Last two images are close ups to better read what they say... need help please

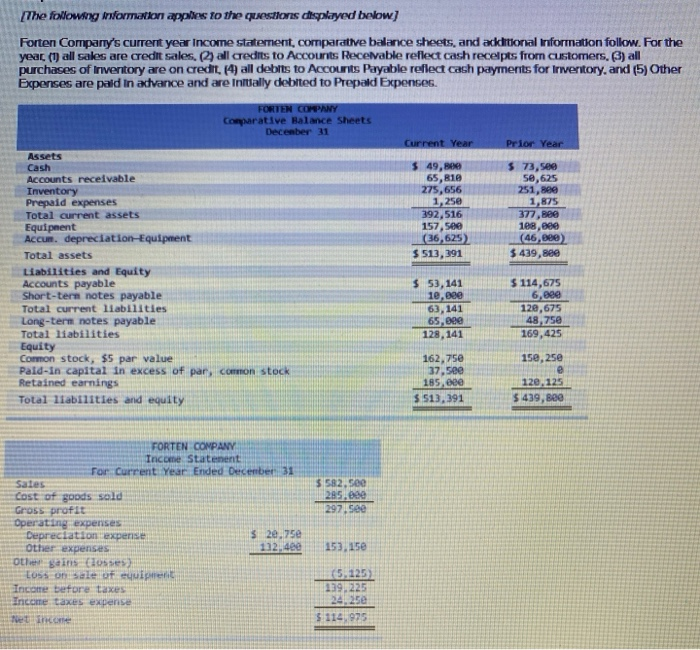

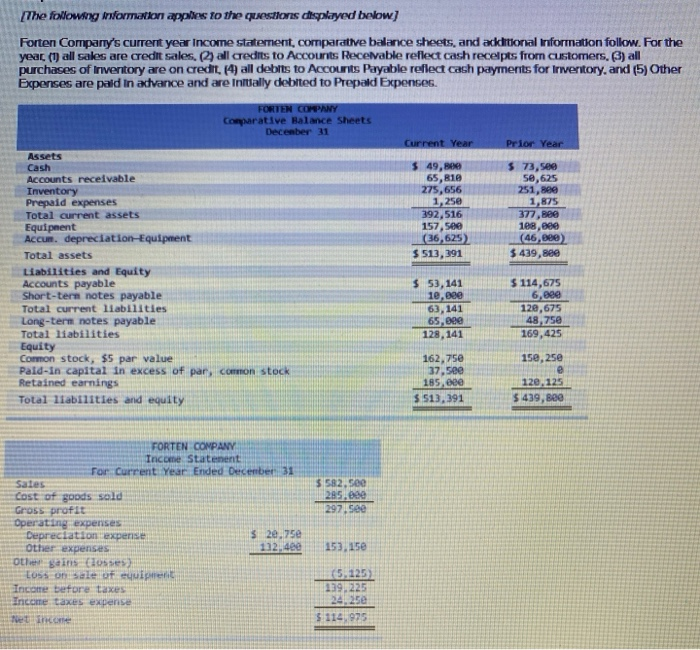

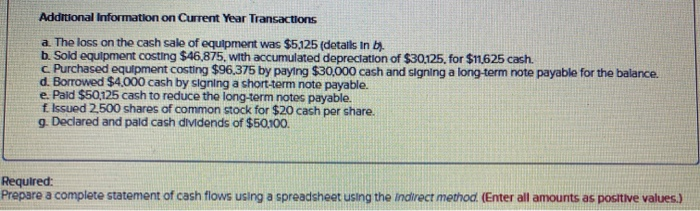

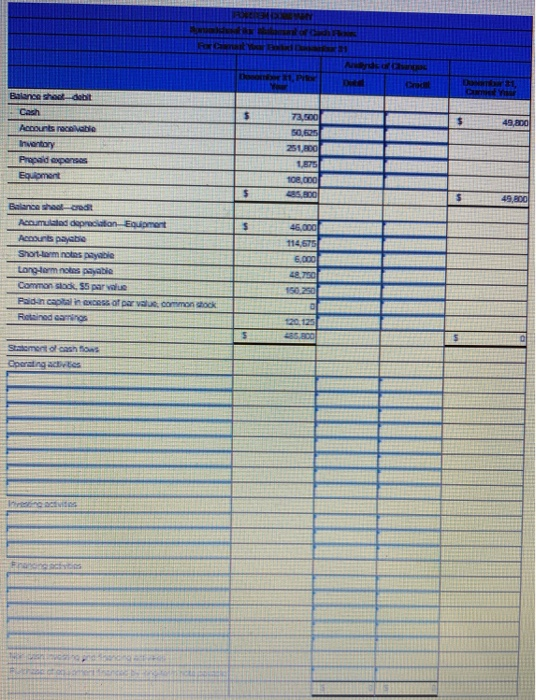

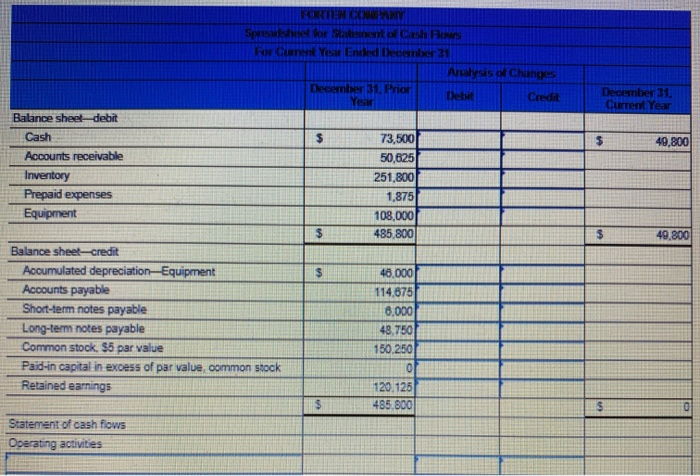

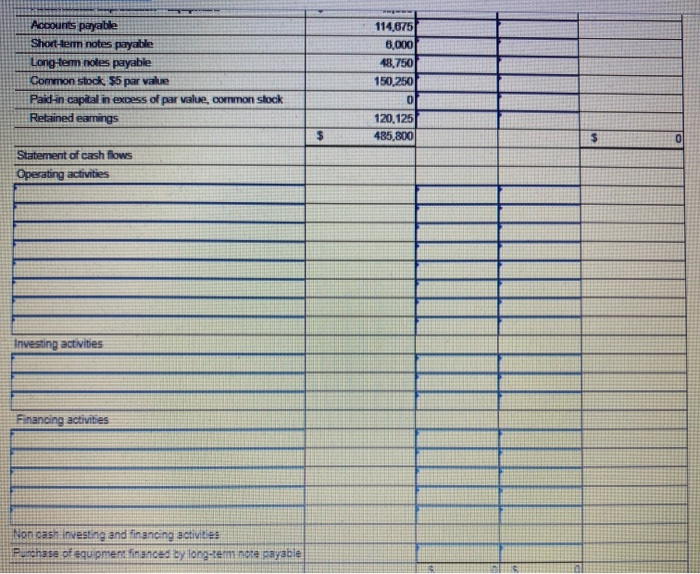

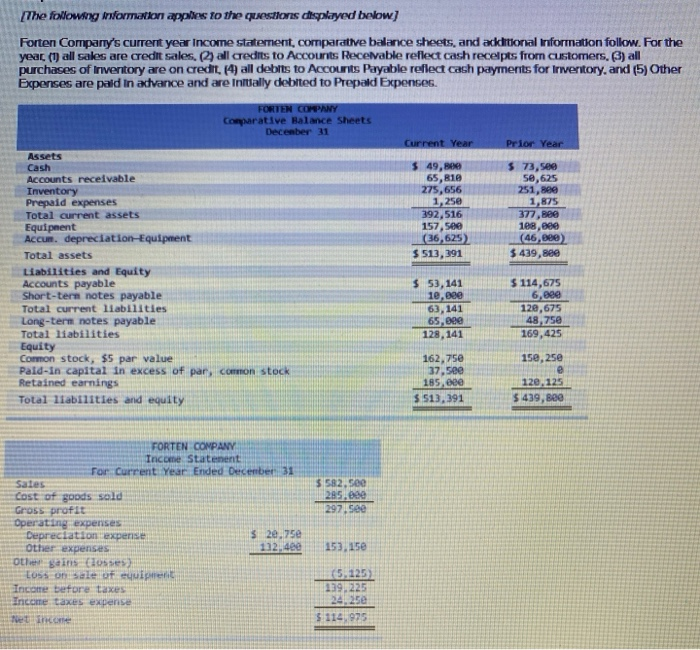

[The following information applies to the questions displayed below) Forten Company's current year Income statement, comparative balance sheets, and actional Information follow. For the year (1) all sales are credit sales, (2) all credits to Accounts Receivable reflect cash receipts from customers.) all purchases of Inventory are on credit, (4) all debits to Accounts Payable reflect cash payments for Inventory, and (5) Other Expenses are paid in axtance and are Initially debited to Prepald Expenses. FORTEN COMPANY Comparative Balance Sheets December 31 Current Year Prior Year 49,99 65,810 275,656 1,25e 392,516 157,500 (36,625 $ 513,391 73, see 50,625 251,889 1,875 377,880 108, ese (46,820) $439,800 Assets Cash Accounts receivable Inventory Prepaid expenses Total current assets Equipment Accum. depreciation Equipment Total assets Liabilities and Equity Accounts payable Short-tern notes payable Total current liabilities Long-term notes payable Total liabilities Equity Cormon stock, $5 par value Paid-in capital in excess of par, common stock Retained earnings Total liabilities and equity $ 53,141 10,880 63,141 65.899 128, 141 $ 114,675 6,880 120,675 48,750 169,425 15e,25e 162,75e 17. See 185, eee $ 513, 391 120.125 $ 439,800 02.00 85.ee FORTEN COMPANY Income Statement For Current Year Ended December 31 Sates Cost of goods sold Gross profit Operating expenses Depreciation expense $ 20.75e Other expenses 132.4ee o sin losses LOs on sale of equipe Income before taxes Income taxes expense Net Income 153, 150 (5.125) 139.225 24 $ 114,975 Additional Information on Current Year Transactions a The loss on the cash sale of equipment was $5,125 (details in by b. Sold equipment costing $46,875, with accumulated depreciation of $30,125, for $11,625 cash c Purchased equipment costing $96,375 by paying $30,000 cash and signing a long-term note payable for the balance. d. Borrowed $4,000 cash by signing a short-term note payable. e. Pald $50,125 cash to reduce the long-term notes payable. f. Issued 2,500 shares of common stock for $20 cash per share. 9. Declared and paid cash dividends of $50,100. Required: Prepare a complete statement of cash flows using a spreadsheet using the Indirect method. (Enter all amounts as positive values.) Balance she debit LES CHES Accounts receive Inventory Prepaid expenses Equipment Balance she credite Accumulated praction Equipment Ansur payable Short-term notas p Long-term notes payable Common stock, 55 par le Paisance in excess of par common dock Retind carros Smeroloosha Operating acres S For HORTEN COMMY heet for Slabert of Cash Flows rent Year Ended Decenber 31 Analysis of Changes December 31. Prior Debat Credit Year December 31 Current Year 49,800 Balance sheetdebit Cash Accounts receivable Inventory Prepaid expenses Equipment 73,500 50,625 251,800 1.875 108,000 485,800 49,800 Balance sheet-credit Accumulated depreciation Equipment Accounts payable Short-term notes payable Long-term notes payable Common stock. 55 par value Paid-in capital in excess of par value, common stock Retained earnings 46.000 114.675 8,000 48.750 150.250 120.125 485 800 Statement of cash flows Operating activities Accounts payable Short-ter notes payable Long-term notes payable Common stock $5 par value Pakchin capital in excess of par value, corrmon stock Retained earnings 114.675 6.000 48,750 150,250 120,1251 485,800 Statement of cash flows Operating activities Investing activities Non cash investing and financing activitie: Purchase of equipment finances by long-term note payable