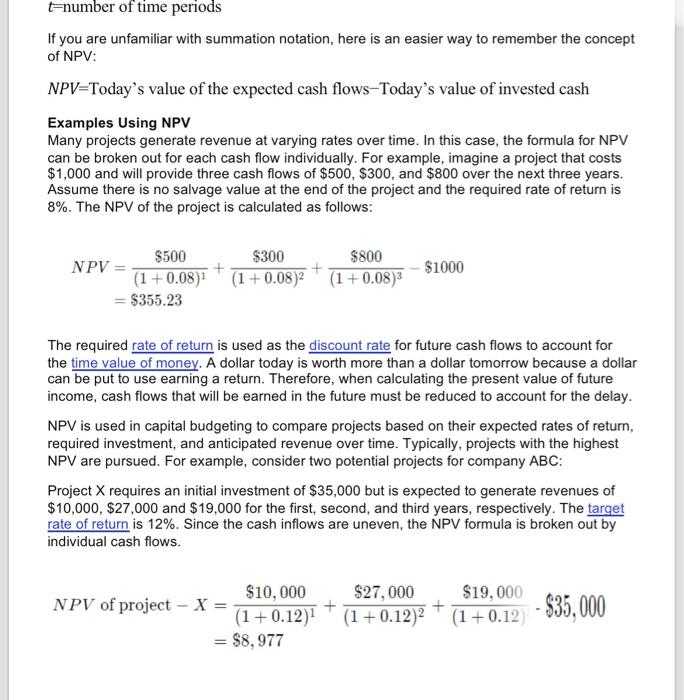

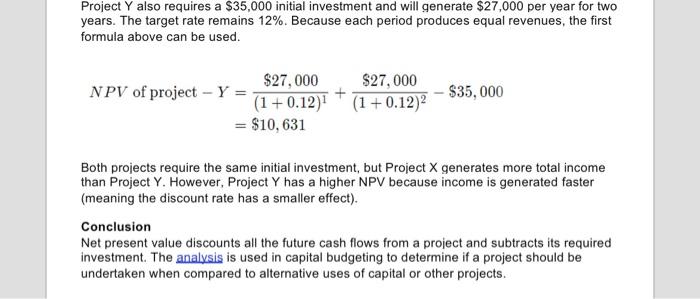

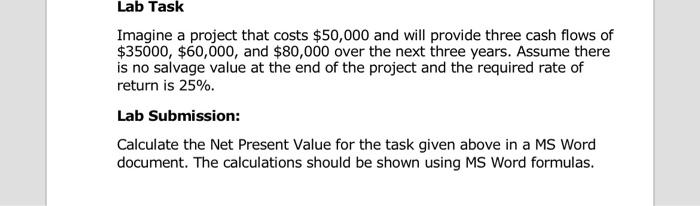

Net present value (NPV) is a method used to determine the current value of all future cash flows generated by a project, including the initial capital investment. It is widely used in capital budgeting to establish which projects are likely to turn the greatest profit. The formula for NPV varies depending on the number and consistency of future cash flows. If there's one cash flow from a project that will be paid one year from now, the calculation for the net present value is as follows. KEY TAKEAWAYS - Net present value, or NPV, is used to calculate today's value of a future stream of payments. - If the NPV of a project or investment is positive, it means that the discounted present value of all future cash flows related to that project or investment will be positive, and therefore attractive. - To calculate NPV you need to estimate future cash flows for each period and determine the correct discount rate. The Formula for NPV The Formula for NPV NPV=(1+i)tCashflow initial investment where: i= Required return or discount rate t= Number of time periods If analyzing a longer-term project with multiple cash flows, the formula for the net present value of a project is: NPV=t=0n(1+i)tRt where: Rt= net cash inflow-outflows during a single period t i= discount rate or return that could be earned in alternative investments t= number of time periods If you are unfamiliar with summation notation, here is an easier way to remember the concept of NPV: NPV= Today's value of the expected cash flows-Today's value of invested cash Examples Using NPV Many projects generate revenue at varying rates over time. In this case, the formula for NPV can be broken out for each cash flow individually. For example, imagine a project that costs $1,000 and will provide three cash flows of $500,$300, and $800 over the next three years. Assume there is no salvage value at the end of the project and the required rate of return is 8%. The NPV of the project is calculated as follows: NPV=(1+0.08)1$500+(1+0.08)2$300+(1+0.08)3$800$1000=$355.23 The required rate of return is used as the discount rate for future cash flows to account for the time value of money. A dollar today is worth more than a dollar tomorrow because a dollar can be put to use earning a return. Therefore, when calculating the present value of future income, cash flows that will be earned in the future must be reduced to account for the delay. NPV is used in capital budgeting to compare projects based on their expected rates of return, required investment, and anticipated revenue over time. Typically, projects with the highest NPV are pursued. For example, consider two potential projects for company ABC: Project X requires an initial investment of $35,000 but is expected to generate revenues of $10,000,$27,000 and $19,000 for the first, second, and third years, respectively. The target rate of return is 12%. Since the cash inflows are uneven, the NPV formula is broken out by individual cash flows. NPVofprojectX=(1+0.12)1$10,000+(1+0.12)2$27,000+(1+0.12)$19,000$35,000=$8,977 Project Y also requires a $35,000 initial investment and will generate $27,000 per year for two years. The target rate remains 12%. Because each period produces equal revenues, the first formula above can be used. NPVofprojectY=(1+0.12)1$27,000+(1+0.12)2$27,000$35,000=$10,631 Both projects require the same initial investment, but Project X generates more total income than Project Y. However. Project Y has a higher NPV because income is generated faster (meaning the discount rate has a smaller effect). Conclusion Net present value discounts all the future cash flows from a project and subtracts its required investment. The analysis is used in capital budgeting to determine if a project should be undertaken when compared to alternative uses of capital or other projects. Lab Task Imagine a project that costs $50,000 and will provide three cash flows of $35000, $60,000, and $80,000 over the next three years. Assume there is no salvage value at the end of the project and the required rate of return is 25%. Lab Submission: Calculate the Net Present Value for the task given above in a MS Word document. The calculations should be shown using MS Word formulas

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started