Answered step by step

Verified Expert Solution

Question

1 Approved Answer

last question is increase or decrease Brandon is an analyst at a wealth management firm. Orie of his cients holds a $7,500 portfolio that consists

last question is increase or decrease

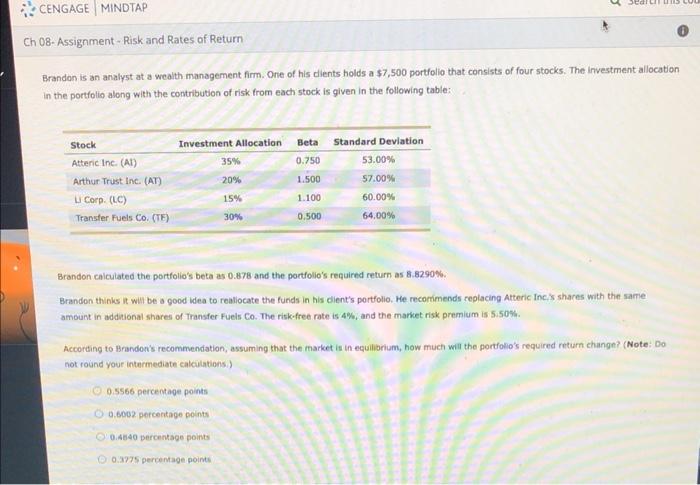

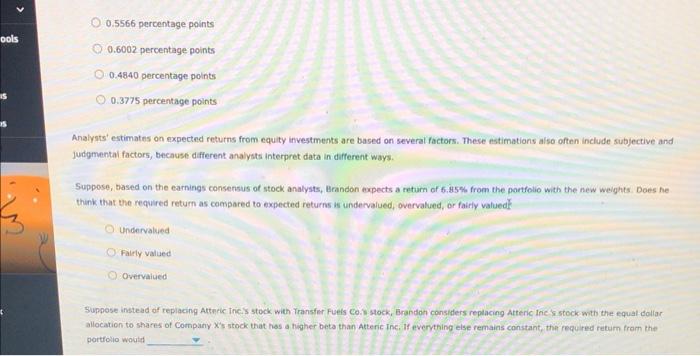

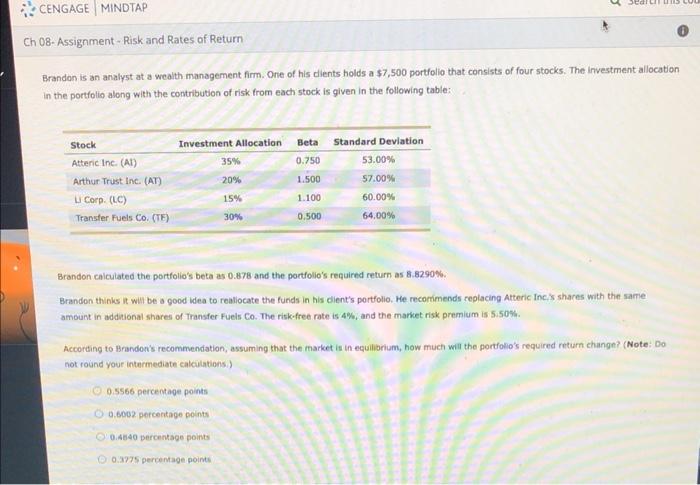

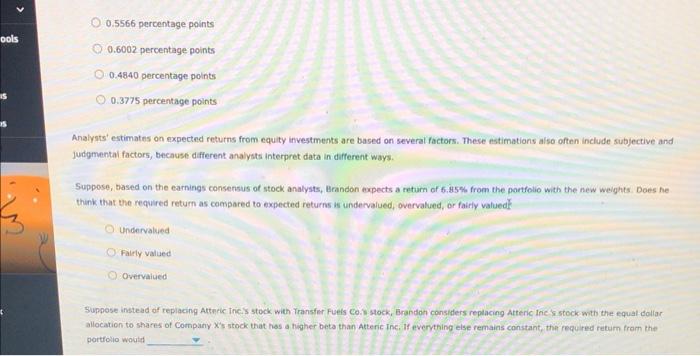

Brandon is an analyst at a wealth management firm. Orie of his cients holds a $7,500 portfolio that consists of four stocks. The investment allocation in the portfolio along with the contribution of risk from each stock is given in the following table: Brandon caiculated the portfolio's beta as 0.878 and the portfolio's required return as 8.82900. Brandon thinks it will be a good idea to reatiocate the furids in his client's portfolio. He recomimends replacing Arteric Inciss shares with the same amount in additional shares of Transfer Fuels Co. The risk.free rate is 4%, and the market risk premium is 5.50%. Accorting to Brandon's recommendiation, assuming that the market is in equilibrium, how much will the portfolio's required return change? (Note: Do not round your intermediate calculations.) 0.5566 percentape points 0.9002 percentage points 0.AE40 percentage points 0.3275 percemage points 0.5566 percentage points 0.6002 percentage points 0.4840 percentage points 0.3775 percentage points Analysts' estimates on expected returns from equity investments are based on several factors. These estimations also often include subjective and judgmentai factors, because different analysts interpret data in different ways. Suppose, tased on the earnings consensus of stock analysts, Brandon expects a return of 6 . H5\% from the portfolio with the new weights. Does he think that the required return as compared to expected returns is undervalued, overvalued, or fairly valueds Undervalued Falrly valued Overvalued Suppose instead of repiacing Attneic thicis stock with Yransfer Fuets co.s stock, Erandon considers replacing Atteric Inc is stock with the equat dollar allocation to shares of Company x 's stock that hos a higher beta than Atteric Inc. If everyehing else remains constant, the required return fram the portfolio would Brandon is an analyst at a wealth management firm. Orie of his cients holds a $7,500 portfolio that consists of four stocks. The investment allocation in the portfolio along with the contribution of risk from each stock is given in the following table: Brandon caiculated the portfolio's beta as 0.878 and the portfolio's required return as 8.82900. Brandon thinks it will be a good idea to reatiocate the furids in his client's portfolio. He recomimends replacing Arteric Inciss shares with the same amount in additional shares of Transfer Fuels Co. The risk.free rate is 4%, and the market risk premium is 5.50%. Accorting to Brandon's recommendiation, assuming that the market is in equilibrium, how much will the portfolio's required return change? (Note: Do not round your intermediate calculations.) 0.5566 percentape points 0.9002 percentage points 0.AE40 percentage points 0.3275 percemage points 0.5566 percentage points 0.6002 percentage points 0.4840 percentage points 0.3775 percentage points Analysts' estimates on expected returns from equity investments are based on several factors. These estimations also often include subjective and judgmentai factors, because different analysts interpret data in different ways. Suppose, tased on the earnings consensus of stock analysts, Brandon expects a return of 6 . H5\% from the portfolio with the new weights. Does he think that the required return as compared to expected returns is undervalued, overvalued, or fairly valueds Undervalued Falrly valued Overvalued Suppose instead of repiacing Attneic thicis stock with Yransfer Fuets co.s stock, Erandon considers replacing Atteric Inc is stock with the equat dollar allocation to shares of Company x 's stock that hos a higher beta than Atteric Inc. If everyehing else remains constant, the required return fram the portfolio would

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started