Answered step by step

Verified Expert Solution

Question

1 Approved Answer

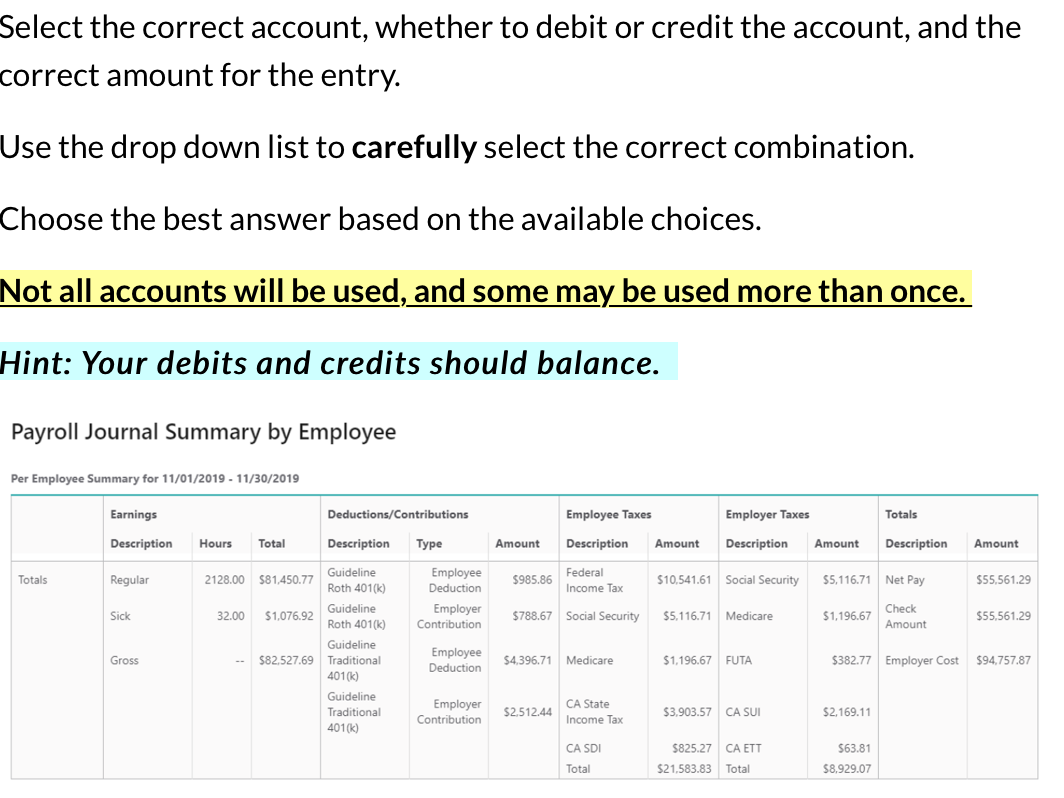

Last picture shows the choices Select the correct account, whether to debit or credit the account, and the correct amount for the entry. Use the

Last picture shows the choices

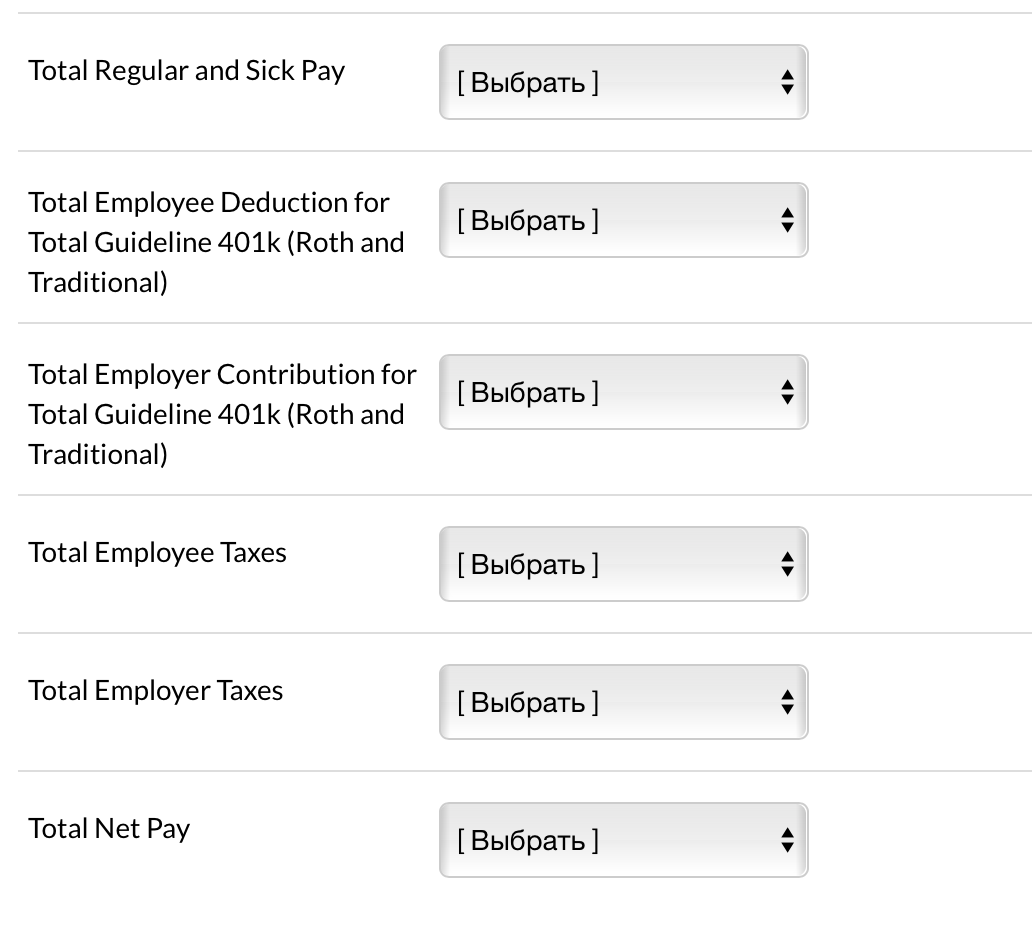

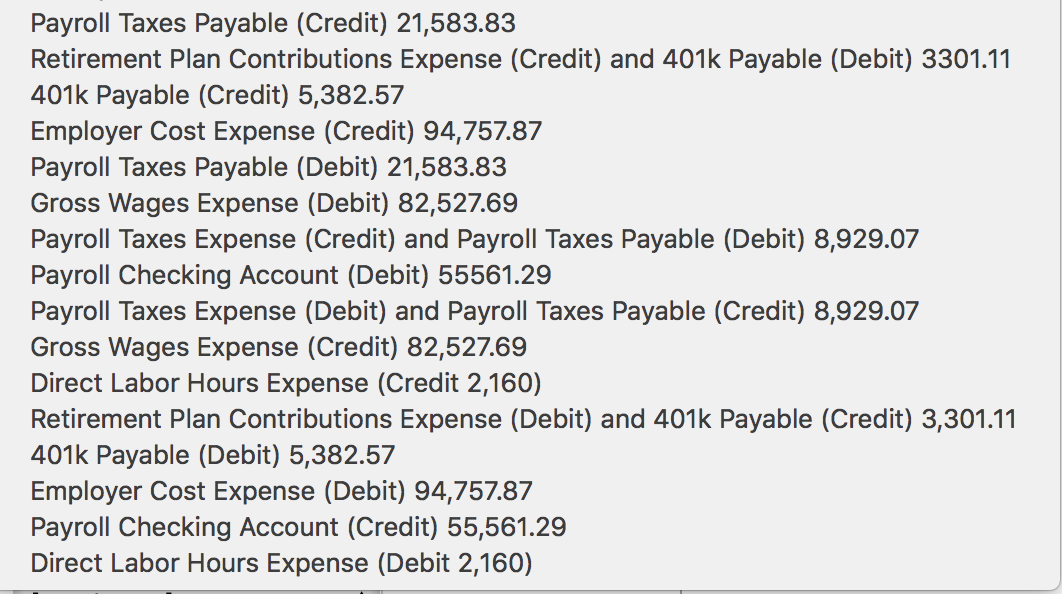

Select the correct account, whether to debit or credit the account, and the correct amount for the entry. Use the drop down list to carefully select the correct combination. Choose the best answer based on the available choices. Not all accounts will be used, and some may be used more than once. Hint: Your debits and credits should balance. Payroll Journal Summary by Employee Per Employee Summary for 11/01/2019 - 11/30/2019 Deductions/Contributions Employee Taxes Employer Taxes Earnings Totals Description Description Hours Total Type Amount Description Amount Description Amount Description Amount Federal Guideline Employee Deduction $10,541.61 Social Security $5,116.71 Net Pay $985.86 Totals Regular 2128.00 $81,450.77 $5,561.29 Roth 401(k) Income Tax Employer Contribution Guideline Check $1,076.92 $788.67 Social Security $5,116.71 Medicare $1,196.67 Sick 32.00 $5.561.29 Amount Roth 401(k) Guideline Employee $382.77 Employer Cost Gross $82.527.69 Traditional $4,396.71 Medicare $1,196.67 FUTA $94,757.87 Deduction 401(k) Guideline CA State Employer Contribution Traditional $2,512.44 $3.903.57 CA SUI $2,169.11 Income Tax 401(k) $825.27 CA ETT CA SDI $63.81 Total $21,583.83 Total $8,929.07 Total Regular and Sick Pay [ ] Total Employee Deduction for Total Guideline 401k (Roth and [ ] Traditional) Total Employer Contribution for Total Guideline 401k (Roth and [ ] Traditional) Total Employee Taxes [ ] Total Employer Taxes [ ] Total Net Pay [ ] Payroll Taxes Payable (Credit) 21,583.83 Retirement Plan Contributions Expense (Credit) and 401k Payable (Debit) 3301.11 401k Payable (Credit) 5,382.57 Employer Cost Expense (Credit) 94,757.87 Payroll Taxes Payable (Debit) 21,583.83 Gross Wages Expense (Debit) 82,527.69 Payroll Taxes Expense (Credit) and Payroll Taxes Payable (Debit) 8,929.07 Payroll Checking Account (Debit) 55561.29 Payroll Taxes Expense (Debit) and Payroll Taxes Payable (Credit) 8,929.07 Gross Wages Expense (Credit) 82,527.69 Direct Labor Hours Expense (Credit 2,160) Retirement Plan Contributions Expense (Debit) and 401k Payable (Credit) 3,301.11 401k Payable (Debit) 5,382.57 Employer Cost Expense (Debit) 94,757.87 Payroll Checking Account (Credit) 55,561.29 Direct Labor Hours Expense (Debit 2,160) Select the correct account, whether to debit or credit the account, and the correct amount for the entry. Use the drop down list to carefully select the correct combination. Choose the best answer based on the available choices. Not all accounts will be used, and some may be used more than once. Hint: Your debits and credits should balance. Payroll Journal Summary by Employee Per Employee Summary for 11/01/2019 - 11/30/2019 Deductions/Contributions Employee Taxes Employer Taxes Earnings Totals Description Description Hours Total Type Amount Description Amount Description Amount Description Amount Federal Guideline Employee Deduction $10,541.61 Social Security $5,116.71 Net Pay $985.86 Totals Regular 2128.00 $81,450.77 $5,561.29 Roth 401(k) Income Tax Employer Contribution Guideline Check $1,076.92 $788.67 Social Security $5,116.71 Medicare $1,196.67 Sick 32.00 $5.561.29 Amount Roth 401(k) Guideline Employee $382.77 Employer Cost Gross $82.527.69 Traditional $4,396.71 Medicare $1,196.67 FUTA $94,757.87 Deduction 401(k) Guideline CA State Employer Contribution Traditional $2,512.44 $3.903.57 CA SUI $2,169.11 Income Tax 401(k) $825.27 CA ETT CA SDI $63.81 Total $21,583.83 Total $8,929.07 Total Regular and Sick Pay [ ] Total Employee Deduction for Total Guideline 401k (Roth and [ ] Traditional) Total Employer Contribution for Total Guideline 401k (Roth and [ ] Traditional) Total Employee Taxes [ ] Total Employer Taxes [ ] Total Net Pay [ ] Payroll Taxes Payable (Credit) 21,583.83 Retirement Plan Contributions Expense (Credit) and 401k Payable (Debit) 3301.11 401k Payable (Credit) 5,382.57 Employer Cost Expense (Credit) 94,757.87 Payroll Taxes Payable (Debit) 21,583.83 Gross Wages Expense (Debit) 82,527.69 Payroll Taxes Expense (Credit) and Payroll Taxes Payable (Debit) 8,929.07 Payroll Checking Account (Debit) 55561.29 Payroll Taxes Expense (Debit) and Payroll Taxes Payable (Credit) 8,929.07 Gross Wages Expense (Credit) 82,527.69 Direct Labor Hours Expense (Credit 2,160) Retirement Plan Contributions Expense (Debit) and 401k Payable (Credit) 3,301.11 401k Payable (Debit) 5,382.57 Employer Cost Expense (Debit) 94,757.87 Payroll Checking Account (Credit) 55,561.29 Direct Labor Hours Expense (Debit 2,160)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started