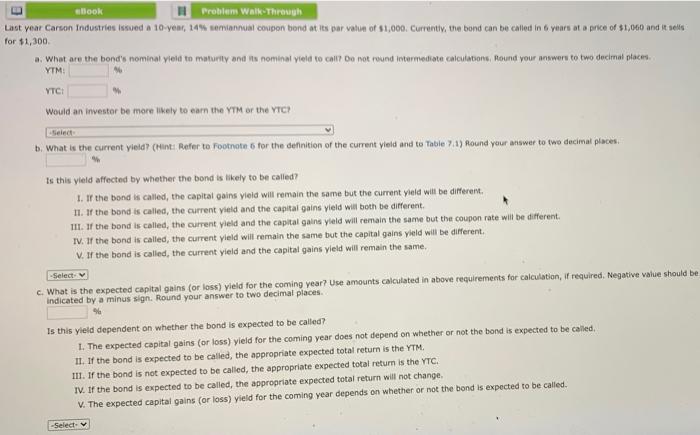

Last w can Industrial Bondato 11.000 Currenthe bond can be edinst price of $1.00 do 11.00 What are the tournalida musty and its tot en met de todo VUR reci Wome to the TVC But it in Heer ofw the detaliate foto.11 to sy when the then we well win the same the current with Wisata de conser lundi mend that we will remained the wind call me you will the came the weet is the data ilmente Wut the case for the coming year can be receive the data into Is this yet pendent when the bed me to be called 1. The capital in the coming year does not depend on whether or not the bonded to be called II. f the expected to be called the protexeded to the II the bond is not eeded to be led de operate excette rom me IV. bonis peded to be called the prestatutarch The lighed for the coming yerder or not the only read to heart ebook Problem Walk Through Last year Carson Industries issued a 10 year, 14% annual coupon bond at its par value of $1,000. Currently, the band can be called in 6 years at a price of $1,060 and it selfs for $1,300 What are the bond's nominal yield to maturity and its nominat yield to call? Do not round intermediate calculations, Round your answers to two declarat places YTM YTC Would an investor be more likely to earn the YTM or the YTC? Select b. What is the current yield (Hint: Refer to Footnoto 6 for the definition of the current yield and to Table 1) Round your answer to two decimal places Is this yield affected by whether the bond is likely to be called? 1. If the bond is called, the capital gains yield will remain the same but the current yield will be different. 11. If the bond is called, the current yield and the capital gains yield will both be different III. If the bond is called, the current yield and the capital gains yield will remain the same but the coupon rate will be different. IV. If the bond is called, the current yield will remain the same but the capital gains yield will be different. V. If the bond is called, the current yield and the capital gains yield will remain the same. Select c. What is the expected capital gains (or loss) yield for the coming year? Use amounts calculated in above requirements for calculation, it required. Negative value should be indicated by a minus sign. Round your answer to two decimal places 9 Is this yield dependent on whether the bond is expected to be called? 1. The expected capital gains (or loss) yield for the coming year does not depend on whether or not the bond is expected to be called 11. If the bond is expected to be called, the appropriate expected total return is the YTM III. If the bond is not expected to be called, the appropriate expected total return is the YTC. IV. If the bond is expected to be called, the appropriate expected total return will not change, V. The expected capital gains (or loss) yield for the coming year depends on whether or not the bond is expected to be called. -Select